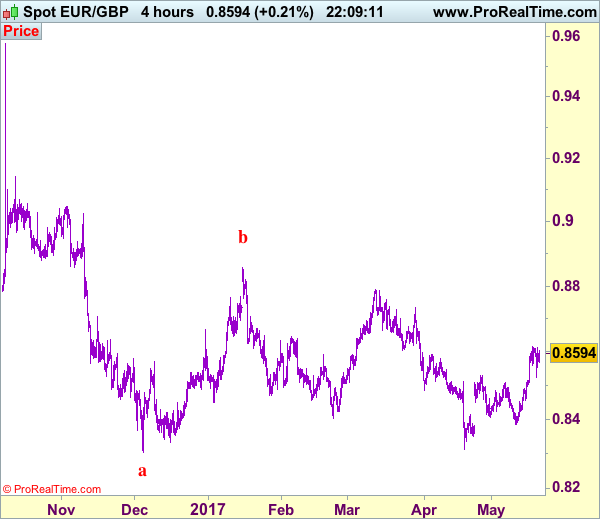

EUR/GBP - 0.8597

Recent wave: Major double three (A)-(B)-(C)-(X)-(A)-(B)-(C) is unfolding and 2nd (A) has possibly ended at 0.6936.

Trend: Near term down

Original strategy:

Bought at 0.8530, Target: 0.8630, Stop: 0.8490

Position: - Long at 0.8530

Target: - 0.8630

Stop: - 0.8490

New strategy:

Hold long entered at 0.8530, Target: 0.8630, Stop: 0.8520

Position: - Long at 0.8530

Target: - 0.8630

Stop: - 0.8520

As the single currency found renewed buying interest at 0.8524 and has staged a rebound, retaining our view that recent upmove from 0.8312 would resume after consolidation, above resistance at 0.8615 (this week’s high) would confirm and extend further gain to 0.8630, having said that, as this move is viewed as retracement of recent decline, reckon upside would be limited to 0.8650-60, risk from there is seen for a retreat later.

In view of this, we are holding on to our short position entered at 0.8530. Below said support at 0.8524 would defer and suggest top is possibly formed, bring weakness to 0.8480-85 and possibly towards support at 0.8457 but break of previous resistance at 0.8452 is needed to confirm and bring test of support at 0.8423 first.

Our preferred count is that, after forming a major top at 0.9805 (wave V), (A)-(B)-(C) correction is unfolding with (A) leg ended at 0.8400 (A: 0.8637, B: 0.9491 and 5-waver C ended at 0.8400. Wave (B) has ended at 0.9413 and impulsive wave (C) has either ended at 0.8067 or may extend one more fall to 0.8000 before prospect of another rally. Current breach of indicated resistance at 0.9043 confirms our view that the (C) leg has ended and bring stronger rebound towards 0.9150/54, then towards 0.9240/50.

Content in ActionForex.com website is for informational purposes only. Contributors submitted forecast, commentaries, analysis, articles are based upon information gathered from various sources believed to be reliable, complete, and accurate. However, no guarantee can be made as to the validity of the believed sources. All statements and expressions in the website are opinions, and not meant as investment advice or solicitation. Forex Markets can be volatile and opinions may change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.