What to watch this week

Summary

- Technical Outlook: Medium Term Bullish, Short Term Bearish

- Fundamental Outlook 1: Three big likely market drivers this week the top calendar events to monitor

- Fundamental Outlook 2: Top calendar events to watch

Health issues keep this week’s post short.

Technical Picture: Medium Term Bullish, Short Term BearishWe look at the technical picture first for a number of reasons, including:

Chart Don’t Lie: Dramatic headlines and dominant news themes don’t necessarily move markets. Price action is critical for understanding what events and developments are and are not actually driving markets. There’s nothing like flat or trendless price action to tell you to discount seemingly dramatic headlines – or to get you thinking about why a given risk is not being priced in

Charts Also Move Markets: Support, resistance, and momentum indicators also move markets, especially in the absence of surprises from top tier news and economic reports. For example, the stronger a given support or resistance level, the more likely a trend is to pause at that point. Similarly, a confirmed break above key resistance makes traders much more receptive to positive news that provides an excuse to trade in that direction.

Indexes Are Good Overall Barometers. Their usual positive correlation with other risk assets, and negative correlation with safe haven assets, makes them good overall barometers of what different asset classes are doing.

Overall Risk Appetite Medium Term Per Weekly Charts Of Leading Global Stock Indexes

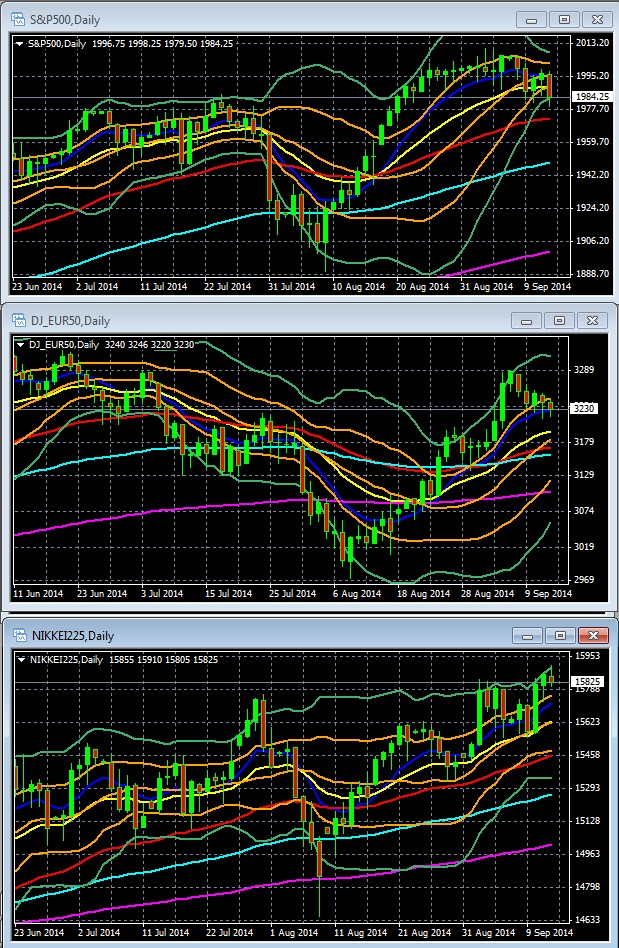

Weekly Charts Of Large Cap Global Indexes May 26 2013 – Present: With 10 Week/200 Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

Key For S&P 500, DJ EUR 50, Nikkei 225 Weekly Chart: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

01 Sep. 14 10.45

Key Points

US Indexes: Last week’s minor pullback brings them to the lower end of their double Bollinger® band buy zones, meaning they’re at the brink of losing medium term upward momentum. Uptrends are obviously still quite solid, so at this point there’s nothing more than a normal correction within a longer term uptrend. Though as we note below with the daily charts, short term deterioration puts the odds in favor of further downside next week, from a purely technical perspective. That said, with so many top tier events that could move markets, the coming weeks’ direction for indexes in general is mostly dependent on the outcomes from these events.

European Indexes: Last week’s pullback put them back into their double Bollinger® band neutral zone, suggesting flat trading ranges in the weeks ahead. Otherwise, the same comments apply.

Asian Indexes: A mixed bag, mostly following the US and EU lower. There were a few exceptions based on local market conditions. Japan’s Nikkei was up on Yen weakness (due to USD strength) which is seen as supportive of this exporter-heavy index. So too was Shanghai, which rose as low inflation figures raised stimulus hopes.

Overall Risk Appetite Short Term Per Daily Charts Of Leading Global Stock Indexes

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.