Today's Highlights

-

The Trump-off Trade

-

SA Apathetic to OPEC

-

What comes after 100%?

Please note: All data, figures & graphs below are valid as of November 29th. All trading carries risk. Only risk capital you're prepared to lose.

WTFDJT

The Trump transition team has been doing a sloppy job so far. No need to count the many mistakes they've made, but I did want to say one thing to all the anyone out there trying to analyse just how much DJ Trump is going to abuse his power: Stop wasting your time!!

As Donald himself has accurately pointed out, conflict of interest laws don't apply to the President of the United States.

Trump has every right and will in fact dictate every policy, foreign and domestic, to first serve himself, then his business, and may do what's in the best interest of the rest of the country when it suits him. This is how it's going to be. There's nothing you can do to stop him. It's why he ran for office!

In the meantime...

Market Overview

The markets do seem to finally be coming to terms with the above. Prices are still way above where they were the night before the election but we are seeing moderate declines in the global stock indexes, with the exception of the China50, which is up 1.26% today. It seems the stimulus from the PBoC is doing it's job there.

In currencies, the USD is still the boss. We have seen some small declines this week but many traders on the network actually see this as an opportunity to join the Dollar train trend...

In the meantime Gold and Silver are maintaining value. A new direction should emerge shortly.

OPEC is Tomorrow

Oil is slipping and sliding ahead of the OPEC meeting tomorrow. There still doesn't seem to be any sort of consensus on whether there will be a deal and Saudi Arabia somehow seems a bit less interested than they were last week, bringing the price down to $46.71 a barrel as at the time of this writing. Some analysts have stated that if there's no deal we could see the price as low as $35

Past 100%

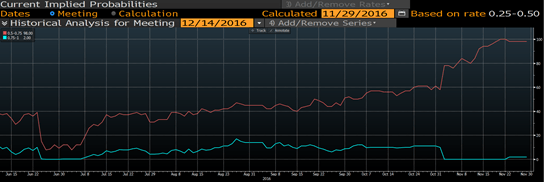

Last week the market expectations of an interest rate hike in December reached 100%. So the question needs to be asked, what comes after 100%?

Well, it seems the meter doesn't go to 101%, but what we are seeing now is a 2% possibility that the Fed will hike by 0.5% instead of 0.25%. Check the blue line below which is now greater than zero once again...

Of course 2% isn't something that we can say is a large probability. What I did want to say is that we do need to be prepared for the other scenario, which is that the Fed dissapoints the market and doesn't cut. Also, it's not very probable but imagine the effects of such a move when the market is not expecting it.

But that's still two weeks away, let's get through today first.

Trading in the Foreign Exchange market might carry potential rewards, but also potential risks. You must be aware of the risks and are willing to accept them in order to trade in the foreign exchange market. Don't trade with money you can't afford to lose.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.