The heightened concerns and mounting uncertainties over the impact of a Brexit on the UK economy have left the Sterling in a highly sensitive state with investors remaining noticeably cautious towards the currency. Major financial heavyweights have wasted no time in voicing their fears over the negative impact of a Brexit on the UK economy and as the battle of pros and cons takes place ahead of the referendum in June, investor sentiment may be torn in various directions. It must be understood that possible impacts of a Brexit are very difficult to quantify and such should provide explosive levels of volatility across Sterling pairs in the currency markets as the referendum looms.

Bank of England Governor Mark Carney will be testifying to lawmakers today with market participants anxiously awaiting his thoughts on the latest Brexit developments and how the BoE may tackle this event risk. Following the resignation of BCC director John Longworth over his strong Brexit views, it is widely expected that Carney will maintain a cautious tone as he represents the BoE, which must be neutral to political events. The current developments add to the UK’s woes as inflation remains notoriously low, while wage growth continues to follow a tepid fashion which provides little incentive for the BoE to raise UK interest rates anytime soon. It has been over seven years since the central bank slashed rates to 0.5% and with the current mixture of events exposing the UK economy to further downside risks, investors have begun to speculate a potential rate cut.

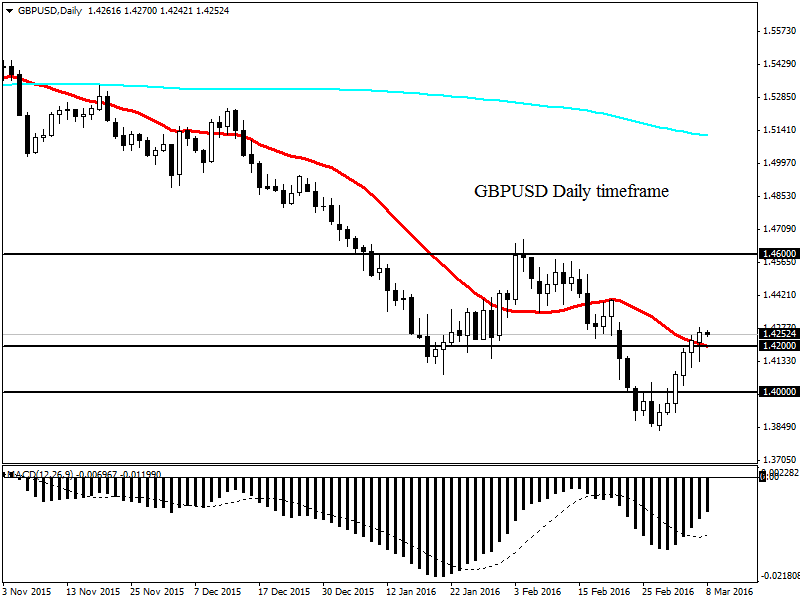

The GBPUSD enjoyed a solid period of gains last week and this had nothing to do with an improved sentiment towards the Sterling but potential Dollar weakness. This pair still remains fundamentally bearish and the growing fears of the impacts of a Brexit should encourage bearish investors to attack prices. The downtrend is firm and the short term interest rate differential between the BoE and Fed should limit high prices can advance in the GBPUSD. From a technical standpoint, 1.46 is a strong resistance and as long as this level defends then prices may decline back down towards 1.40.

China data dampens global sentiment

The global markets were rattled in the early hours of this morning following the sharp decline in China’s exports which reinforced the lingering concerns over the slowing pace of growth in the world’s second largest economy. China’s exports slumped by a painful 25.4% in February, while imports declined 13.8% which suggested that despite the aggressive measures Beijing have implemented to jumpstart growth, economic data has failed to pick up. Capital outflows have continued to accelerate, and Moody’s have already signaled that China’s debt rating may be slashed but China’s leaders remain optimistic still forecasting growth between 6.5 to 7% in 2016. Sentiment remains bearish towards the Chinese economy and this should trickle back down to the China markets which are already under pressure.

Commodity spotlight – WTI Oil

The mounting speculations of a possible production cut complimented with expectations that demand for oil may be increasing have powered WTI bulls to send prices to fresh highs above $38 during trading on Monday. This relief rally seems exaggerated as supply in the global markets still remains at frightening levels, while Iran’s oil has landed in Europe for the first time since the sanction lift which should spook investor attraction. Although there have been talks of an OPEC meeting in March, not all members have agreed to a deal and the visible conflict of interests across the board should encourage bearish investors to send WTI lower. The key level looks to be $40 and as long as bears can defend this resistance, oil prices may decline back down towards $35 and potentially lower.

From a technical standpoint, bears must breach and attain a daily close back below $35 for a further decline towards $30. If the $35 support proves too strong for bears to breach, then the next relevant resistance will be based at $40.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.