Global Markets

The Sterling spiked to downside across the global currency markets as a result of UK GDP printing below expectations at 0.5%. This currency has suffered for an extended period of time as a result of a riskoff environment mixed with escalating fears of a slowdown in economic momentum in the UK economy. It seems that BoE Mark Carney’s statement suggesting the possibility, rather than the certainty of a UK rate hike has pushed back expectations deep into 2016. Economic data in October from the UK has lost its robust touch and with this GDP figure failing to meet expectations today, the Sterling has been left vulnerable. The GBPUSD which had four consecutive days of decline last week remains under pressure, a breakdown below the 1.5300 support on this pair may open a path to the next relevant support at 1.5200.

The Dollar Index encountered an aggressive appreciation last week as a result of the ECB hinting of further QE in the future. Despite the index surging to 10week highs, Dollar vulnerability still remains the main theme in the global currency markets. This upside momentum within the USD may be shortlived as with only a slim chance that the US rates will be hiked in the FOMC statement this week, this single currency will be left vulnerable which should result in the bears taking control once again. Sentiment remains bearish for the Dollar and the creeping fears of a potential slowdown in economic momentum in the States combined with the mounting concerns that the GDP growth in the US for Q3 has shrunk, add to the already diminishing expectations of a US rate hike in 2015.

Even though Gold has experienced a technical decline which started from the second week of October, it still remains fundamentally bullish. Whilst the sharp appreciation of the USD played a part in capping any upwards momentum in this precious metal, the renewed fears about the decelerating growth in China should provide a foundation for the Gold bulls to take center stage once more. The FOMC statement this week, which most are expecting to conclude with no action being taken by the Fed to hike US rates, may inspire upwards momentum within this yellow metal, resulting in prices trading back above the 1170.00 resistance.

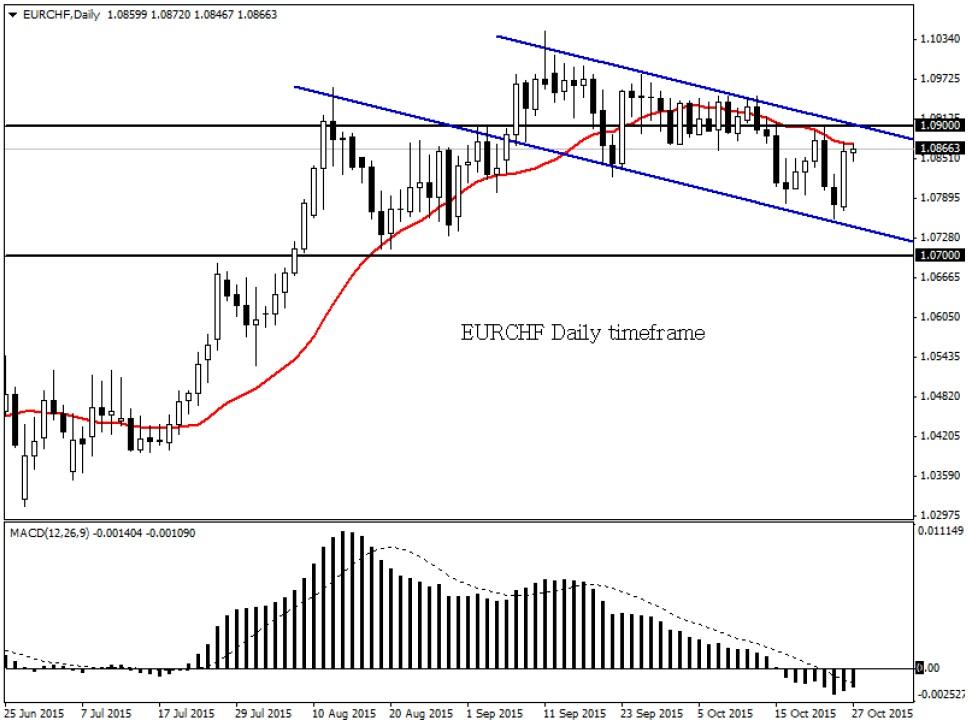

EURCHF

The EURCHF is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. As long as the 1.0900 resistance holds, there may be a decline to the next relevant support at 1.0700.

EURJPY

The EURJPY is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below the 133.00 support may open a path to the next relevant support at 131.00.

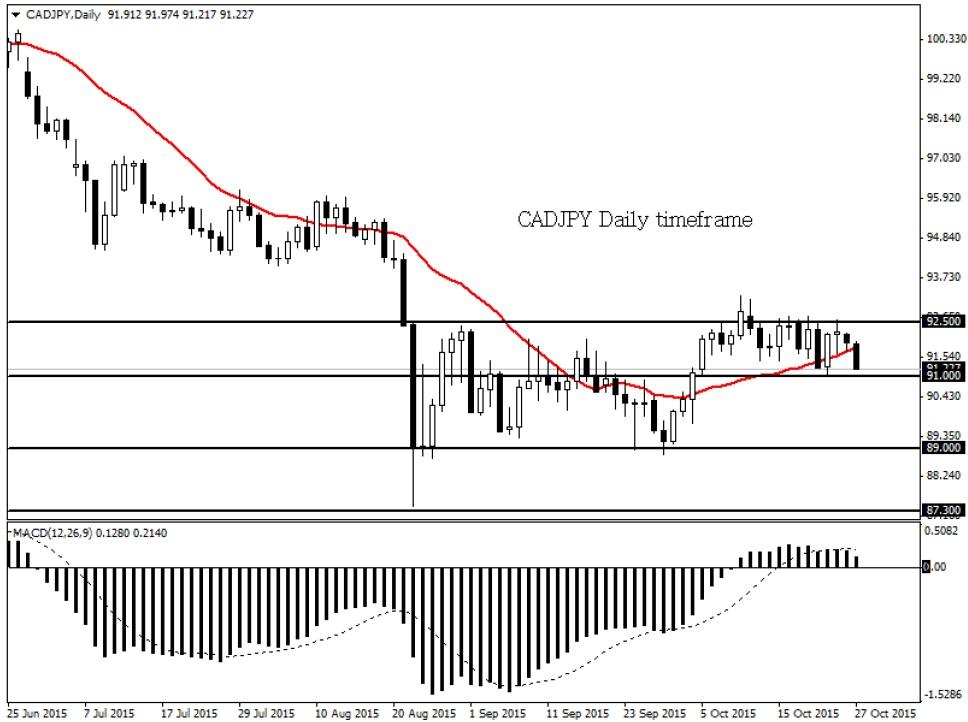

CADJPY

The CADJPY becomes technically bearish once a breach below the 91.00 support is achieved. Prices are currently trading below the daily 20 SMA and the MACD is in the process of crossing to the downside. The next relevant support is based at 89.00.

AUDCAD

The AUDCAD is technically bullish on the daily timeframe. A break above the 0.9580 resistance may open a path to the next relevant resistance based at 0.9650. Technical indicators such as the 20 SMA and MACD point to the upside.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.