From the top of my head

I have been trading FX for 35 years but still there are a few things that puzzle me – or rather – irritate me.« If you have a lot, you want more » is a saying. In FX it means that if it goes a lot, it shall go even more. At the start of the year – just below 1.3000 – the whole bunch of pundits predicted the EURUSD down for a retest of 1.2660. A week later the same guys started talking about 1.37-1.42.

What caused the change of mood? Draghi might be the first that comes to your mind and you are right. It was Draghi – again.

Like six months ago you might add but then I disagree. There is a huge difference between what he said then and what he said a few days ago. Back last summer he said « we will do whatever it takes…..and believe me it will be enough ». That is strong wording and a strong commitment. No wonder the falling trend as seen throughout the first half of 2012 was reversed.

This time around though - when pressed in a Q&A session whether the decision by the governing council not to cut rates was unanimous - Draghi replied « yes » and then he outlined why. The « yes » was firm and the explanations very detailed but neither of the supporting arguments were news. It was the way he said it and his confidence level when lining up the arguments. I buy that it was a EURUSD positive performance but not to the extent of that seen six months ago. I see a big difference in the two performances and I will claim that the 300 pips we got from the show ten days ago was to the limit of what was in that statement – nothing more.

Draghi expressed confidence and bulls took the advantages of that. Above the high of last week I see nothing but struggle for EURUSD simply for the reason that confidence has taken us up 1200 pips over the last six months. To extend that move further we need more than Draghi.

Major "market movers" 2013

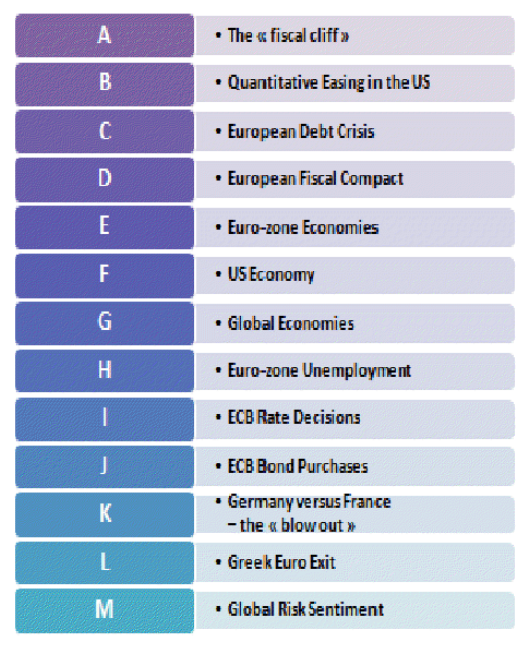

- These are the major topics I set out as « major market movers » in my « The EURUSD Strategy Builder » six weeks ago.

- Since then the outlook for a rate cut by the ECB might have been delayed a bit but is still on the cards. I have moved the rate cut expectations three months further into 2013 than what was originally set out.

- On the next page I have set out when these different « market movers » are likely going to have a significant impact on EURUSD.

- I have further set out what I think will be the impact on EURUSD in terms of major moves and trends throughout 2013. This formed the basis for my EURUSD strategy planning 6 weeks ago and it is still my overall view.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.