We’ve seen a number of interesting developments worth highlighting, and the tectonic plates that underpin the financial markets continue to move around wildly.

The Brexit discussions are actively debated on the desk, with traders fading the move through Asia into 1.3020/40. Tactically, one could argue it feels premature to be putting on GBP bearish trades, aimed at a formal deal being rejected through the UK Commons in the months ahead, as we still have to first know what the agreement terms actually look like, and from here we can make a serious assessment on whether the terms will pass, although most think what we know so far won't get through the Commons .

At this point, media reports are that a number of heavyweights from Theresa May’s cabinet, who meet tonight at 3 am (AEDT), are on board with whatever has been agreed in the 500-page legal document.

That said, the flow of GBP selling into Asia trade suggests that forming a possible consensus in the cabinet will not be an easy feat, and we may even see resignations from various officials who will protest the terms that are handed to them from the EU. The speculation is that there is still a possibility Dominic Raab steps down in protest, and that would genuinely bring a whole new layer of uncertainty. However, should the cabinet back the draft terms then put 25 November on the radar, as we should get confirmation of a new special EU Summit and a date at which officials can thrash out the workings ahead of 13th-14th EU council meeting. Without resignations and confirmation of the cabinet onboard and GBPUSD should push to 1.31.

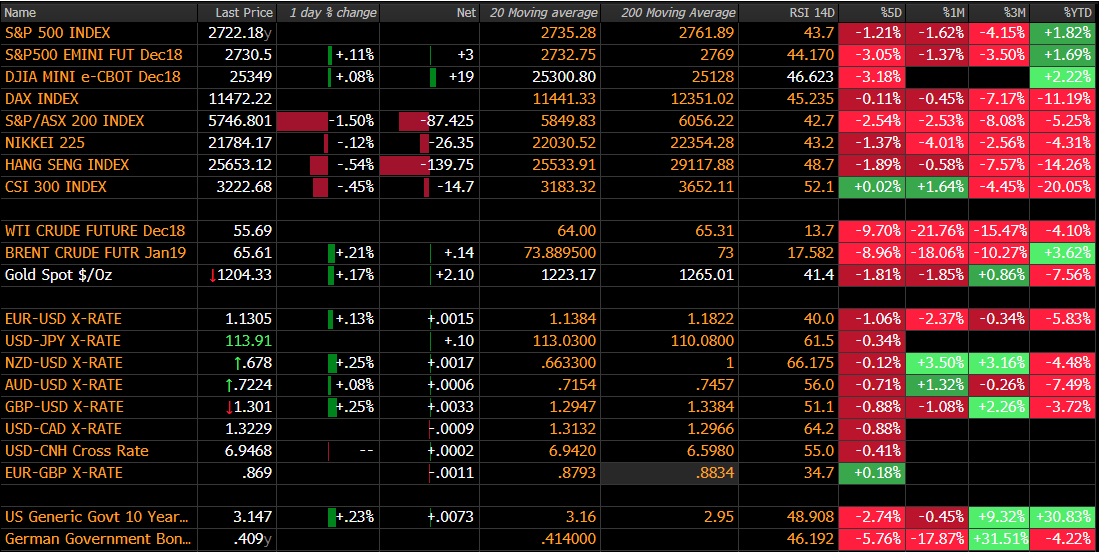

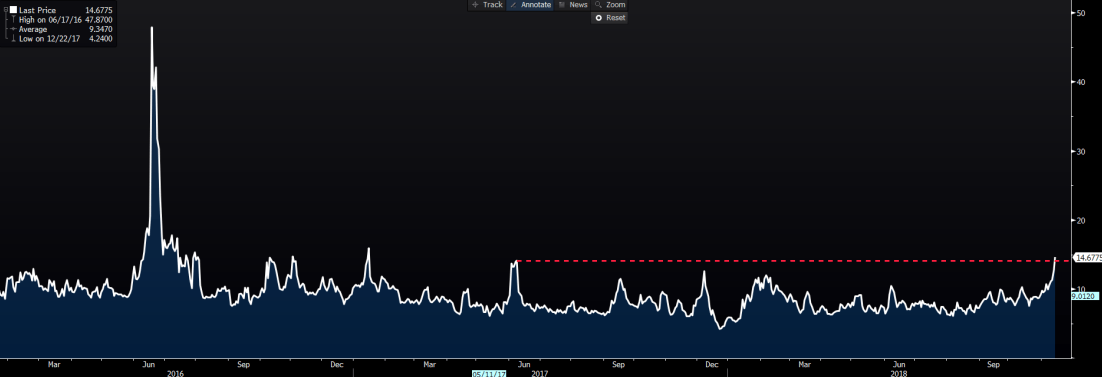

It’s no surprise to see GBP implied volatility push higher, with GBPUSD 1-week implied volatility is advancing to the highest levels since January 2017 and at 14.67% gives us an expected move over the coming five trading days of 223 points. That suggests the market sees a potential move to $1.2780 or $1.3228 and gives us some insights for risk management and position sizing.

(1-week GBPUSD implied volatility)

In other GBP crosses, we have seen interest to buy EURGBP into 0.8680, but trading EUR from the long side is somewhat brave, and more work needs to happen here to feel longs have real promise. The first target is for a move through the 0.87, and that seems tough with German Q3 GDP due at 18:00AEDT (consensus -0.1%qoq) and the Italian budget talks in play, with the Italian government standing firm on its growth targets and even asking the EU for leeway. The talk is Italy will be handed an Excessive Deficit Procedure (EDP), which will largely be aimed at fines and one questions if this backfires and provides fodder for the anti-EMU parties ahead of the European elections in May.

AUD flows have been mixed and not helped by a weak feel to Asian equity markets, with China and Hong Kong modestly lower. AUDNZD has been on the radar for a while and is my preferred vehicle for expressing a bearish view on the AUD, with price breaking to the lowest levels since April and trending well. China data has not helped the AUD broadly, with a decent miss in October retail sales (8.6% vs 9.2% eyed), although industrial production and fixed asset investment both slightly beat consensus expectations. However, when we combine these metrics with the sharp drop in yesterday’s October money supply number then this data will not do any favours to growing concerns around global growth. Japan’s 1.2% (annualised) qoq GDP contraction of 1.2% will only add fuel to this camp.

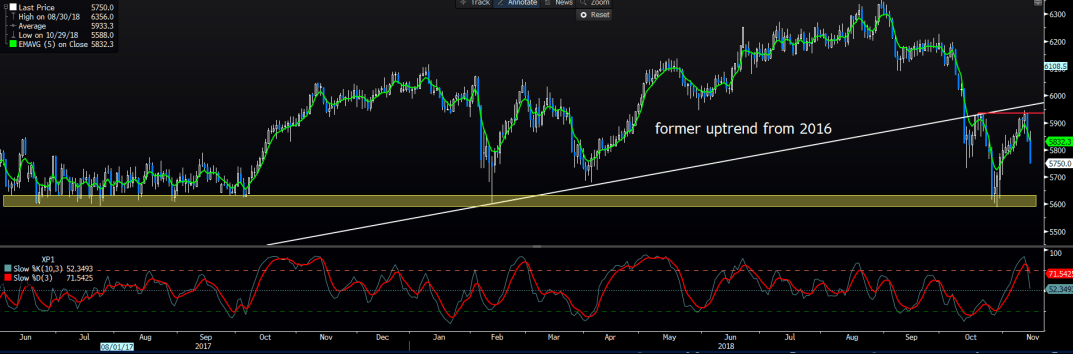

The ASX 200 is the laggard, -1.5%, with financials and materials accounting for 49-index points and we see a heavy feel here. I have turned to Aussie SPI futures to give oversight on the ASX 200, and the daily (or weekly) shows such clear battle lines – there is huge support into 5600, while it is hard to have a bullish bias until we see the double top being taken out at 5930 - see chart below

Back on the AUD, and the data flow has given the AUD bulls some scope for encouragement, but not a lot, and we can also see 3-year Aussie bond yields completely unchanged at 2.08% on the day. It’s hard to believe Aussie consumers were more confident during November, with Westpac Confidence report increasing 2.8% in November, although the market gave this a big swerve, with AUDUSD moving a whole six-pips in the five minutes post the data release. As expected, Aussie Q3 wages increased 20 basis points to 2.3% YoY, which is still the strongest level of wage growth since 2015, but well shy of the 3.5% growth Governor Lowe recently identified as a target – keep in mind that should wage actually get to 3.5% it would be the strongest level of growth since December 2012, and naturally the cries of rate hikes will be more pronounced.

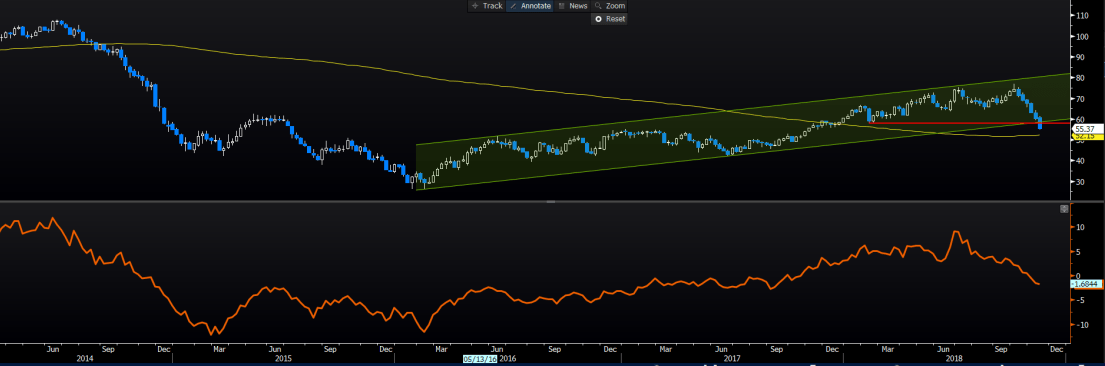

The other major talking point remains squarely on oil prices, with WTI implied volatility spiking to 50% and the highest levels since December 2016, while many have pointed out that the 9-day RSI sits at a lowly 6, and has never been lower.

The weekly chart of crude shows the broad structure and the clear break of the bullish channel that has been in place since 2016, while the price has closed through one horizontal support level after another. We can look at the term structure, and here I have looked at the year ahead (front month minus the 13th-month contracts) to see the spread, and here see an ever-increasing contango, with front-month futures cheapening relative to that of future contracts. The bulls will need to see this structure change, but, if anything it looks like it is getting more pronounced and rallies are a gift and unlikely to be too pronounced.

(Upper pane- daily chart of WTI crude, lower pane - 1-year term structure)

OPEC nations will want to get in front of this juggernaut soon enough, and verbal intervention is approaching, and this drawdown will be a bitter pill to swallow as the US shale producers will pick up share here and will only react once OPEC move. A perfect storm of oil weakness has been in play, with worries that supply is increasing at a time of falling demand, so it promises to be a fascinating battle between OPEC and US shale, so I guess that means we focus on the US rig count more readily again!

One suspects the market will also be super sensitive to tomorrows API inventory (0830 aedt), so should we see a draw in the data and oil prices could rally hard.

Trading leveraged products carries a high level of risk and may result in you losing substantially more than your initial investment. Pepperstone Group Limited is licensed and regulated by the Australian Securities and Investments Commission (AFSL 414530). Pepperstone Limited is authorised and regulated by the United Kingdom Financial Conduct Authority (FRN 684312). This information not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.