Crude

Pressure on commodity prices further mounted on Monday. Some of broader commodity indices fell recently even below levels seen after the collapse of Lehman Brothers in 2008. This time, the main sources of concern seem to be prospects of monetary policy tightening in the US and fears about China’s demand.

The oil price declined in the fourth consecutive session and hit a four-month low yesterday. Apart from factors mentioned above, a possibility of higher production in Iran along with recent US oil market data has weighed on price. As for the latter, a closely watched Baker Hughes Rig Count data showed the largest increase in US active rig counts since April 2014 (mainly thanks to increases in Louisiana and Texas). Moreover, most recent Commitment of Traders (CoT) reports (CFTC and ICE) showed that speculators cut their bets on increase of oil prices quite sharply in case of both WTI and Brent. This also confirms that bullish conviction of some speculators has been waning…

Metals

Last week, metals prices have been under a strong pressure - base metals prices fell by more than 4% on average. While price of gold remained broadly stable in the last couple of sessions, the recent sell-off of Chinese equities did not trigger more pronounced response of gold buyers in China – this is at least suggested by stable physical premiums in Shanghai and Hong Kong.

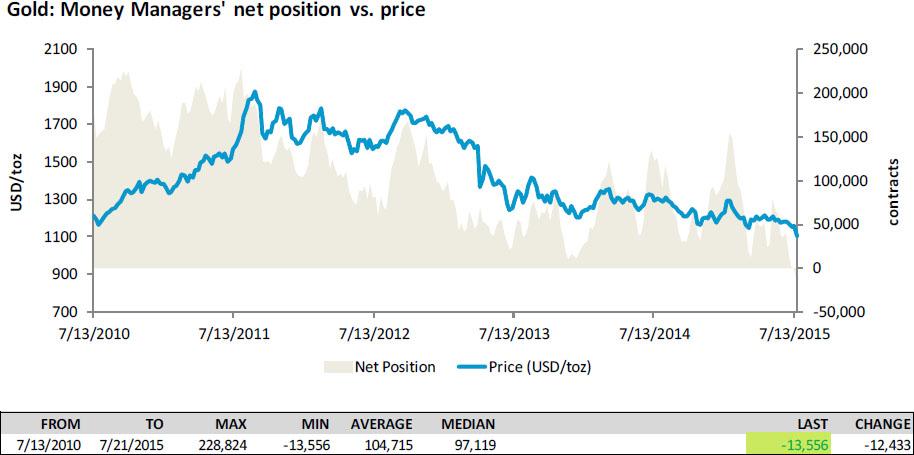

Interestingly, a net speculative position in COMEX gold futures fell below zero for the first time on record (disaggregated CFTC CoT report dates back to June 2006) which means that speculators started to bet on a decline of gold prices for the first time in at least last nine years! In absolute value, the size of net position however remains tiny compared to long positions recorded in the past which suggests that gold may have a long way to go, especially if Fed decides to increase interest rates soon…

Chart of the day:

In July, a speculative position in COMEX gold futures fell into negative territory for the first time in the history of the report.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.