Crude

Today in early trading, the oil price extends yesterday’s slide as strengthening US dollar weighs on price. At the time of writing of this note, the front-month contract on Brent is trading below 65 USD/bbl.

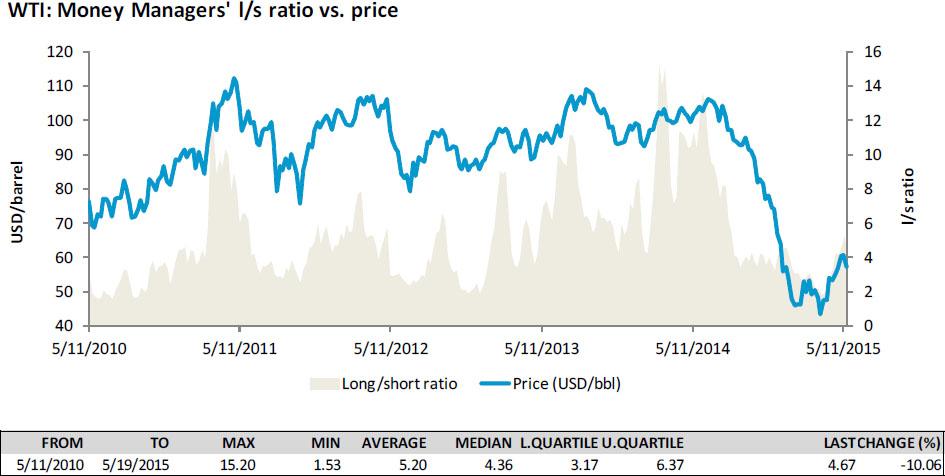

Quite an interesting piece of data was released by the CFTC on Friday. A so called Commitment of Traders report showed a relatively sharp decline in net speculative positions in NYMEX WTI futures; a so-called long-to-short ratio, which compares a number of long contracts to a number of short contracts held by money managers, declined by 10% due to both decline in the longs and increase in the shorts. The report again confirmed different views on future evolution of crude prices among speculators as number of entities holding short positions increased markedly and is seen well above its median while, at the same time, number of speculators holding long position remains high as well. As for the ICE CoT data on Brent futures, it painted a similar picture (drop in the l-s ratio was even more pronounced than in case of WTI).This suggests that a recent period of relatively low volatility (in comparison with the first months of the year) may not last long.

Chart of the day:

A speculative long-to-short ratio in WTI futures dropped markedly last week.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.