Crude

Rising tensions in Ukraine have so far overshadowed mixed news from Libya and the price of Brent (ICE) hit a six-week high on Monday. Apart from events in Ukraine, stronger than expected March US retail sales have supported the price of oil yesterday.

Regarding Libya, Reuters reported yesterday that despite a deal between government and rebels was reached on unblocking ports that had been under rebel’s control, the port of Zueitina – one of the major ports in the eastern part of the country which used to load about 200 thousand barrels of oil per day – is still not under control of Libya’s government.

Let us recall that Libya is important source of oil mainly from the perspective of Mediterranean refineries that should be gradually returning from a seasonal maintenance in weeks to come and prospective increase of exports from Libya could therefore help to ease the pressure on oil price. On the other hand, yesterday’s news suggests that oil from Libya cannot be overly relied on.

Base Metals

The recent events in Ukraine which could spark a military action against pro-Russian rebels (its likelihood has been steadily rising) supported nickel price on Monday. The metal hit a fourteen-month high yesterday as markets worry about tightening of western sanctions against Russia, which is the major producer of the metal (its refineries account for about 15% of World capacity).

Let us recall that tensions between the West and Russia are not the only source of nickel’s strength this year. The price has been supported by Indonesia’s new export rules imposed on mineral ores which could turn the market balance from last year’s surplus to a small deficit this year.

Chart of the day:

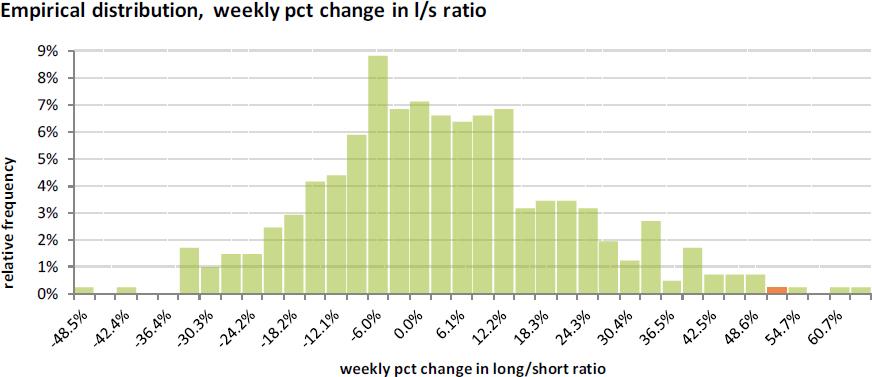

Money managers boosted their net long position in WTI futures last week by cutting their short positions.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.