Stocks slip while bond yields keep advancing

US stocks slipped on Thursday led by technology shares. Dow Jones industrial average lost 0.2% to 24713.98. The S&P 500 slid less than 0.1% to 2720.13. The Nasdaq composite fell 0.2% to 7382.47. The dollar strengthening accelerated again: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 92.446 but is lower currently. Stock indices futures indicate mixed openings today.

Bond yields continued to rise with 10-year Treasury note yield near 3.1%, a seven year high. Technology stocks followed Cisco’s lead which slumped 0.5% after downbeat report. In economic news initial jobless claims rose by 11,000 to 222,000 last week, the highest level in a month, but still near multi-decade lows. The Philadelphia Fed manufacturing index rose sharper than expected.

Energy shares lead European stocks higher

European stocks extended gains on Thursday led by energy. The euro continued the slide against the dollar while theBritish Pound extended gains, with both rising currently. The Stoxx Europe 600 index rose 0.7%. Germany’s DAX 30 gained 0.9% to 13114.61. France’s CAC 40 outperformed jumping 1% and UK’s FTSE 100 added 0.7% to 7787.97. Markets opened flat to lower today.

British Pound was buoyed by news Britain plans to stay in Europe’s customs union after Brexit on a temporary basis to avoid a hard border with Ireland.

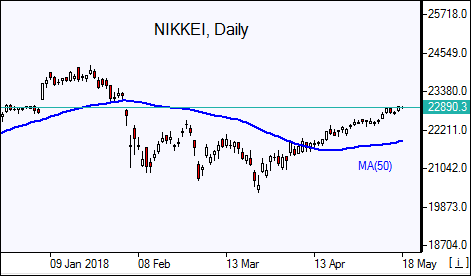

Asian markets rebound

Asian stock indices are mostly higher today. Nikkei rose 0.4% to three-and-half month high 22930.36 helped by continued yen slide against the dollar. Chinese stocks are higher despite President Trump’s comment China had become “spoiled” and he doubted trade negotiations would be successful: the Shanghai Composite Index is 1.2% higher and Hong Kong’sHang Seng Index is up 0.5%. Australia’s All Ordinaries Index is down 0.1% as Australian dollar turned higher against the greenback.

Brent steady

Brent futures prices are steady today on strong demand. They ended marginally higher yesterday, breaching above $80 during the session: Brent for July settlement closed at $79.30 a barrel on Thursday.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.