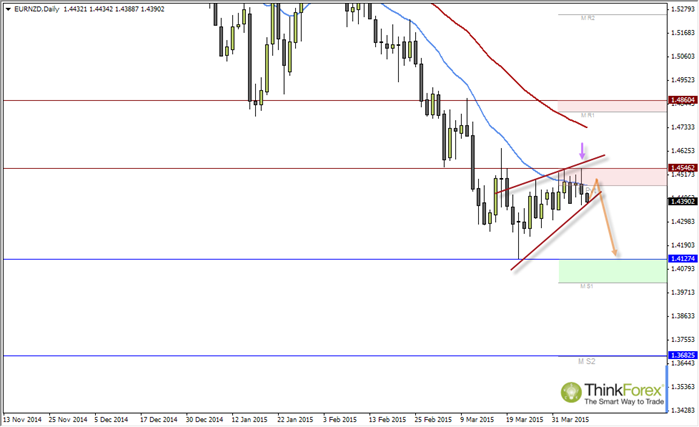

The original analysis in Dec and Jan has played out nicely as the carry trade on the two divergent economies continued to push EURNZD down towards my 1.360 target

Trading around 1.60 at the time of the original analysis we find ourselves 'only' 700 pips from the 1.360 target. When you consider this pair can easily move in excess of 300 pips in a single session then the 700 pip leg should not cause too much of a concern.

The current daily range is within the 100-150 pip region and has found resistance below 1.4560 resistance, suggesting the end of a correction may be nearing. We also find ourselves around the 20 day eMA and below the Monthly Pivot. If we see any bounces within yesterday's range (a Spinning Top Doji) then I will consider fading into the 1.4560 resistance which could achieve a decent 3:1 reward / risk ratio, assuming we move down towards the March lows.

There is no noteworthy news from NZ this week so any significant movements are likely to come from the Eurozone, in particular anything to do with GRExit.

However we may also see a reaction around FOMC, with further Dovish signals from the FED likely to help support Euro crosses and see an upside reaction on EURNZD. Under this circumstance I will still be seeking shorting opportunities in line with the dominant bearish trend, just at higher prices.

As long as we remain below 1.4560 resistance then I favour a run down to 1.4130 lows and eventually beyond.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.