With Iron ore continuing to print fresh 5-year lows and the Australian Dollar under heavy selling pressure then AUS200 could easily be dragged down with it.

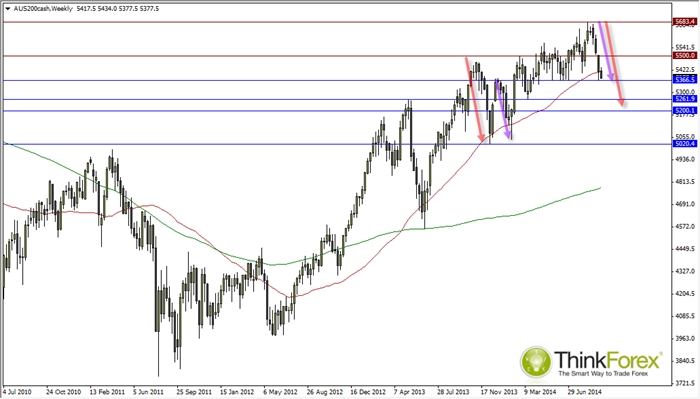

The AUS200 suffered a 600 point decline in April 2013, only to quickly reverse and break to new multi-year highs. The current decline has shed 317 points from the 2014 highs and teeters on the edge of 5366 support. This is a critical level to monitor as it has been successfully tested and respected 5 times this year, which would suggests if it does break the downside could be more significant.

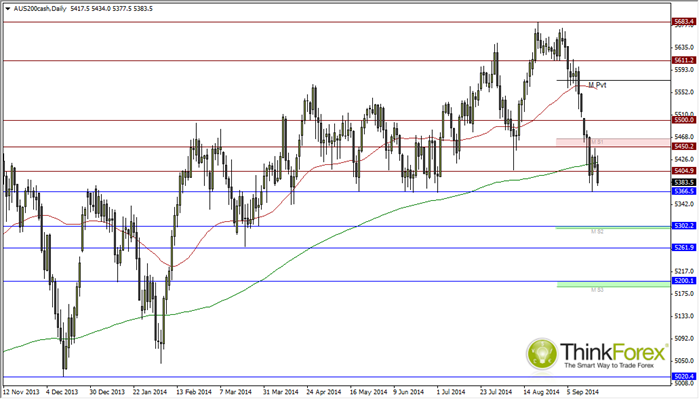

At current levels we are now below the 200 day moving average and the momentum is clearly bearish on the daily charts, to favour a break below the 5366 level sooner than later.

The fact that both the Australian Dollar and Iron ore prices remain under heavy selling pressure also makes a downside break on AUS200 a very likely scenario. Bearish targets include 5302, 5262 and 5200.

Potential methods to trade this are to set sell-stop orders below 5366. These wanting to achieve a higher reward/risk ratio (but also increasing the risk taken from the trade) could look to enter before the anticipated downside breakout. The obvious risk here being that price continues to respect 2366 support and see a bullish move similar to Dec '13 and Jan '14, where both rallies quickly gained over 360 points and 450 points respectively.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.