Today's inflation figures show an annualised reading of 3%, at the top of RBA inflation band, to dampen likelihood of a rate cut.

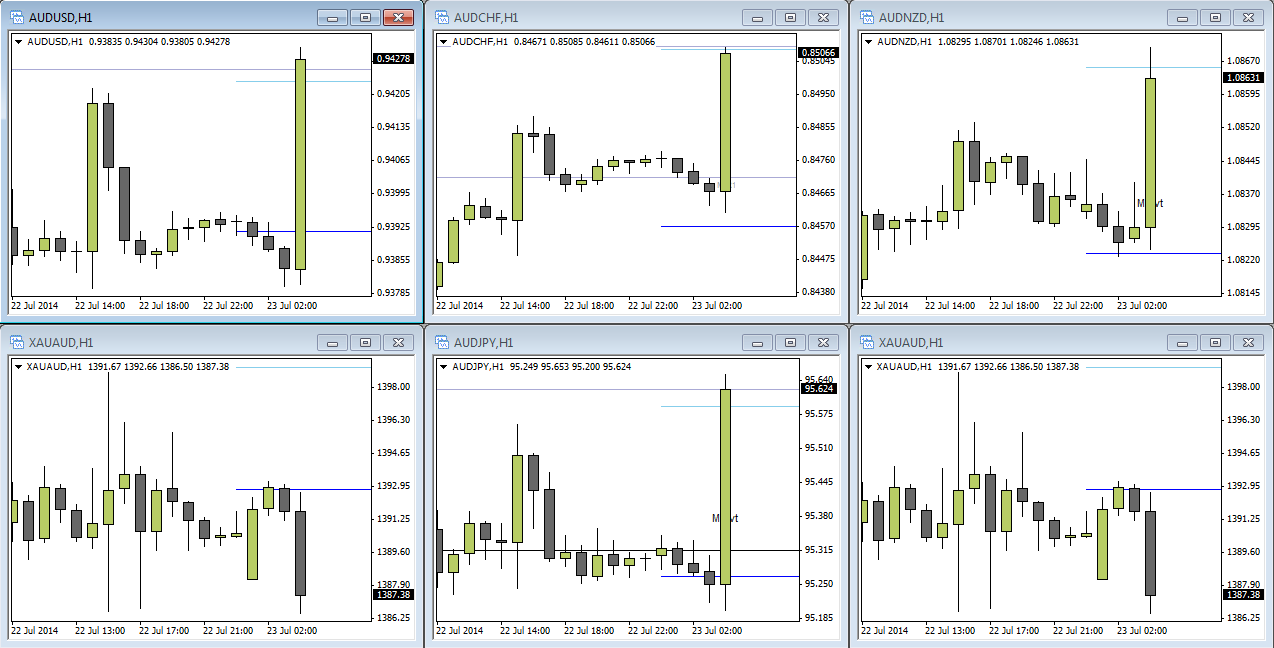

Until today's release the Aussie had lacked both volatility and direction, but following today's positive inflation data the Aussie is now trading at a 9-day highs and appears set to test 0.945. However I expect it to meet headwinds at this level as this could entice profit taking and entice bearish traders to enter short.

A bullish close today near current levels would add to the argument we are seeing a basing pattern forming above 0.9320. Since the bearish decline form 95c (and the 2 most bearish consecutive days in 6-months) bulls have successfully defended the 0.932 level with intraday bullish momentum clearly more bullish.

Tomorrow we have China PMI data which if positive should help support the A$ above 94c. A break back below 94c puts as back into 'no-man’s land' as this lacks any clear direction, with a break below 0.932 swing low to become bearish, keeping in mind we are just above the 93c level.

Does today's inflation raise pressure for a rate increase?

Annualised inflation is now at the top of the "2-3%" band targeted by the RBA, which will raise hopes of a rate increase. Looking at CPI annualised it certainly looks more rosy for Australia, now sitting higher for the 3rd consecutive quarter and at its highest since 2012. However 1 figure at or above this threshold does not necessarily mean rates have to be risen. For example RBA may want to wait for 2 or more quarters above this band before seriously considering it. There are also others factors in play.

Uncertainty remains as to the effectiveness of the current cash rate at 2.5% and it is too soon to completely rule out a rate cut from RBA over the coming months. As we progress further into the year and tapering winds up from the US then I expect this to weigh down heavily on both the A$ and NZD$. Whilst there is a hunt for yields globally from investors, a rate rise from a low yield US will be more significant than a lower rate cut from RBA in my opinion and we should see the A$ back below 90c.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.