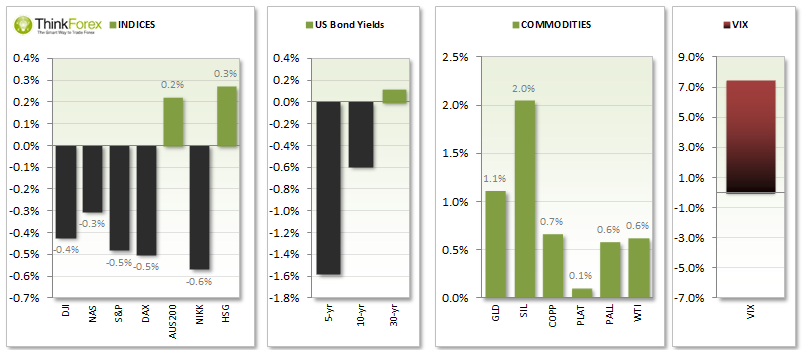

Equities resumed their downwards path and investors took their usual flight to safety following Portuguese bank, as Banco Esparto Santo, (Portugal’s largest bank) had their shares suspended form trading. Europe was the worst hit seeing FTSE is at 10-week lows; CAC40 closed at 19 week lows; DAX closed at 8-week lows

BoE kept rates on hold at 0.5% and UK Trade Balance fell short of expectations and at a 4-month low following higher aircraft imports; Cable saw increased volatility but remained directionless, holding near the multi-year highs.

Canadian Housing Price Index fell short of expectations, but grew at 0.1%, below 0.3% forecast. USDCAD closed flat for the day but we suspect continues to form a basing pattern

US unemployment claims fell to 304k, down from 315k last week and below expectations. This is the lowest since May.

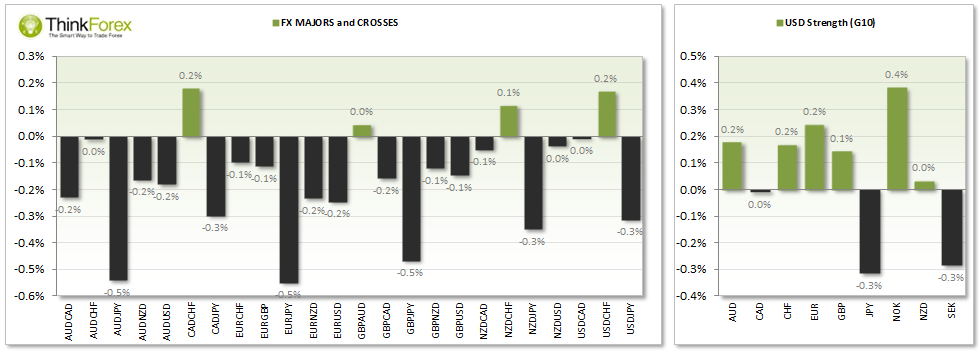

FOREX:

DXY Bullish piercing line but remains below Monthly pivot; Bias it neutral for the day

AUDUSD Long Legged Doji which is also an outside day; Intraday bias is bearish below 94c

EURUSD Dark Cloud Cover but remains between key levels of 1.358 and 1.365; Bias remains neutral

GBPUSD Bearish Hanging Man Reversal but within sideways correction; Intraday remains neutral

USDCAD Trading within suspected basing pattern and midway with sideways correction; Bias remains neutral

USDCHF Intraday bullish bias above 0.892

USDJPY Intraday bias is bearish below 101.250; Otherwise neutral

NZDUSD Rikshaw Man Doji warns of sideways trading or retracement from the highs; Bearish below 0.879 support towards lower channel

COMMODITIES:

GOLD finally saw a push higher to suggest a bullish continuation pattern has been confirmed; $1433 target achieved - above $1330.70 targets $1355

WTI Bullish piercing line holds above $101.60 support to warn of near-term strength

BRENT WTI tests and respect $107.70 support and closed with a bullish piercing pattern to suggest near-term strength

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.