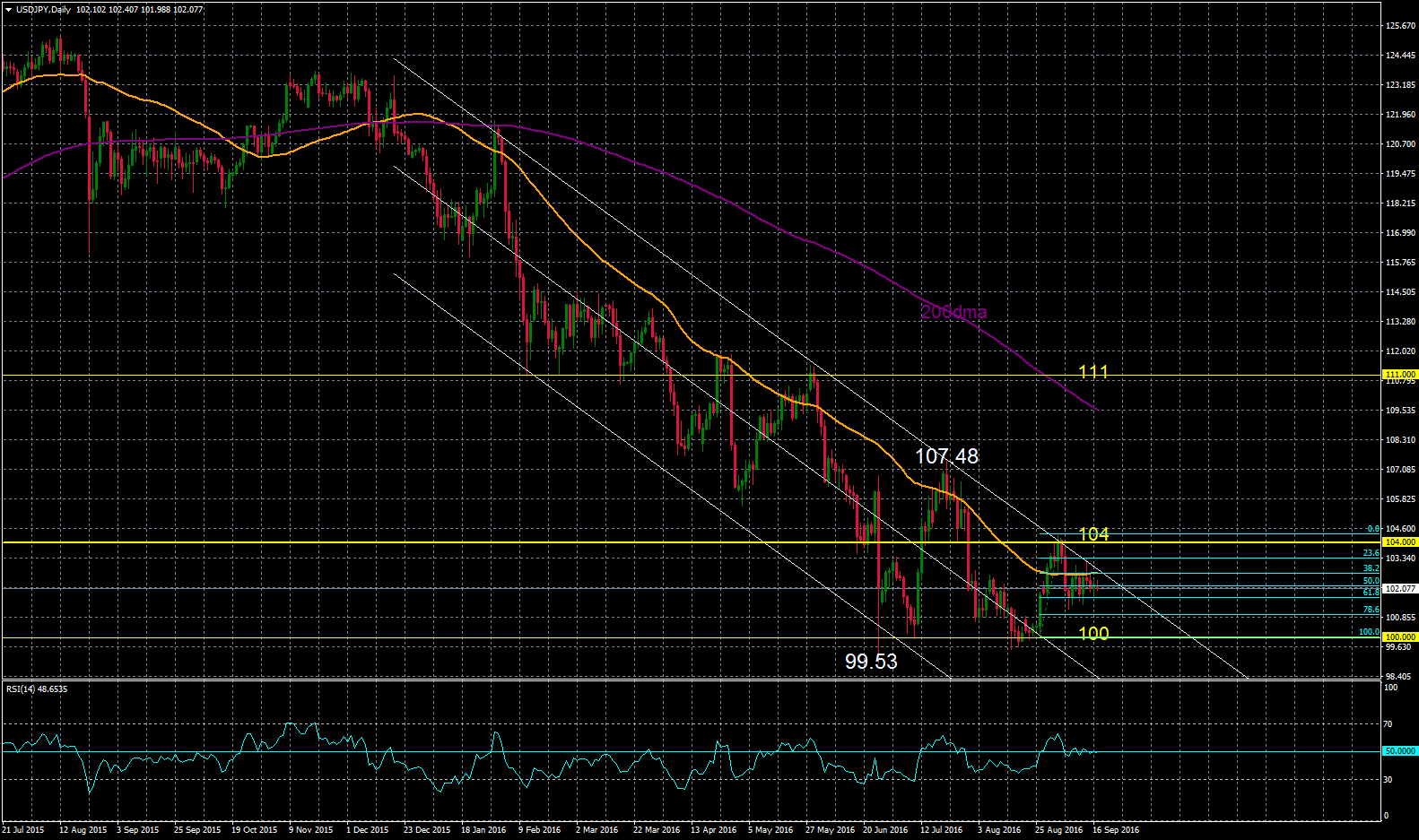

USD/JPY continues to trade in a range, thus keeping a neutral bias for the short term. After rebounding from the 100 yen area on August 26, the pair rose to briefly peak above the 104 yen level. It reached a high of 104.31 on September 2. Since then, the market has pulled back and is now pivoting the 50% Fibonacci retracement level (102.20) of the recent August to September rise. The RSI is flat and hugging the 50 level, which suggests consolidation in the near term.

To the upside, prices are capped at the 50-day moving average at 102.70, which also happens to be the 38.2% Fibonacci level. Prices would need to rise above this resistance level and clear the key 103.00 level in order to see more upside momentum towards 103.40 and 104.00.

To the downside, immediate support lies at 101.70 (61.8% Fibonacci). A break below this would see prices target the 101.00 area and then the critical 100.00 level. A drop below this level would extend the longer-term downtrend that started at the end of December.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.