EURUSD

The Euro cracked strong 1.1400 barrier, on the fifth consecutive day’s extension of rally from 1.1213 (25 Apr low). Sustained break above 1.1400 will open next targets at 1.1463 (12 Apr high) and 1.1495 (15 Oct 2015 peak).

Bullish technicals support further upside, as the pair is on track for strong weekly bullish close.

Initial supports lay at 1.1345/32 (session low / daily 20SMA) and guard 1.1300 support zone (yesterday’s low / daily 10/30SMA’s bull cross).

Res: 1.1412; 1.1463; 1.1495; 1.1555

Sup: 1.1367; 1.1345; 1.1332; 1.1300

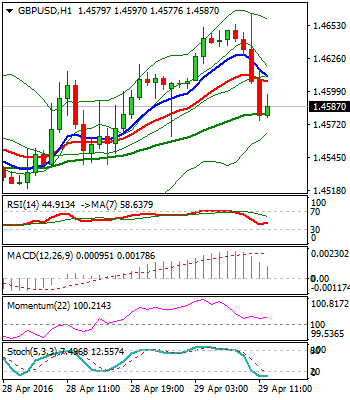

GBPUSD

Cable reached its initial target at 1.4665 (04 Feb high), on today’s fresh bullish extension, signaling an end of two-day congestion and resumption of bull-leg from 1.4004 (06 Apr trough).

Rally was so far capped by weekly Kijun-sen line, with subsequent consolidation, expected to precede fresh attempts higher.

Daily studies maintain firm bullish tone, confirmed by 10/100 & 20/30 SMA’s bull crosses and daily Tenkan-sen line in steep ascend.

The pair is on track for strong weekly close, also ending month in long-tailed bullish candle.

Break above 1.4665 will open next significant barrier at 1.4701(/ Fibo 61.8% of 1.5237/1.3834 descend), above which, stretch towards 1.4900/1.5000 zone, could be anticipated.

Session low at 1.4562, marks initial support, followed by yesterday’s low and hourly higher base at 1.4520, which is expected to contain dips.

Downside trigger lies at 1.4470, two-day consolidation floor, reinforced by ascending daily Tenkan-sen line.

Res: 1.4665; 1.4701; 1.4750; 1.4803

Sup: 1.4594; 1.4562; 1.4520; 1.4470

USDJPY

The pair remains under pressure and extends yesterday’s sharp fall. Loss of strong support and base at 107.60, triggered fresh bearish acceleration, which cracked 107 handle and came ticks away from next downside target at 106.70 (Fibo 76.4% of 100.81/125.84, year-long bull leg).

Firm bearish tone dominates on technicals on all timeframes and sees potential for downside extension towards next significant supports at 105.50/00 zone, as the pair is on track for very strong bearish weekly close and also monthly close in red.

However, daily studies are approaching oversold territory and suggesting corrective action in the near-term.

Former base at 107.60 now marks initial resistance, followed by session high at 108.20.

Res: 107.60; 108.20; 108.80; 109.47

Sup: 106.90; 106.70; 106.00; 105.50

AUDUSD

Aussie closed positive yesterday, taking a breather after Wednesday’s sharp fall triggered by soft inflation data. Overnight’s recovery extension was so far capped by daily 20SMA at 0.7660, keeping bearish setup of daily MA’s in play for possible fresh attempts lower, despite bullishly aligned daily indicators.

The pair is awaiting next week’s RBA’s rate decision for clearer direction. RBA is forecasted to stay unchanged and such decision would boost Aussie for return to 0.7833 (fresh 10-month high, posted on 21 Apr).

Conversely, any surprise from RBA (rate cut) would put the pair under pressure and expose strong supports at 0.7500/0.7490 zone (daily Ichimoku cloud top / daily higher base).

Res: 0.7660; 0.7690; 0.7710; 0.7763

Sup: 0.7617; 0.7578; 0.7546; 0.7490

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.