EURUSD

Bearish acceleration that commenced at the beginning of European session broke initial support at 1.1070, daily Kijun-sen / former hourly base and took out more significant 200SMA, which previously acted as strong support.

Extension below 1.1051 cracked next target at 1.1016, rising daily 30SMA and eyes psychological 1.1000 support.

We look for daily close below 200SMA to confirm bearish stance and signal probe below 1.10 handle, towards next strong support at 1.0963, Fibonacci 61.8% of 1.0709/1.1374 rally, reinforced by 100SMA.

However, daily Slow Stochastic is oversold and bullish signal on reversal higher, could be anticipated.

Former supports at 1.0951/70, now act as initial resistances, which guard pivotal barrier at 1.1140, former consolidation top, which is expected to limit stronger corrective attempts.

Res: 1.1051; 1.1070; 1.1122; 1.1140

Sup: 1.1000; 1.0963; 1.0900; 1.0865

GBPUSD

Cable started the week with approx 120 gap-lower, on increased concerns that Britain would leave European Union, following comments of influential London Major Boris Johnson, who supported Brexit campaign. Johnson’s comments offset positive sentiment, gained on Friday’s EU-UK agreement, which aimed to keep Britain in the bloc.

Bearish acceleration after choppy consolidation in Asia, surged through initial supports at 1.4147/1.4100 and cracked key support at 1.4078, 21 Jan former low. Corrective phase from 1.4078 to 1.4665 has been completed and close below 1.4078 will confirm break for fresh extension of the downleg from 1.4665, lower top of 04 Feb.

Daily studies hold firm bearish setup and favor extension of the second leg of larger downtrend from 1.7189, peak of 15 July 2014, towards 1.3680, low of June 2001 an key long-term support at 1.3501, low of 23 Jan 2009, which is coming in short-term focus.

Former base at 1.4233/45 zone, lows of 17/19 Feb, is expected to ideally cap recovery attempts.

Res: 1.4133; 1.4180; 1.4245; 1.4303

Sup: 1.4055; 1.4000; 1.3945; 1.3900

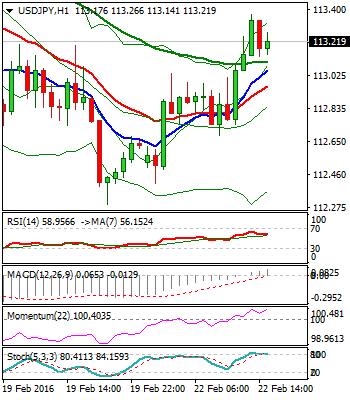

USDJPY

The pair is in near-term recovery mode, off Friday’s low at 112.29, which was posted on two-day bearish acceleration, which extended pullback from 114.85, 16 Feb high.

Fresh bullish acceleration left inversed hourly H&S pattern, which signals extension towards measured levels at 113.65/85, Fibonacci 138.2% and 161.8% expansion of the wave C that commenced from 112.68, today’s low, as a part of five-wave rally from 112.29 low.

Near-term technicals are gaining traction, however, larger picture remains firmly bearish and signals limited recovery while initial barrier, falling daily 10SMA at 113.56, which capped past four-day descend, stays intact.

Otherwise, daily close above 10SMA, will form bullish Outside Day reversal pattern and signal possible stronger recovery.

Today’s low at 112.68, is expected to contain extended dips and keep fresh near-term bulls in play.

Res: 113.56; 113.65; 113.85; 114.30

Sup : 113.00; 112.68; 112.29; 111.65

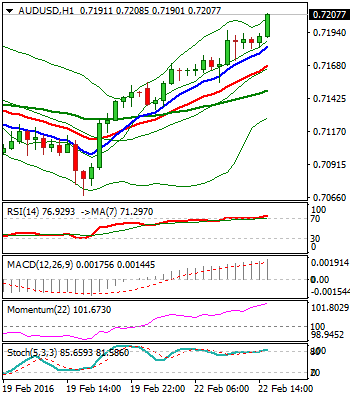

AUDUSD

The Aussie remains well supported in the near-term and extends bull-leg off 0.7067, low of last Friday, through former recovery high at 0.7185. Fresh strength cracked psychological 0.7200 barrier and looks for final push towards key near-term barrier at 0.7241, 04 Feb former recovery top.

Regain of the latter is needed to confirm completion of 0.7241/0.6972 corrective phase and signal resumption of recovery rally from 0.6825, low of 15 Jan.

Daily studies are in firm bullish setup, with additional bullish signal being given by Friday’s long-tailed daily candle, which confirmed persisting buying interest.

Rising daily 10SMA underpins the action at 0.7129, followed by 20SMA at 0.7107, which reinforces pivotal support, daily Ichimoku cloud top.

Res: 0.7241; 0.7282; 0.7325; 0.7383

Sup: 0.7185; 0.7160; 0.7129; 0.7107

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.