EURUSD

The Euro trades within narrow range above fresh low at 1.0832, posted yesterday, with consolidation being so far capped at 1.09 zone, and negatively aligned near-term studies, showing limited upside.

The action is seen preceding final push towards key short-term support at 1.08 zone, multi-month congestion low.

However, caution is required as daily studies are overextended and slow Stochastic is entering oversold zone.

Falling daily 10SMA offers strong barrier at 1.0960, followed by bear-trendline off 1.1712 peak that maintains descend and lies at 1.10 zone. Extended rallies should be capped here, to prevent attempts for stronger correction.

All eyes are turned on today’s US NFP data, which is forecasted at 180K, with general opinion that releases above 150K will be considered as good result and speculations about 100-125K, being also on the table.

Releases at or above forecasted levels will be supportive for the greenback for eventual break below 1.08 handle.

Res: 1.0896; 1.0923; 1.0960; 1.1000

Sup: 1.0862; 1.0832; 1.0807; 1.0713

GBPUSD

Cable establishes below 1.5200, Fibonacci 76.4% of 1.5105/1.5506 rally, on fresh extension of yesterday’s sharp fall, which was triggered by dovish BoE’s rate comments.

Yesterday’s long red daily candle and today’s fresh acceleration lower, confirm strong downside pressure for final push to the key 1.5105/1.5085 support zone, 30 Sep low / Fibonacci 61.8% retracement of 1.4563/1.5928, Apr/June rally, on anticipation of strong US jobs data.

Fresh weakness came ticks away from weekly Ichimoku cloud base at 1.5147, seen as sole obstacle on the way to 1.5105 target.

However, corrective action of past week’s sharp fall, could be expected, before final attack at 1.5105/1.5085 support, as daily slow Stochastic is entering oversold zone.

Former lows at 1.5240, mark initial resistance, ahead of daily 30SMA at 1.5311, 200SMA at 1.5340 and daily Ichimoku cloud base at 1.5358, below which, extended rallies should be capped.

Res: 1.5217; 1.5240; 1.5311; 1.5340

Sup: 1.5147; 1.5105; 1.5085; 1.5050

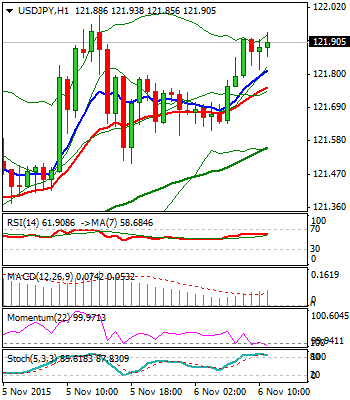

USDJPY

The pair remains supported and consolidates recent rallies that peaked at 122.00. Consolidation was contained at 121.50, tick away from former top at 121.46, with fresh strength, looking for retest of 122 barrier and bullish resumption.

The dollar is supported by positive US NFP expectation, with strong bullish tone of daily technicals and action being underpinned by broken thick daily Ichimoku cloud, top of which lies at 120.70.

Positive NFP release could trigger strong bullish acceleration and open next target at 124.14, June 2007 peak.

Conversely, disappointing NFP would shift focus towards 200SMA and daily cloud top supports.

Res: 122.00; 122.37; 122.92; 123.83

Sup: 121.50; 121.10; 120.70; 120.24

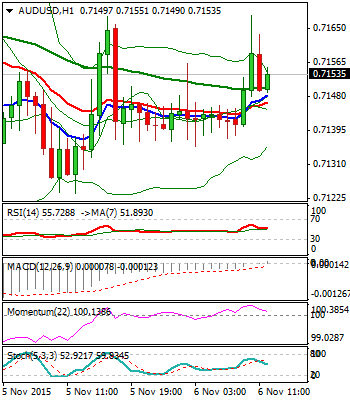

AUDUSD

Aussie found temporary support at 0.7124, Fibonacci 61.8% of 0.7064/0.7220 rally, above which, near-term price action consolidates in narrow range.

Studies of lower timeframes hold in neutral mode, ahead of NFP data, while daily bears, established on upside rejection at 0.7222, remain in play.

Daily 20SMA, which capped recovery, reverses lower, as daily indicators hold below midlines, favoring fresh downside action.

Break below 0.7124 handle is needed to confirm and trigger fresh acceleration towards key near-term supports at 0.7078, daily Ichimoku cloud base and 0.7064, 29 Oct low.

Daily cloud top at 0.7171 offers initial barrier and stays intact for now, guarding more significant barriers at 0.7206 and 0.7222, daily 20SMA / upside rejection.

Res: 0.7154; 0.7176; 0.7214; 0.7222

Sup: 0.7135; 0.7124; 0.7078; 0.7064

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.