EURUSD

Bounce from near-term base that is forming at 1.09 zone, cracks psychological 1.10 resistance, on extended recovery, triggered by week-end profit-taking. The notion is supported by daily slow Stochastic that reverses from oversold territory and gives bullish signal.

However, limited upside action is expected, ahead of fresh leg lower, as overall structure remains bearish and initial signal of more significant downside extension, was given by cracking monthly bearish wedge pattern’s support line, which lies at 1.0895.

Also, daily 10/200SMA Death Cross is forming at 1.1108 and signals increased pressure.

Expect corrective rallies to be ideally capped at 1.1072, bear-trendline that connects 1.1712 and 1.1458 peaks.

Only sustained break above 200SMA would sideline near-term bears, in favor of stronger correction.

Res: 1.1023; 1.1072; 1.1094; 1.1108

Sup: 1.0964; 1.0923; 1.0895; 1.0862

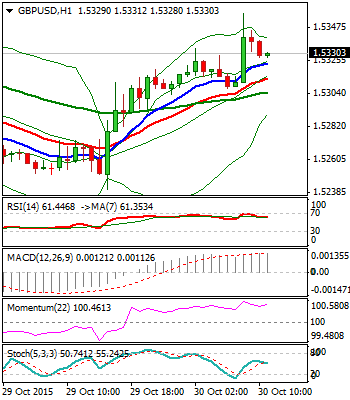

GBPUSD

Near-term price action is moving in corrective mode, signaled by yesterday’s Outside Day candle and today’s fresh extension higher that probes above 200SMA at 1.5335, also near Fibonacci 38.2% of 1.5504/1.5240 downleg.

Initial basing signal could be expected on sustained break here, as the action is signaled by daily slow Stochastic, reversing from oversold zone.

However, near-term studies are still weak, with bearish daily technicals, seeing current action as limited correction, preceding fresh attempts lower.

Significant barriers lay at 1.5372, daily Tenkan-sen, ahead of psychological 1.54 barrier, also Fibonacci 61.8% of 1.5504/1.5240, marking initial pivot and guarding daily Ichimoku cloud base, now lowered to 1.5463.

Res: 1.5372; 1.5403; 1.5463; 1.5506

Sup: 1.5307; 1.5285; 1.5240; 1.5200

USDJPY

Fresh bearish acceleration and return into daily Ichimoku cloud, signals repeated upside stall. Recovery action today, spiked at 121.46, previous peaks 23/26 Oct, which acts as strong resistance and caps for now.

This would signal prolonged consolidation phase, which is now entrenched within 120.00/121.46 range, before the price action establishes in fresh direction.

Bullishly aligned daily technicals, still keep the upside in focus; however, weakening near-term studies, maintain downside risk.

Break below range floor, also daily Ichimoku cloud base, reinforced by daily 20SMA, would trigger fresh weakness and confirm near-term platform at 121.46.

Res: 121.00; 121.25; 121.46; 121.64

Sup: 120.15; 120.00; 119.60; 119.35

AUDUSD

Near-term price action moves in narrow consolidation, after posting fresh low at 0.7064 yesterday and closing below daily Ichimoku clod base and 0.7105, Fibonacci 61.8% retracement of 0.6935/0.7380 upleg.

Daily bears are firming for further downside attempts that focus psychological 0.7000 support and see key 0.6935/ 05 supports in extension.

Daily cloud base offers good resistance and should ideally cap consolidation.

Only acceleration through 0.7196, daily cloud top, would question bears.

Res: 0.7135; 0.7179; 0.7196; 0.7218

Sup: 0.7076; 0.7040; 0.7000; 0.6935

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.