EURUSD

The Euro ended yesterday’s trading in long-legged Doji and managed to close above thin daily cloud top that lies at 1.1141. Corrective pullback from 1.1212, 12 Aug peak, found support at 1.1078, Fibonacci 38.2% of 1.0854/1.1212 upleg and marked false break of pivotal daily55SMA at 1.1090. Subsequent bounce peaked at 1.1164, with near-term price action stabilizing within 1.1136 and 1.1164 range. Near-term studies returned to positive mode, together with daily indicators establishing in positive territory and bullish setup of daily MA, keeping the upside in focus. The pair is poised for strong weekly close that comes after double weekly Doji and suggests further recovery. Eventual push above pivotal 1.1212/15 double-top, is needed to signal fresh extension of larger bull-leg from 1.0844, 05 Aug low. However, further hesitation under 1.1215 would keep downside risk in play, as daily Stochastic is overbought, with daily 55SMA and yesterday’s low, still marking pivotal support. Close below here to signal stronger correction and expose 1.1025, low of 12 Aug and daily Tenkan-sen line, next strong support.

Res: 1.1160; 1.1186; 1.1215; 1.1250

Sup: 1.1136; 1.1093; 1.1078; 1.1025

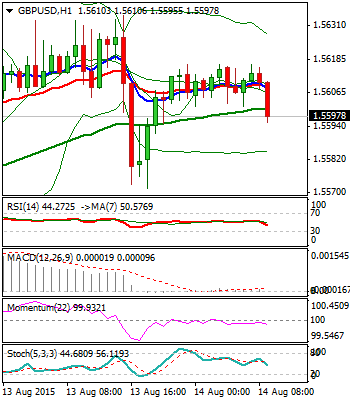

GBPUSD

Cable remains supported, as near-term price action holds above daily cloud top at 1.5557, pivotal support. Yesterday’s long-legged Doji, signals indecision ahead of 1.5670/88 breakpoint, keeping daily indicators in neutral mode, while daily MA’s are bullishly aligned and 20SMA offers initial support at 1.5571 that contained yesterday’s dips. Also, hourly studies are neutral, while 4-hour technicals are losing traction. This suggests prolonged sideways mode, with near-term focus shifted higher, while 20SMA / cloud top holds. Otherwise, expect weaker near-term structure and focus turned towards the lower side of short-term 1.5420/1.5688 range, on break lower.

Res: 1.5616; 1.5635; 1.5658; 1.5670

Sup: 1.5595; 1.5571; 1.5557; 1.5531

USDJPY

The pair trades in near-term consolidative phase, after bounce from 123.78, 12 Aug pullback’s low, peaked at 124.61 and consolidation being established within 124.24 and 124.61 range. Near-term technicals are neutral / weak that keeps the downside vulnerable. Daily 20SMA marks pivotal support at 124.16 and remains under pressure, with break here to further soften near-term tone and risk retest of the next pivot at 123.78, for stronger correction, on violation of the latter. Otherwise, bullish daily structure is expected to keep focus at the upside, as long as 20SMA holds, with rallies through 124.61/70, recovery peak / Fibonacci 61.8% of 125.26/123.78, to signal resumption of recovery from 123.78 low.

Res: 124.61; 124.70; 125.00; 125.26

Sup: 124.16; 123.78; 123.50; 123.00

AUDUSD

The pair trades in tight consolidative range, after recovery bounce off fresh low at 0.7212 was capped at 0.7406, yesterday. Daily 20SMA continues to protect the downside and marks pivotal support at 0.7343, along with north-heading daily indicators and positively aligned near-term studies, keeping the upside in focus. Key barrier lies at 0.7435, 11 Aug high and sustained break here to give initial signal for stronger recovery. Failure to break higher, would signal extended consolidation, while 20SMA holds. Otherwise, break lower is expected to soften near-term structure and re-focus fresh 6-year low at 0.7212.

Res: 0.7406; 0.7435; 0.7455; 0.7495

Sup: 0.7343; 0.7321, 0.7300; 0.7282

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.