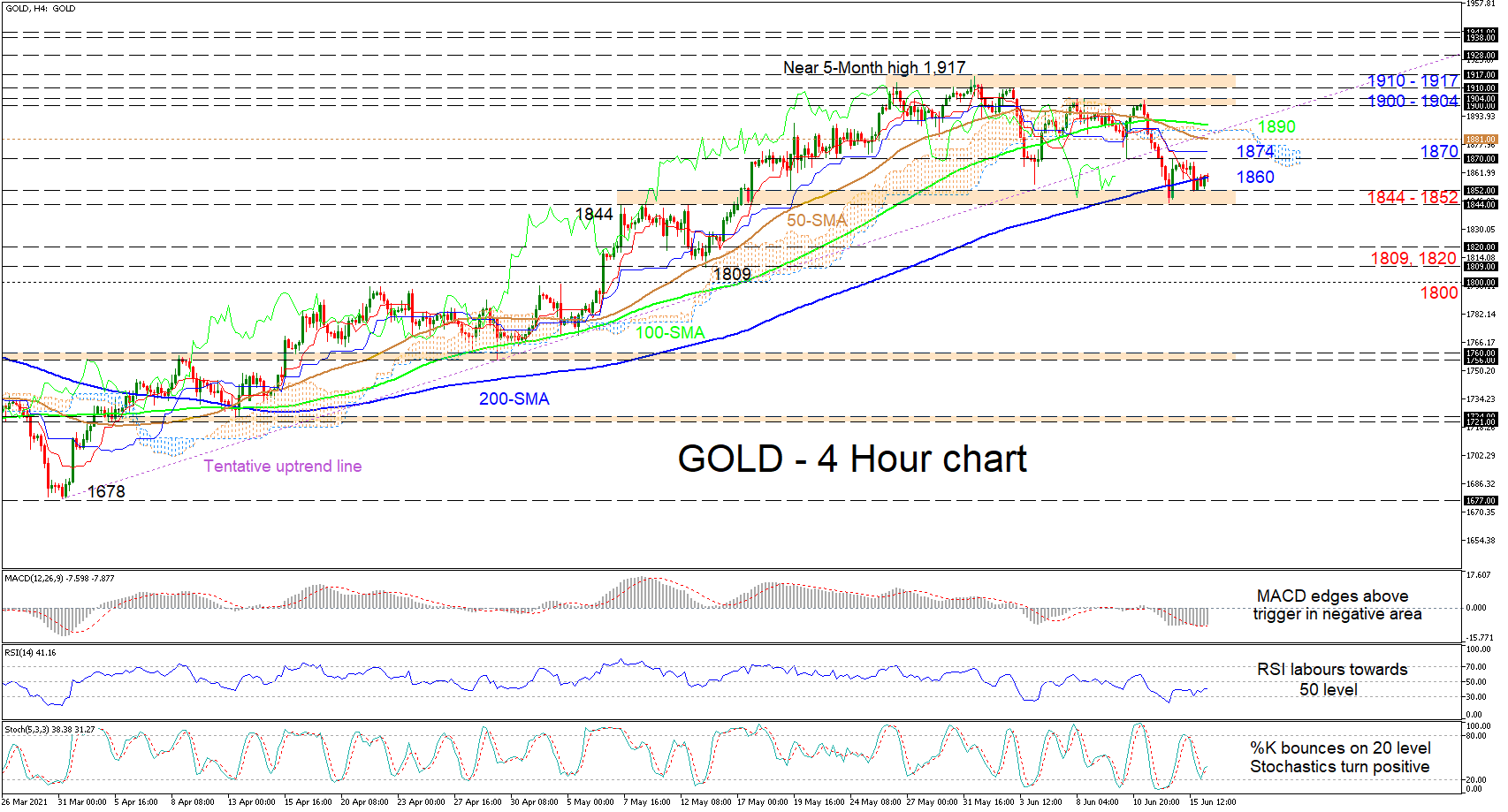

Gold has located its footing in the support zone of 1,844-1,852 after steadily fading from the 1,900 vicinity, breaking a tentative uptrend line - pulled from the 1,678 trough - and piercing below the 200-period simple moving average (SMA). The declining slope of the 50-period SMA has somewhat eased and together with the 100-perod SMA, are suggesting the price may adopt a sideways trajectory, at least for a while until a more absolute direction evolves.

The flattening blue Kijun-sen line is signalling that negative momentum has lost its power, while the short-term oscillators are indicating that buyers are striving to gain the upper hand. The MACD, some distance below zero, has prodded marginally above its red trigger line, while the RSI is struggling to improve towards its neutral threshold. Should the recently gained bullish charge in the stochastic oscillator endure, this could promote extra positive traction in the price.

If the vital border of 1,844-1,852 proves to be a strong foundation and the price returns above the 200-period SMA at 1,860, early resistance could arise from the 1,870 nearby high. Hiking further, gold may then encounter a resistance zone between the 50- and 100-period SMAs at 1,881 and 1,890 respectively. Next, the crucial 1,900-1,904 boundary may impede additional gains in the commodity. However, if buying interest dominates, the focus may then turn to the 1,910-1,917 neigh bouring ceiling, the latter level being the 5-month peak.

To the downside, immediate support may come from the 1,844-1,852 zone. Should this significant border break down, the price could sink towards the next corresponding troughs of 1,820 and 1,809. Despite continual downside pressures, the price would need to fall beneath the 1,800 handle to confirm that price sentiment has become increasingly negative.

Summarizing, gold seems to have moulded a strong footing around the 1,844-1,852 proximity. The commodity may adopt a sideways demean our should this foundation remain steadfast.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.