The Australian dollar has seen its sharpest fall in over 12 months as it fell strongly every day last week from near 0.94 down to a six month low at 0.90 to start this week. The doldrums that have befallen the Euro and pound over the last couple of months have finally been caught by the Australian dollar. The long term key level at 0.90 has been called upon to desperately provide some much needed support to the Australian dollar, which it has done in the last 24 hours. It showed some positive signs to finish out a couple of weeks ago as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 before falling sharply again. A few weeks ago it enjoyed a solid week moving up from below 0.9300 to a then three week high around 0.9370 before easing a little lower to finish the week. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level.

The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Australian house price rises are among the highest in the world but a new report warns homes here could be overvalued. The Bank of International Settlements, known as the central bank for central banks, says Australian house price growth was second only to Norway. But stripping out the effects of inflation, Australia's real property price growth rate was almost flat in the past three years, the report said. The BIS data, which covered 29 countries, also shows that Australia's housing prices were unusually high relative to rents, along with Norway, Canada and Sweden. 'This could be a reason to expect a price correction in the future,' the report said. 'Interestingly, some of these countries have experienced only moderate price growth recently (eg Canada, Norway and Sweden), or even price declines (eg Australia, Belgium and France).' Only Belgium had higher prices than Australia when compared to household incomes, the report showed. It said current property prices in some countries were at least 20 per cent higher than those implied by the historical relationship to incomes, suggesting 'potential downward pressures on real house prices'. 'This might lead to a reversal or moderation of recent growth (eg in Canada) or a further sliding of prices (eg in Belgium and France),' the report said.

(Daily chart / 4 hourly chart below)

AUD/USD September 16 at 02:35 GMT 0.9039 H: 0.9043 L: 0.9025

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is consolidating and trading in a narrow range around 0.9040 after recently dropping sharply back down to 0.90. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again. Current range: trading right around 0.9040.

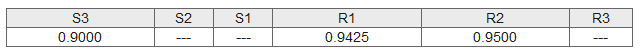

Further levels in both directions:

- Below: 0.9000.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.