The Australian dollar is trading in a small range just below the key 0.9425 level after reaching a three week high just shy of 0.9480 in the last 24 hours. During the last couple of days, it has enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week high, before easing back towards that level. It started this week by slowly easing away from the resistance level around 0.9425 which continues to stand tall and play havoc with buyers. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 a few weeks ago, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time.

The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

The house price boom shows no sign of cooling despite the onset of winter. Price growth in almost all capital cities in the three months to June has helped the median Australian house price soar almost 11 per cent in just 12 months. Sydney is leading the surge, where the median house price climbed by more than $100,000 in the year to June, or 17 per cent, to hit a record $812,000. Melbourne recorded 10 per cent growth to $608,000, according to the latest report from Australian Property Monitors (APM). June quarter prices showed capital city housing markets are showing no signs of slowing down, APM senior economist Dr Andrew Wilson said. "Most capital cities are maintaining or exceeding the solid to strong prices growth levels recorded during the previous quarter," he said. "Other leading indicators of housing market activity such as home loan activity and auction clearance rates point to continued solid buyer activity through 2014." Canberra was the only capital city not to have an increase in house prices in 2013/14, dropping by 0.5 per cent to a median price of $576,000. Despite strong growth in median house prices, unit prices were more varied. Sydney's 13.3 per cent growth did pull the national average up to 8.3 per cent, but Brisbane, Canberra and Hobart all fell.

(Daily chart / 4 hourly chart below)

AUD/USD July 24 at 23:30 GMT 0.9416 H: 0.9422 L: 0.9413

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is trading in a small range just below the key 0.9425 level after reaching a three week high just shy of 0.9480 in the last 24 hours. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading below 0.9425 around 0.9415.

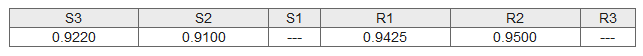

Further levels in both directions:

- Below: 0.9220 and 0.9100.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.