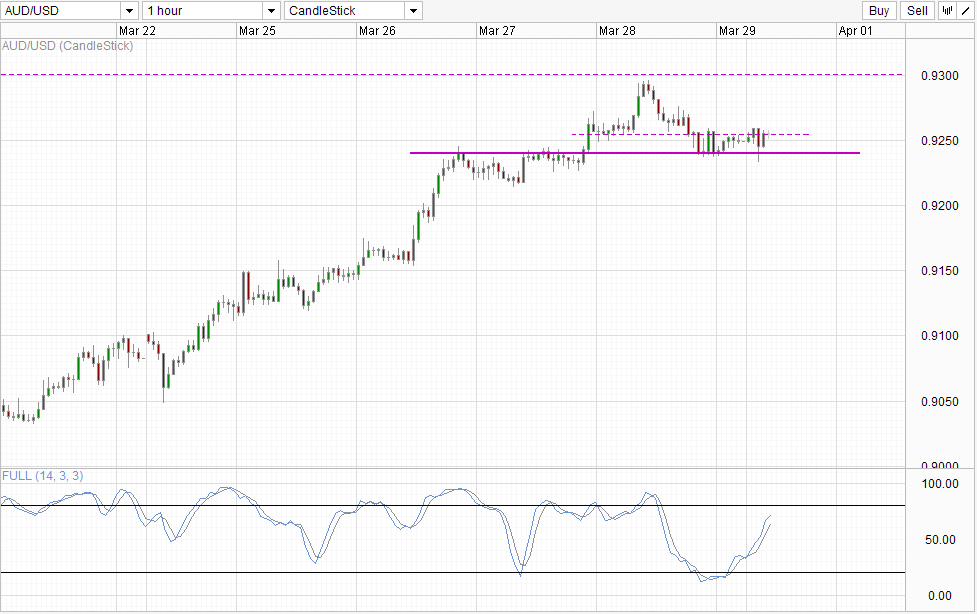

Prices appears stable this morning, staying mostly around the trading range seen during Friday's US session. There was a small pop during opening hours but prices quickly pushed lower after tagging the soft resistance of 0.9255. As the decline wasn't sparked by any news nor was it in line with the broad bullish market sentiment (Asian stocks are in the black with Nikkei 225 +0.43% while ASX 200 +0.71%), the decline was only driven by pure market sentiment alone.

Hourly Chart

This highlights the strength of bears, and suggest that the possibility of further bearish correction remains. The attempt to break soft support 0.924 failed this time round, but a retest of 0.924 may be possible especially since Stochastic indicator agrees with Stoch curve likely to reverse around the "resistance" level of 65.0. That being said, it should be remembered that prices actually started bullishly today, and overall trend remains broadly bullish in the short-run. Hence, we should not be expecting a landslide in prices. Furthermore, even if 0.924 is broken, price will likely find support around the consolidation zone seen between 26th -27th March, and failing which the 0.92 round figure will come into play.

Daily Chart

Long-term chart is more bearish though, as prices appears to be topping around the 0.93 significant resistance level. Stochastic indicator concurs as Stoch curve has already U-turn and crossed the Signal line, suggesting that a Stoch is likely in place. That being said, we are still a distance away from a proper bearish cycle signal, and that is likely to happen should price levels break the narrowing wedge top which will open up a move towards lower wedge.

It is difficult to see whether prices will be able to breach the lower wedge altogether, as bullish momentum from late Jan 2014 remains in play. Also, lower wedge is likely to be confluence with the 0.913 ceiling, and as such stronger support should be expected.

On the fundamental side of things, as central bank RBA has signaled that they would like to keep interest rates stable in the next few months, the risk of rate cuts have shrunk considerably and as such declines due to rate expectations have disappeared. Economic prospect have brighten up a little as well, with latest employment data much stronger than expected. However, with China's economy at risk of a collapse, there remains downside risks to Australia's economy who exports mainly to China.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.