The post-BOJ global risk-on rally petered out yesterday. This prevented further USD gains. USD/JPY initially stabilised in the lower half of the 121 big figure, but lost slightly ground later to end the day at 120.99 (from 121.14 on Friday). The US eco data (spending and income, Markit manufacturing PMI and manufacturing ISM) were soft, but mostly close to expectations and had hardly any lasting impact on USD trading. Fed Fisher acknowledged the potential impact of the recent rise in volatility, but refused to given any hints on what the Fed will do in March.

EUR/USD regained some ground after Friday’s USD gains. Even so, the pair holds within the boundaries of an extremely tight range and closed the session at 1.0888 (1.0831 on Friday evening).

This morning, most Asian equities show modest losses in line with Europe and the US yesterday. Oil extends yesterday’s decline with Brent trading below $34/barrel. Chinese equities outperform and show gains of about 2%-3%. The PBOC tries to maintain market calm going into the Lunar New Year holidays. The Bank fixed the yuan at the strongest level against the dollar since in early January. The Reserve Bank of Australia as expected kept its policy rate unchanged at 2.0%. The exchange rate of the Aussie dollar has continued its adjustment to the evolving economic outlook. For now, the RBA stays in wait-and-see modus, but maintains its easing bias. “Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand”. The Aussie dollar lost a few ticks after the RBA’s statement and trades currently just below the AUD/USD 0.71 big figure. The halt in the risk-on rally and the decline in the oil price also weigh slightly on the US dollar. USD/JPY changes hands in the 120.70 area. EUR/USD regained the 1.09 mark.

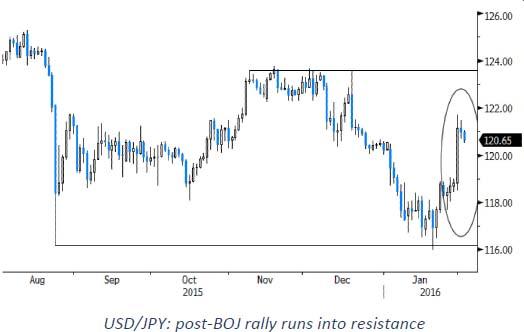

Today, the eco calendar is extremely thin. The EMU PPI and unemployment rate are interesting, but a bit outdated and no market movers. In the US there are only second tier eco data on the agenda. Yesterday morning, it looked that the positive fall-out from the BOJ easing on Friday could be enough for the dollar the preserve its recent gains. However, the positive momentum, both for equities and oil, evaporated during the day and also broke the short-term USD-positive momentum. What can’t go up, must come down.

So, in a day-today perspective, the dollar is now again drifting cautiously lower against the euro and the yen. However, especially EUR/USD still evolves within an extremely tight sideways range.

From a technical point of view, EUR/USD several times tried to break below the 1.08 barrier, but a sustained down-move didn’t occur, leaving the pair in a very tight sideways consolidation pattern. Next support is at 1.0711/1.0650 (correction low, 76% retracement off 1.0524/1.1060) and at 1.0524. On the topside, 1.0985/1.1004 (reaction top) is a first reference. This level was left intact even as sentiment was outright risk-off before the ECB meeting. Next resistance comes in at 1.1060/1.1124 (15 Dec top: 62% retracement). We expect this resistance to be difficult to break. We look to sell EUR/USD on upticks for return action lower in the range. The picture for USD/JPY improved as the pair rebounded above 120 after Friday’s BOJ policy decision. Even so, we are reluctant to position for further sustained USD/JPY gains as long as global uncertainty persists.

Sterling shows remarkable strength

Yesterday, sterling initially hovered up and down against the euro and the dollar, but finally closed the day with strong gains The UK currency touched a first intraday top mid-morning as the UK manufacturing PMI came out stronger than expected, while the December money supply and lending data were uneventful. In technical, order driven trade, the post- PMI gains were almost immediately reversed. Conflicting headlines on the EU/UK negotiations maybe were a source of intraday volatility. At the end of the day, sterling made a remarkable comeback, even as oil declined, which was often a negative for sterling trading of late. EUR/GBP closed the session at 0.7544 from 0.7608 on Friday evening. Cable even rebounded north of 1.44 level, but part of the is rise was due to USD weakness rather than GBP strength.

Today, the UK construction PMI is expect marginally weaker at 57.5 from 57.8, but it won’t affect trading much. Oil, global sentiment on risk and the Brexit debate will remain the key drivers for GBP trading. These issues suggest a weaker sterling short-term. Yesterday’s GBP rally in the absence of a clear trigger looks overdone. Investors will also look forward to the BoE policy decision and the new inflation report on Thursday.

In a longer term perspective, uncertainty on Brexit and global negative risk sentiment remain important drivers for sterling weakness. As long as these issues aren’t solved, a sustained sterling rebound is unlikely. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next resistance stands at 0.7875. A return below 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.