Stocks: More volatility following hawkish Powell

Stock prices were volatile on Tuesday, as the S&P 500 fell to the new local low. But today it may rebound again. but will the downtrend continue?

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

The S&P 500 index lost 1.90% on Tuesday, Nov. 30. The market went lower following testimonies from the Fed Chair Powell and the Treasury Secretary Yellen. On Monday the broad stock market retraced more than a half of its Friday’s sell-off, but yesterday it fell to the new local low of 4,560.00. Today it is expected to open 1.0% higher again, so we will see more short-term volatility.

The nearest important support level is at 4,560-4,600. On the other hand, the resistance level is at 4,650, marked by the recent local lows. The S&P 500 retraced most of its early November advance, as we can see on the daily chart.

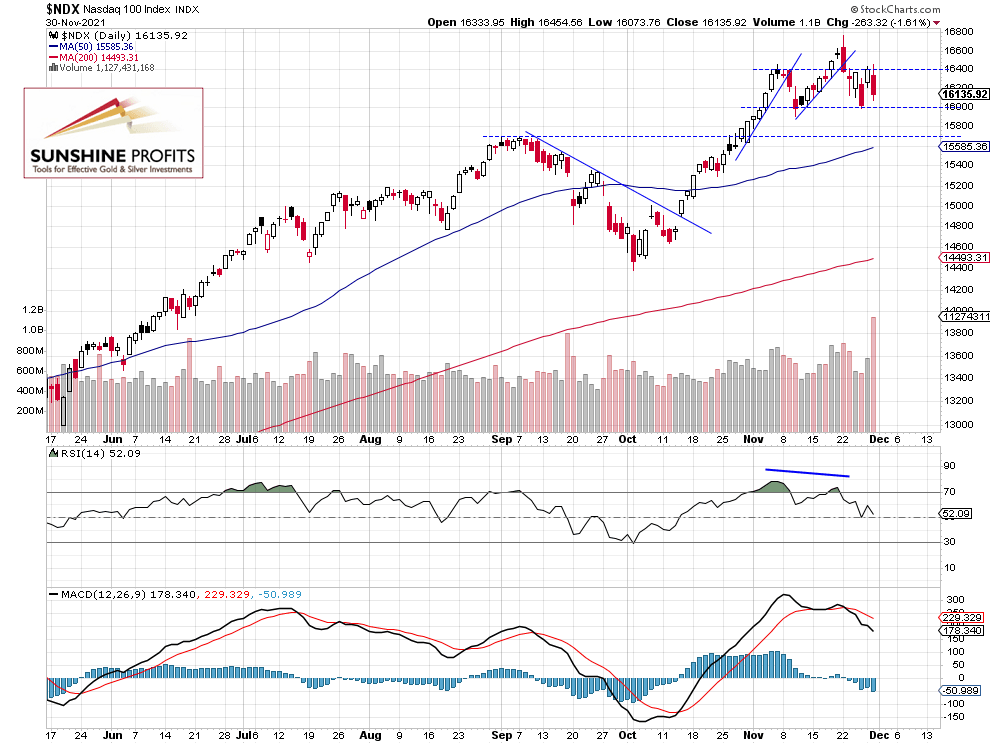

Nasdaq 100 remains relatively stronger

Let’s take a look at the Nasdaq 100 chart. The technology index remained relatively stronger than the broad stock market yesterday, as it didn’t extend a short-term downtrend. It remained above its Friday’s local low and above the 16,000 mark, as we can see on the daily chart:

Apple got close to the record high again

Let’s take a look at biggest stock in the S&P 500 index: AAPL. Apple accelerated its uptrend a week ago and it reached the new record high of $165.70. However, it retraced almost all of its intraday advance that day. On Friday it got back to a support level of around $157. And yesterday it got back to the all-time high, as it closed slightly above the $165 price level.

Conclusion

The S&P 500 index is expected to open 1.0% higher this morning following an overnight rebound from the yesterday’s new short-term low. We will likely see an intraday consolidation following a higher opening. And for now, it looks like a consolidation within a short-term downtrend.

Here’s the breakdown:

-

The S&P 500 extended its short-term downtrend yesterday, but today it is expected to open higher again.

-

A speculative short position is still justified from the risk/reward perspective.

-

We are expecting a 5% correction.

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.