Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

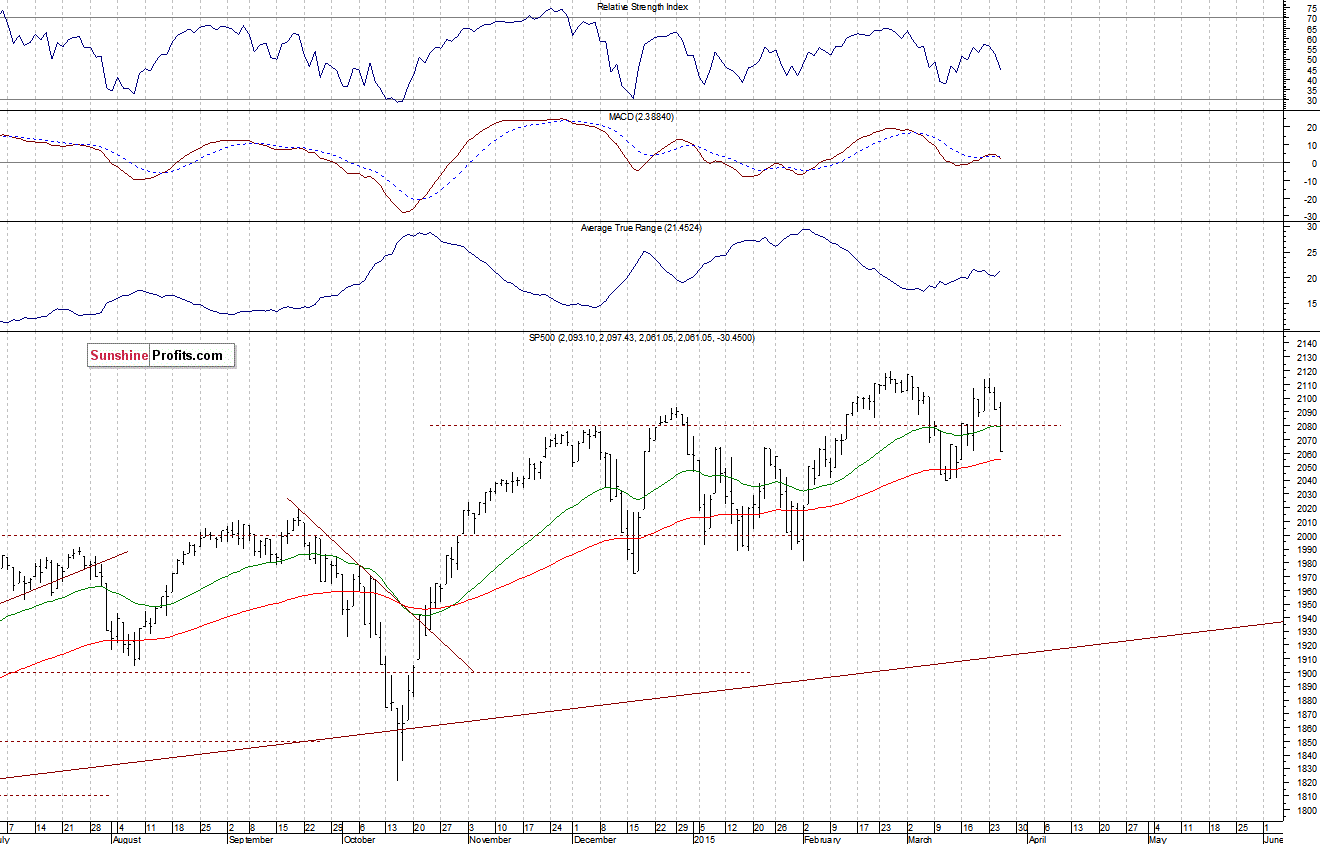

The main U.S. stock market indexes lost between 1.6% and 2.3% on Wednesday, retracing last week's move up, as investors intensified their selloff. The S&P 500 index broke below support level of 2,080-2,090, as it got further away from late February all-time high at 2,119.59. The nearest important support level is at 2,040-2,050, marked by early March local lows, among others. for now, it looks like some further medium-term consolidation following October-November rally:

Expectations before the opening of today's trading session are negative, with index futures currently down 0.6-1.0%. The European stock market indexes have lost 1.2-1.5% so far. Investors will now wait for the Initial Claims number release at 7:30 a.m. The S&P 500 futures contract (CFD) is within an intraday downtrend as it trades below yesterday's low. The nearest important level of resistance is at around 2,050. On the other hand, potential support level is at 2,030, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades within an intraday downtrend, following a breakout below the level of 4,300. The nearest important level of resistance is at 4,300-4,320, and support level is at 4,250-4,260, as we can see on the 15-minute chart:

Concluding, the broad stock market accelerated its short-term decline yesterday, as it retraced most of last week's move up. For now, it looks like some further medium-term consolidation, following last year's October-November rally. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.