Briefly: In our opinion, speculative short positions are favored (with stop-loss at 1,975 and profit target at 1,875, S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

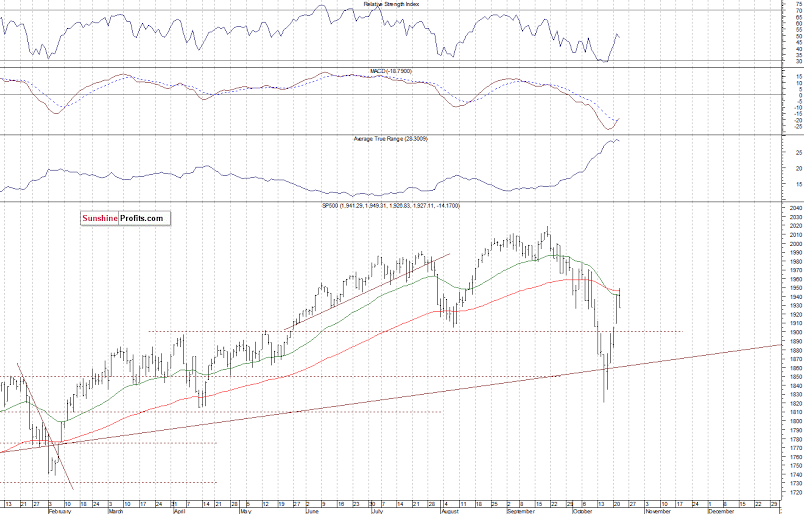

The U.S stock market indexes lost between 0.6% and 0.9% on Wednesday, retracing some of their recent move up, as investors took short-term profits off the table. Our yesterday’s bearish intraday outlook has proved accurate. The S&P 500 index bounced off resistance level at around 1,950, marked by the early October consolidation, among others. The next level of resistance is at 1,970-1,980, marked by previous local highs. On the other hand, the nearest important level of support is at 1,900-1,910, marked by Tuesday’s daily gap up, as we can see on the daily chart:

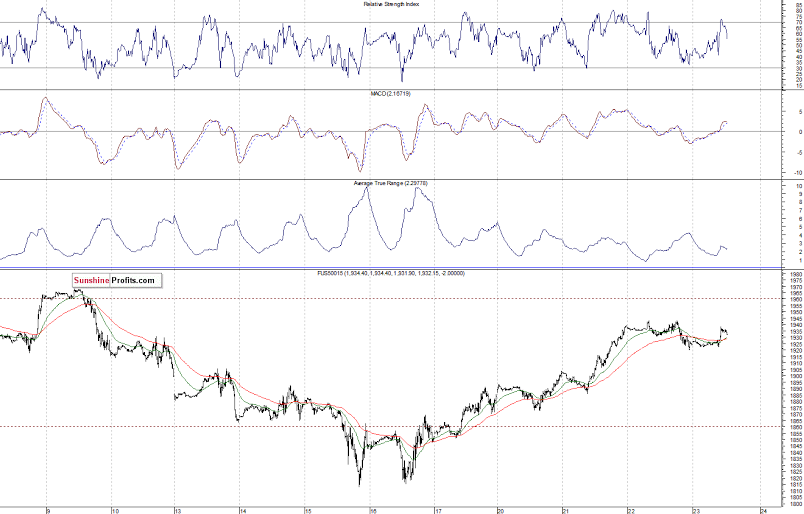

Expectations before the opening of today’s trading session are positive, with index futures currently up 0.4%. The main European stock market indexes have been mixed so far. Investors will now wait for some economic data announcements: Initial Claims at 8:30 a.m., FHFA Housing Price Index at 9:00 a.m., Leading Indicators, New Home Sales number at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday uptrend, as it retraces some of yesterday’s move down. The nearest important level of resistance is at around 1,940-1,945, marked by local highs. On the other hand, the support level is at 1,920, among others, as the 15-minute chart shows:

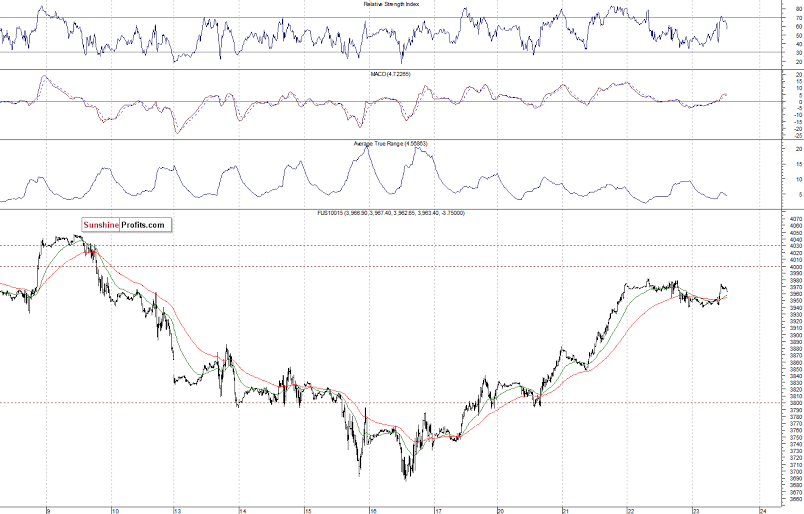

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades closer to resistance level of 3,970-3,980. The next level of resistance is at around 4,000, and support level is at 3,940:

Concluding, the broad stock market retraced some of its recent move up as investors took short-term profits off the table. We expect some more downside following a sharp rebound off last week’s lows. Therefore, we continue to maintain our already profitable speculative short position with entry point at 1,941 (yesterday’s opening price of the S&P 500 index). Stop-loss level is at 1,975, and potential profit target is at 1,875 (S&P 500 index). It is important to set some exit price level in case some events cause the price to move in an unlikely direction. Having safety measures in place helps limit potential losses while letting gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.