Briefly: In our opinion, speculative short positions are favored (with stop-loss at 1,970 and a profit target at 1,850, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook remains bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

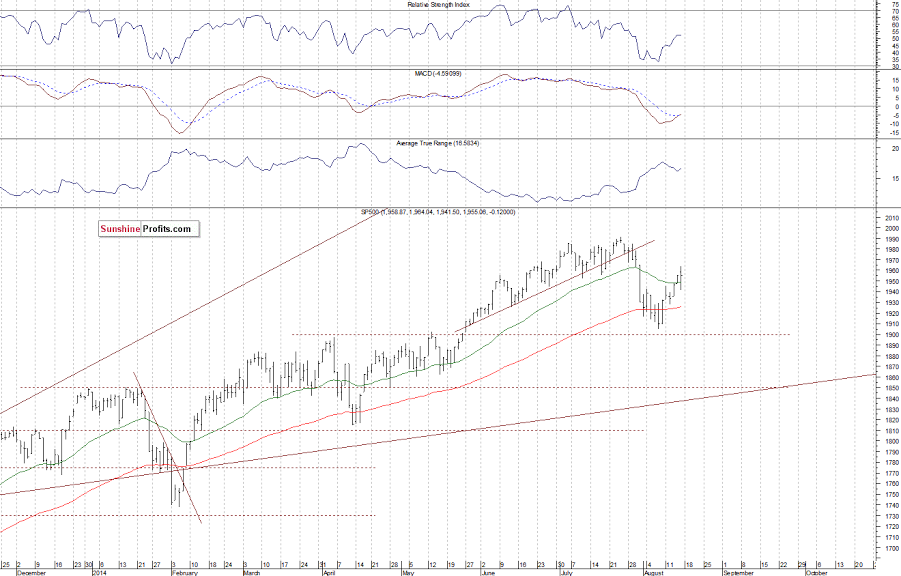

The U.S. stock market indexes were mixed between -0.3% and +0.5% on Friday, following volatile trading session, as investors reacted to some geopolitical news concerning Russia-Ukraine conflict, among others. The S&P 500 index retraced more than half of its late July – early August decline, however, closing slightly below Fibonacci’s 61.8% retracement of 1,958.3 (with the daily high at 1,964.04). The resistance level is at around 1,970-1,980, marked by previous local highs, and the next resistance is at 1,990-2,000, marked by July 24 all-time high of 1,991.39. It still looks like a correction within a short-term uptrend, however, a bullish scenario cannot be excluded here:

Expectations before the opening of today’s session are positive, with index futures currently up 0.5%. The main European stock market indexes have gained 0.6-1.4% so far. The S&P 500 futures contract (CFD) is in a relatively narrow intraday trading range, fluctuating along Friday’s highs. The nearest important resistance level is at around 1,960-1,965, marked by some of the previous local extremes. On the other hand, the level of support remains at 1,940, among others, as we can see on the 15-minute chart:

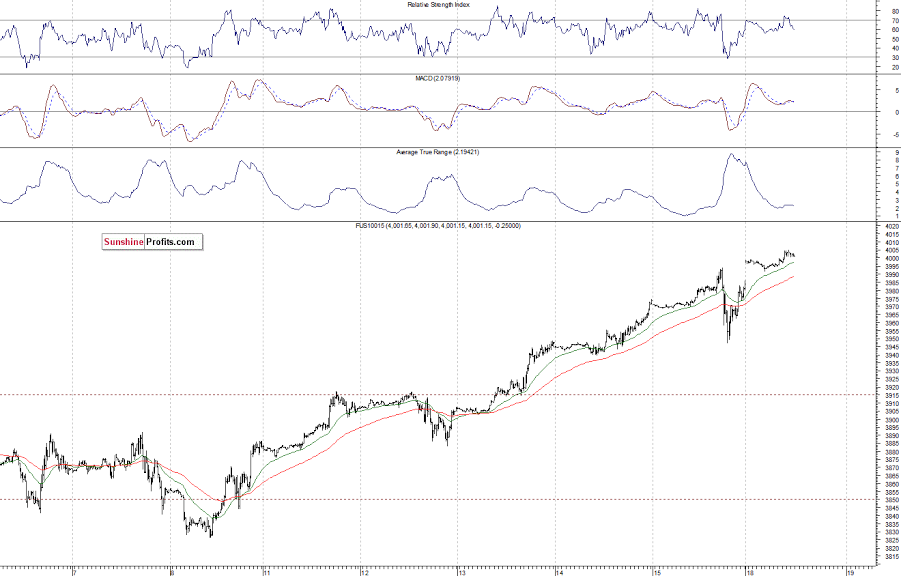

The technology Nasdaq 100 futures contract (CFD) reaches new long-term highs, as it trades close to the level of 4,000. The nearest important support level is at around 3,950-3,970, as the 15-minute chart shows:

Concluding, the broad stock market continues its recent move up, as it retraces more than half of the late July – early August sell-off. Is this a new uptrend or just a strong upward correction? We remain cautiously pessimistic, maintaining our speculative short position, with stop-loss at 1,970 (S&P 500 index). So, the price currently tracks dangerously close to our stop-loss figure. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps to limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.