Many Bitcoin fans like to say, that we – chartists – do not understand the crypto-currency and its behavior. There are Bitcoin lovers, still blinded by the past performance of the virtual currency, neglecting the change in trend. Ignorance is the cause why many investors took a hit, when Bitcoin topped in December 2013. Today we are presenting a second overview of the future price movement in Bitcoin.

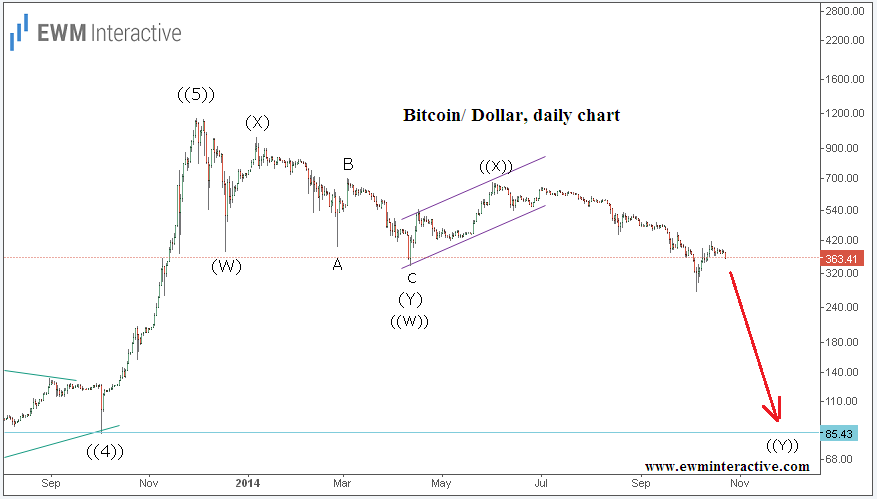

The crypto-currency topped at the remarkable level of 1151.49. In December 2013 the currency reached its termination point. Since then it has lost over 70 percent of its value and still moves in a corrective fashion, validating the ongoing bear market. The price movement from the top, which has ended in April, is counted as a double zig-zag “(W)-(X)-(Y)”.

The countertrend rally form April to June is labeled ((X)) due to its three-wave structure. Afterwards the market dragged prices down to the 270 level, tracing out the first wave of the next decline for wave “((Y))”.

In conclusion, the Elliott Wave Principle is based on mass psychology and, in our opinion, it is the best method for understanding the markets. Our long-term forecast states that prices will continue to move lower, all the way to the price territory of wave “((4))”, dropping below the 100 level. There could be short-term, counter-trend movements, but for now the trend remains to the downside.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.