Daily Forecast - 04 April 2016

S&P June Contract

Emini S&P outlook remains positive until we see a sell signal with a break above 2067/68 to target late December highs for the March contract at 2074/75. If we continue higher look for 2082/83 then 2090/91.

Failure to hold above 2064 risks a slide to 2060 then support at 2049/48. Longs need stops below 2044. Further losses meet a buying opportunity at 2039/37. Longs need stops below 2034.

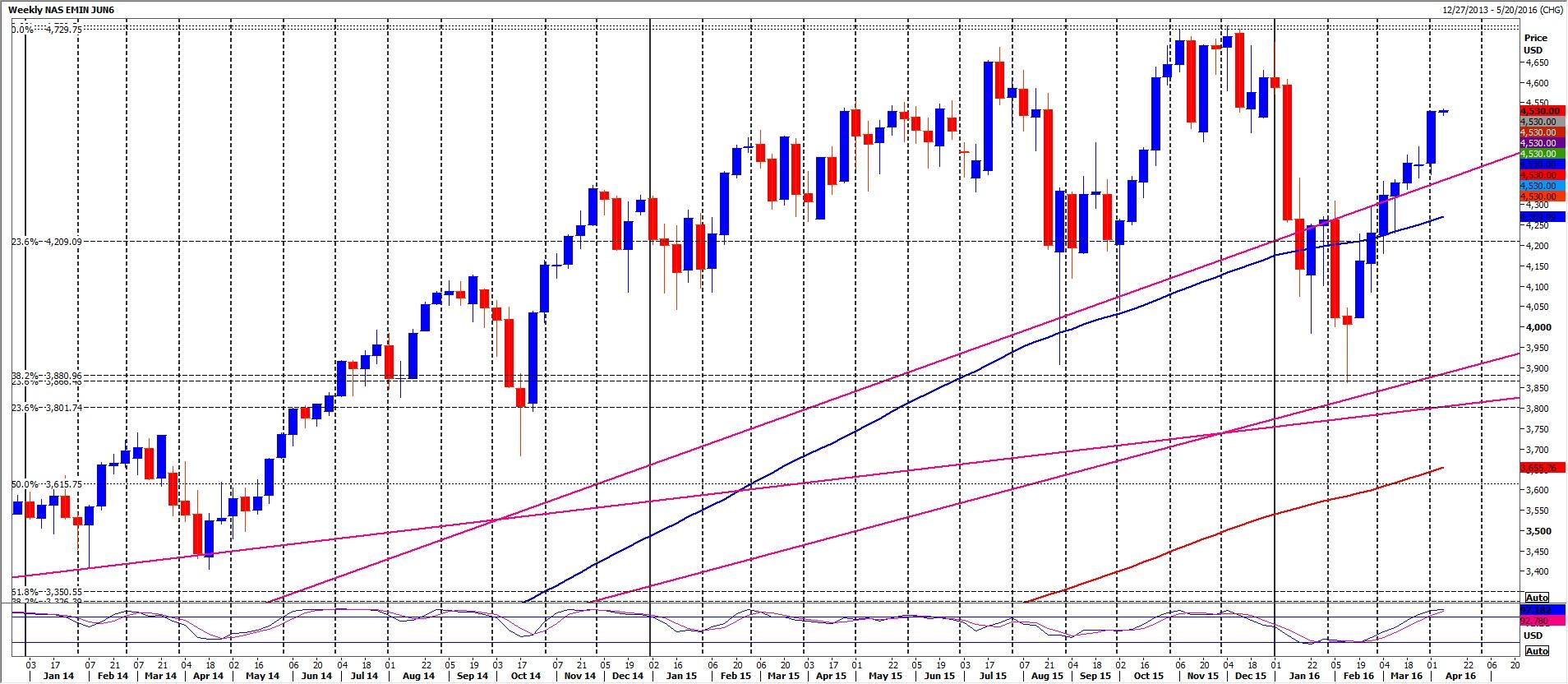

E Mini Nasdaq June Contract

Emini Nasdaq now holding above 4516/20 keeping bulls in control of the 2 month bull trend. Next targets are 4540/42, 4551/53, 4566 & 4570/73.

Below 4520 risks a slide to support at 4510/08. If we continue lower we could bounce off 4498/95.

Emini Dow Jones June contract

Emini Dow Jones holding above 17700 targets 17760/765 & 17785, perhaps as far as mid December highs at 17810/820. Further gains run in to strong resistance at November/December highs at 17905.

Below 17695 risks a slide to 17655 then support at 17560/550 for a buying opportunity. Longs need stops below 17510.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.