Daily Forecast - 31 March 2016

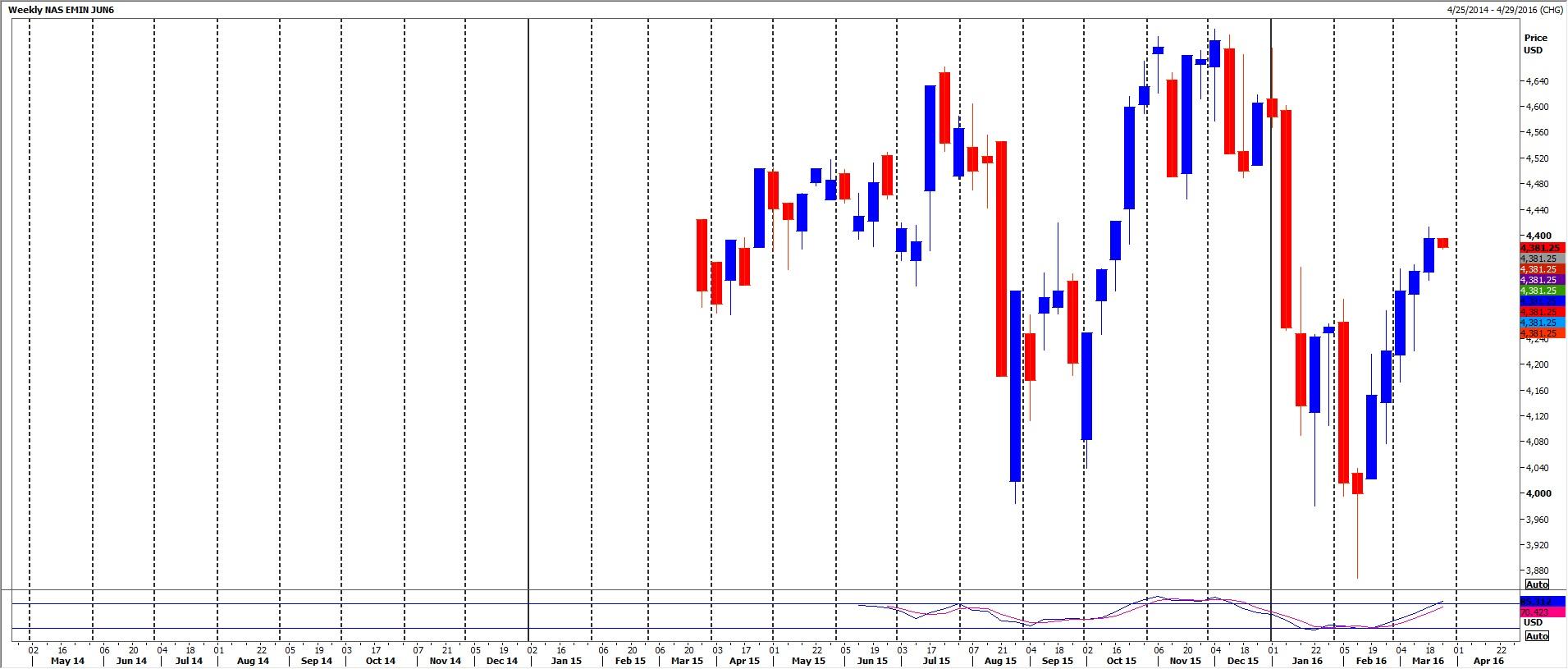

E Mini Nasdaq June Contract

Emini Nasdaq making a break below 4478/77 as I write which adds pressure & targets minor support at 4460/58. A collapse is unlikely but if we continue lower look for strong support at 4444/42. A good chance of a low for the day but longs need stops below 4437.

Holding above 4478 keeps bulls in control for today & re-targets 4493/96. Gains are expected to be limited but if we continue higher, a high for the day is certainly possible again at 4505/10. However on a break higher look for minor resistance at 4516/20.

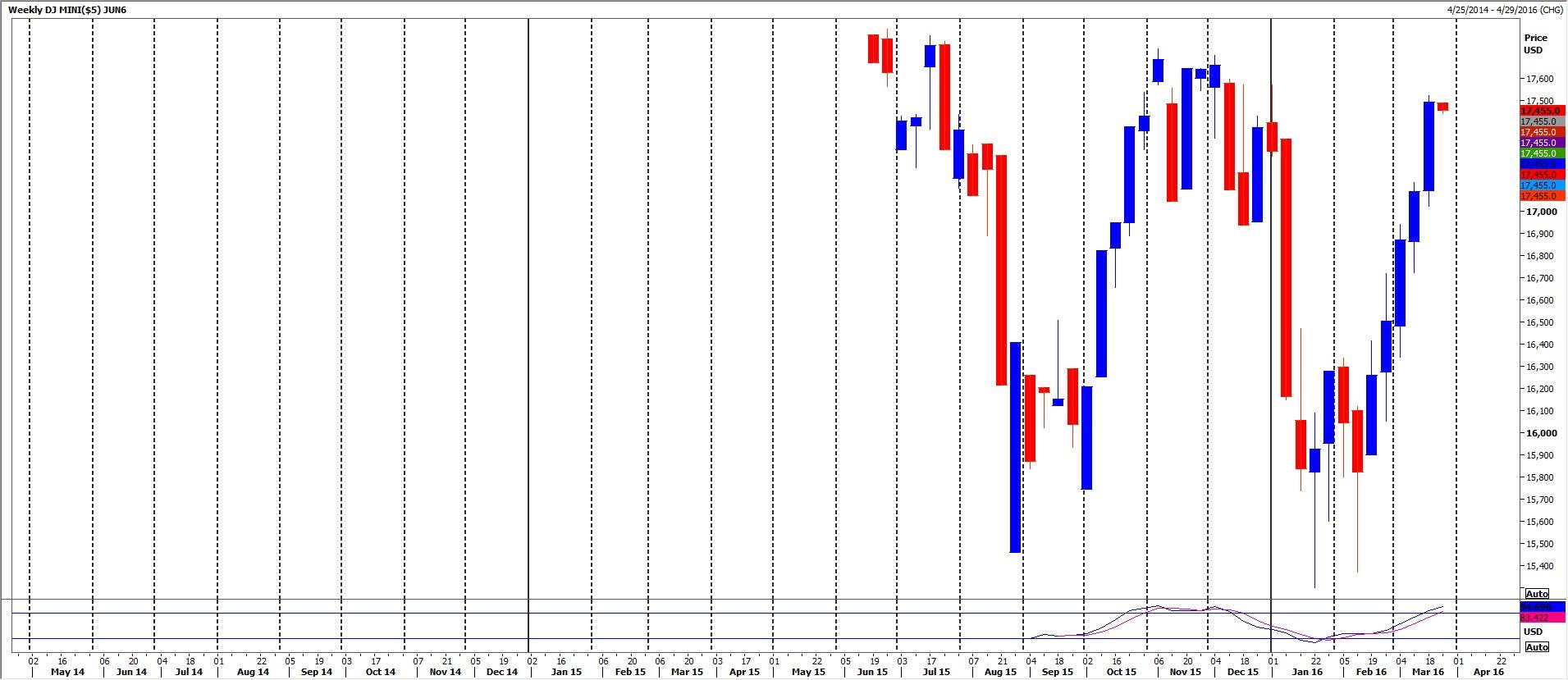

Emini Dow Jones June Contract

Emini Dow Jones needs to see some profit taking. A good chance we have seen a short term high yesterday & a break below 17600 today targets 17520/510 then support at 17490/470. A big move to the downside is not expected & we could see a low for the day here. Longs need stops below 17440

If we manage to hold above 176100/600 look for a recovery to 17655 then quite strong resistance at 17670/680 & a good chance of a high for the day once again. Shorts need stops above 17700. A break above 17700 however then targets 17760/765 & 17785, perhaps as far as 17810/820.

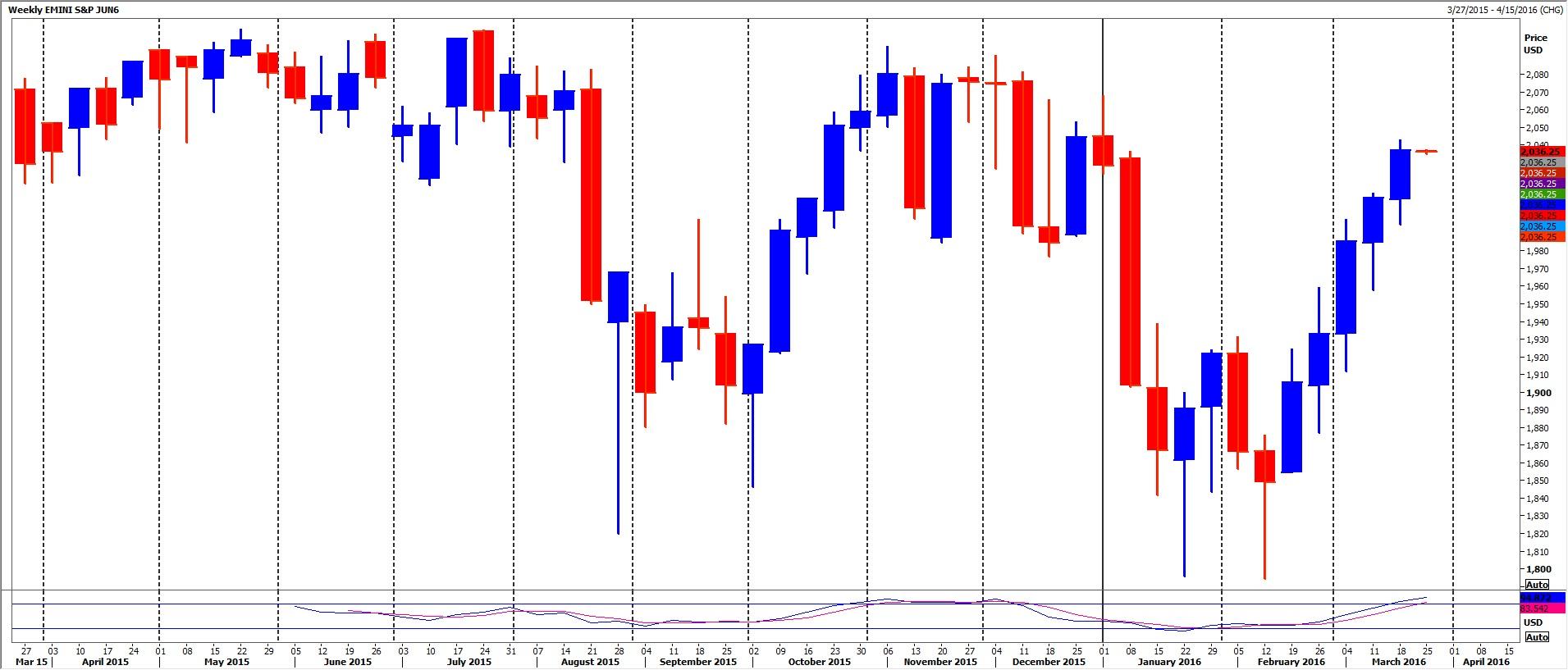

S&P June Contract

Emini S&P looks likely to have made a short term high yesterday. We could see profit taking & a drift lower in to the end of the week now. Minor support at 2051/50 then better support at 2042/40. In fact there is further good support at 2037/36 so this 6 point area is probably the most important of the day on the downside. However failure here targets 2029/28.

Holding 2051/50 allows a recovery to 2056 & 2061. Above yesterday's high at 2064/65 targets late December highs for the June contract at 2067/68 & late December highs for the March contract at 2074/75. If we continue higher look for 2082/83.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.