Daily Forecast - 19 December 2014

Gold February Contract

Gold has immediate support at 1190/1188 but below here keeps the market under pressure to target support at 1182/80. This could hold the downside again but longs need a stop below 1176. Be ready to go with a break lower to target 1172 then 1169/68 & perhaps as far as 1164/63.

Holding above 1190 opens the door to a recovery to 1201/1203 today. It could still be worth trying shorts again with stops above 1206, even though this trade did not work yesterday. Be ready to go with a break higher again however to re-target strong resistance at 1212/1213. Look for a high for the day here and try shorts with a stop above 1216.

Mini Russell 2000 March contract

Mini Russell above 1192 meets the March contract high at 1200. Above here we can test all-time highs at 1211/1213. It's a weekly close which adds significance, so a close above either of these levels keeps the outlook positive into next week. A break higher today targets 1218/1219 then 1225/26.

Below 1186 may trigger some profit-taking as far as 1178/1176. This could hold the downside but on a break lower look for a very good buying opportunity at 1168/1166, with stops below 1160. Try longs again at 1153/1151 with stops below 1145.

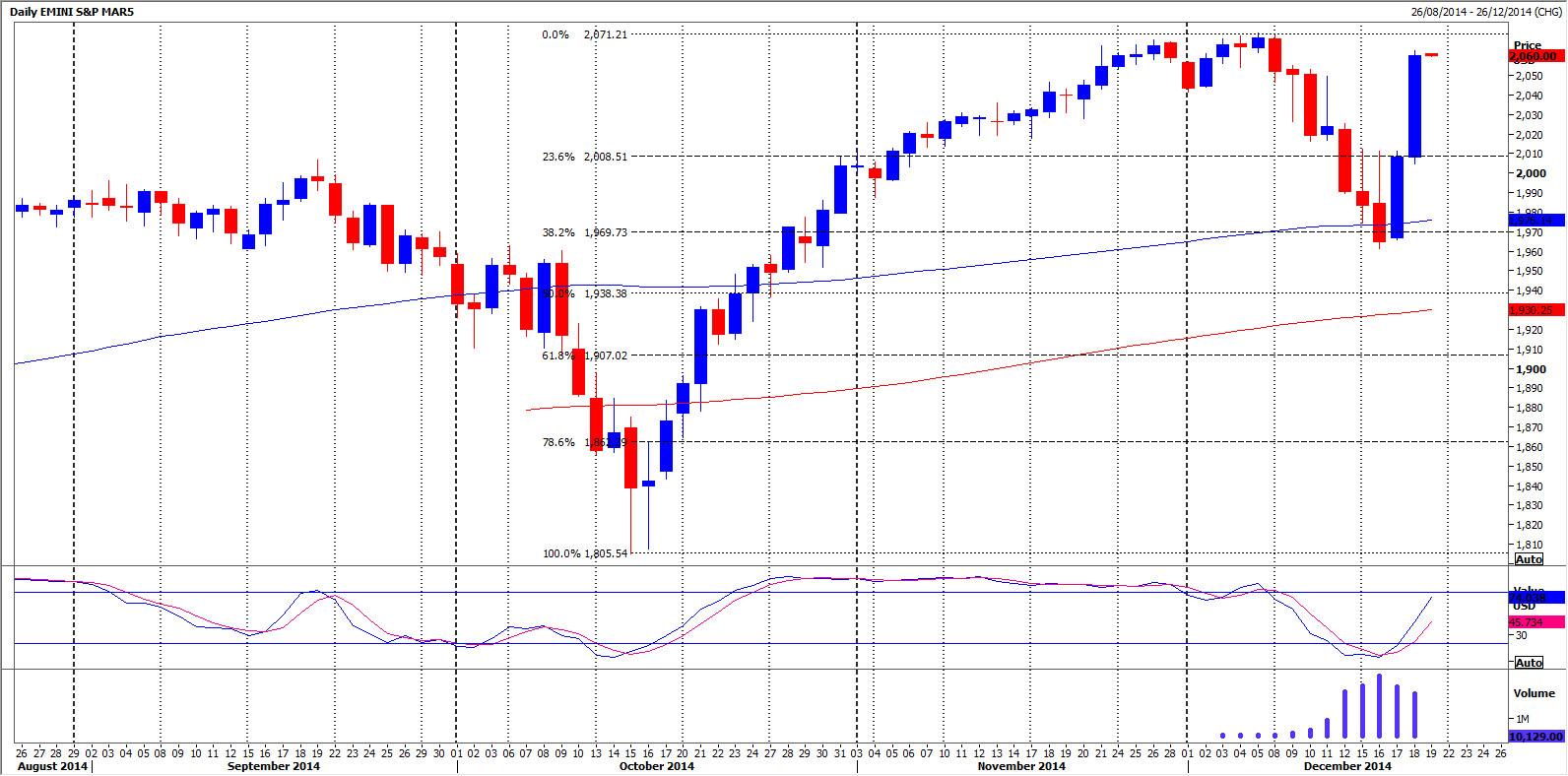

S&P March contract

Emini S&P made it as far as 2062 yesterday in a near 60 point rally, less than 10 points from the all-time high for the March contract at 2071.75. Above here we meet the all-time high at 2079. It's the weekly close tonight, which adds significance and of course a close above either of these levels keeps the outlook positive for next week. Break higher today targets 2084/85 then 2090/91. If we continue higher look for 2097/2099.

We are overbought in the short-term but any profit-taking offers a buying opportunity in the Bull trend. First support is at 2040/2038, but longs need a stop below 2032. Next target and support seen at 2028/2025. This should hold the downside but longs need a stop below 2020. Try longs again at 2013/2010.

Silver Futures December contract

Silver again faces resistance at 1590/1595 this morning but a break higher again targets 1620/1625. If we continue higher look for a selling opportunity at 1645/50 today. Try shorts with a stop above 1667. Be ready to go with a break higher to target strong resistance at 1695/1700.

Failure to beat strong resistance at 1590/1595 keeps the market under pressure to retest yesterday's low at 1575/74 then this week's low at 1560/55. If we continue lower today, look for a test of the next support at 1525/1520. Any longs here will need a stop below 1500.

AUDJPY Spot

AUDJPY unexpectedly beat 9695/9705 to hit our next targets of 9745 then 9765/9775 & topped exactly here at 9761. However be ready to go with a break above 9775 today to target strong resistance at 9800/9810. Try shorts with stops above 9840. Once again we must be ready to go with a break using 9810 as support for a move towards 9855 then 9875/78.

Immediate support at 9700/95 could hold the downside now but below here targets 9665/60 then good support at 9630/9615. This area should hold the downside and is worth trying longs with a stop below 9595. A break lower however sees 9615/9620 act as resistance for a move down to 9570 then 9550/9545. Any further losses risk a retest of this week's low at 9529/9518.

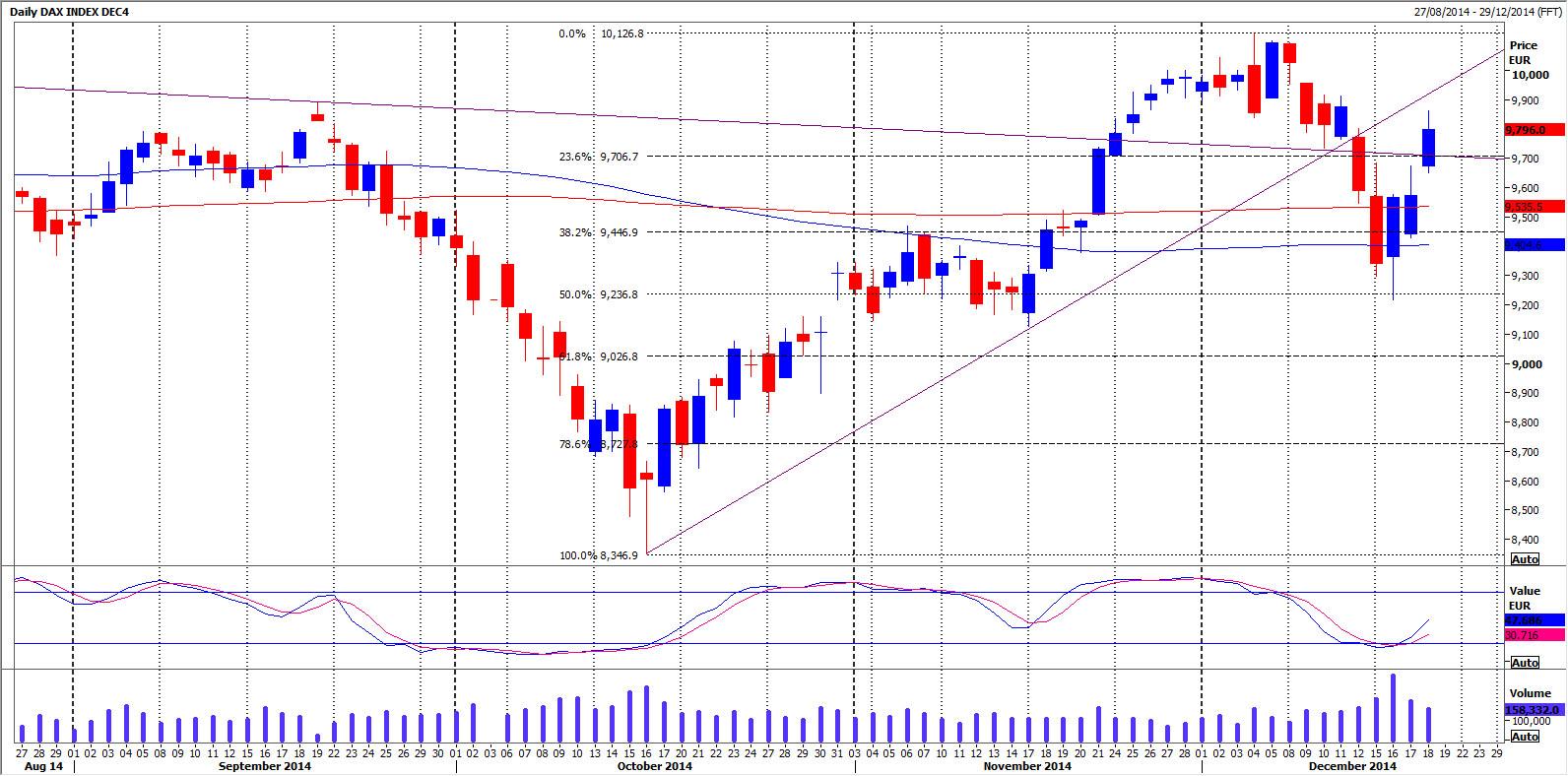

Dax December contract

Dax outlook remains positive so be ready to go with a break above 9865/9870(March 9877/82) to target 9895/9900(March 9907/9912) then 9911/9914(March 9923/26). If we continue higher today we should test two month trendline resistance at 9950/9955. There is quite good chance of a high for the day here but be aware that a break higher targets 9990/10,000.

Any profit-taking today meets immediate support at 9805/9800(March 9817/12) but below here look for a buying opportunity at 9765/55(March 9777/67) with a stop below 9730(March 9740). However on a break lower look for the next buying opportunity at 9710/9700(March 9722/12) with a stop below 9670(March 9680). An unexpected break lower targets 9640(March 9651) but below here risks a slide as far as 9578(March 9590).

E Mini Nasdaq March contract

E-Mini Nasdaq above yesterday's high of 4272 targets 4287 then resistance at 4294/96. We should struggle here initially, but a break higher in this very strong Bull trend is always possible and should target 4315 then 4320/23. If we continue higher look for 4330 then a retest of March contract highs at 4342.25.

Any profit-taking meets immediate support at 4258/4257 but below here it could be worth trying longs at 4247/4243 with a stop below 4234. However on a break lower we should target 4225/4224 then a very good buying opportunity at 4216/4212 with a stop below 4205.

Emini Dow Jones March contract

Emini Dow Jones saw a near 500 point gain yesterday to take as back up to last week's midweek highs at 17,702/738. A break above yesterday's high of 17,744 is obviously positive and targets 17,800/17,815. If we continue higher look for 17,860 then the all-time highs in 17,892/17,908 area. It's the weekly close tonight and of course a close above the all-time high would start next week with a very positive outlook. A break higher today targets 17945/55 then 17,990/18,000.

Failure to hold above 17,700 could trigger a little short-term profit-taking down to 17,650/645 but below here look for a buying opportunity at 17,600/590 with a stop below 17,540. Just be aware that an unexpected break lower targets 17,505/500 then 17,466/457.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.