S&P 500: Strong support again at 4170/65

Emini SP 500, Nasdaq, Emini Dow Jones

Emini S&P JUNE holding strong support at 4170/65 as we establish a sideways trend.

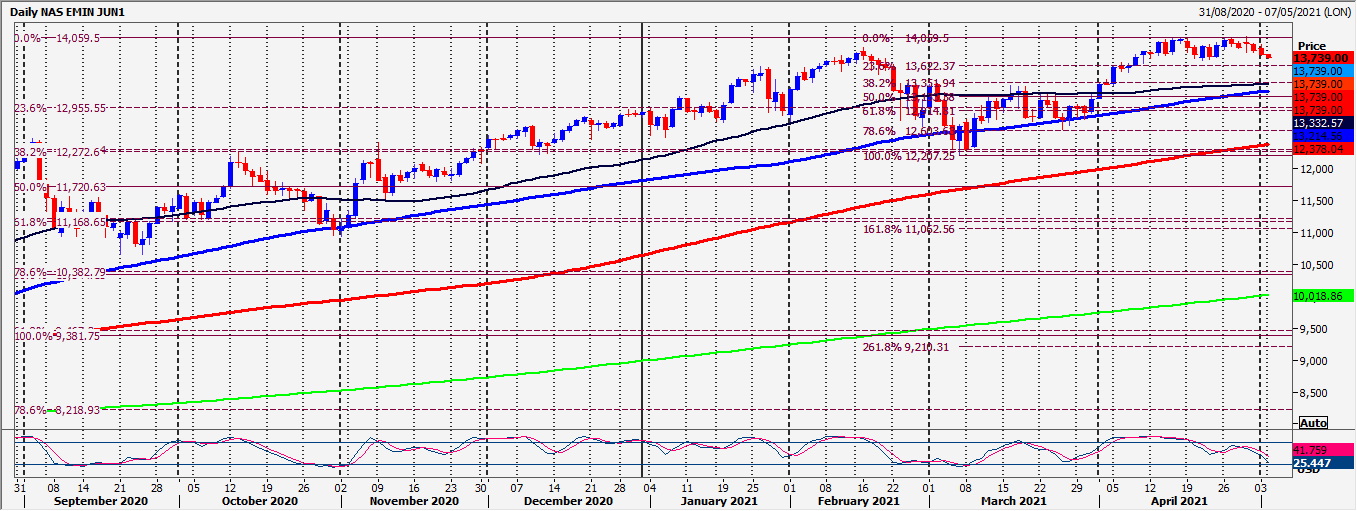

Nasdaq JUNE retests first support at 13900/850.

Emini Dow Jones sideways for 2 weeks. |The daily ranges are getting smaller. We again held first resistance at 33950/34000 & best support at 33660/610.

Daily analysis

Emini S&P strong support again at 4170/65. Longs need stops below 4160. A break lower targets 4150 & support at 4135/30. Longs need stops below 4120.

Minor resistance at the new all time high of 4209/11. If we continue higher look for 4220/22 & 4231/33.

Nasdaq double top risk at the all time high at 14060 as we hold below here all last week. A break higher however opens the door to further significant gains, initially targeting 14140/150 & 14250/270, perhaps as far as 14400.

Failure to beat the all time high at 14060 risks a small double top reversal pattern. We tested support at 13900/860 but over ran to 13818 last week. First support at 13780/750 being tested today. Longs need stops below 2 week lows at 13700. Further losses meet strong support at 13640/600.

Emini Dow Jones holding minor resistance at 33950/34000 this morning. Further gains retest the all time high at 34140/144 (held yesterday). A break higher however targets 34220/240 & 34330/350.

Minor support at 33860/830 before the best support for today again at 33660/610. Longs need stops below 33560. A break lower targets 33450/440 & strong support at 33290/240. Longs need stops below 33190.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk