The labour force participation rate has declined rapidly over recent years. Our analysis shows that only part of the decline is caused by cyclical factors.

Even if participation rates return to normal levels, demographics will keep a lid on labour force growth. This means that the Fed’s 6.5% unemployment threshold is likely to be reached around mid-2015.

A standard Taylor rule would suggest a much earlier start to the Fed’s hiking cycle. The emphasis on inflation versus unemployment is in our view biased currently.

Labour force set for a cyclical rebound but trend is slowing

In general the developments in the labour force participation rate, defined as the percentage of the population aged 16 years and older in the labour force, can be divided into three distinct phases since 1950.

The first phase is characterised by a relatively stable participation rate and lasts until the mid-1960s. The second phase is characterised by a sharp increase in labour force participation driven by more women entering the labour force and the entering of the baby boom generation into age cohorts with high levels of labour force participation.

The third phase starting around 2000 shows a gradual decline in the participation rate and this is primarily driven by demographics. However, from the onset of the recession in 2008 to today, the decline in participation rates has been more pronounced than can be explained by an aging population alone. The labour force participation rate for those aged 16 and older has declined from around 66% in 2007 to 63.5% today. The question is how much of the decline can be attributed to cyclical factors, and hence are temporary, and how much is a permanent decline in participation.

Looking at labour force flows, it is evident that the flow of workers from unemployment to nonparticipation (UN) surged from 2005 to 2010, suggesting that due to the recession, people gave up searching for a job and left the labour force. This is supported by the fact that the number of discouraged and marginally attached workers has surged. In contrast, the flows from employment to nonparticipation (EN) and from nonparticipation to employment (NE) have been relatively stable. If the decline in the participation rate were driven only by non-cyclical factors such as aging of the population, we would have expected the EN flows to increase more.

Don’t expect a full rebound in participation

While part of the decline in the labour force is due to cyclical factors, the aging of the US population has also been a factor. In fact our calculations suggest that one percentage point of the decline in the participation rate can be explained by demographic developments.

The decline in the labour force participation rate due to population aging can be calculated by using the age distribution from 2007 and applying today’s participation rates for the different age groups:

where represents the 2007 population shares for the different age groups from those aged 16-19 years and up to the final group aged 70 and over and LFPR is the labour force participation rate for those age groups in 2013. The result is a total labour force participation rate of 64.5% which is exactly one percentage point higher than the actual LFPR of 63.5%, suggesting that 1pp of the decline in the labour force is due to demographic changes.

That still leaves a potential catch-up of 1.5pp if the total LFPR is to return to its pre-crisis level. However, some of the recent changes to labour force participation might be more permanent in nature and the aging of the population is set to continue in coming years. In the section below we look in more detail on the projection for the labour force and the implications for the unemployment rate and ultimately for the Federal Reserve.

Fed’s unemployment threshold set to be reached mid-2015

As explained above, the trend in the aggregated labour participation rate is down due to demographic reasons. However, in the short term, there is potential for a pick-up in labour force growth. Cyclical forces have further added to the decline in the participation rate over the past five years and it seems that the economy is now turning which could bring discouraged workers back into the labour force.

We assume that participation rates for individual age groups will return to their pre-crisis averages over the next four years. However, we make a couple of exemptions. First, participation rates for those aged 55 and older have actually increased over recent years. This is, in our view, due to structural forces rather than cyclical. In particular, people are living longer and healthier lives, leading to workers playing an active role in the labour market for longer. In our projections, we therefore assume that participation rates for those above 55 will stay unchanged.

Second, the participation rate for those aged 16-19 years has declined extraordinarily fast. While some of the decline is cyclical, a large part is due to the fact that an increasing number of younger people are enrolled in education. We therefore assume only a limited increase in the participation rate for this age group over the coming years.

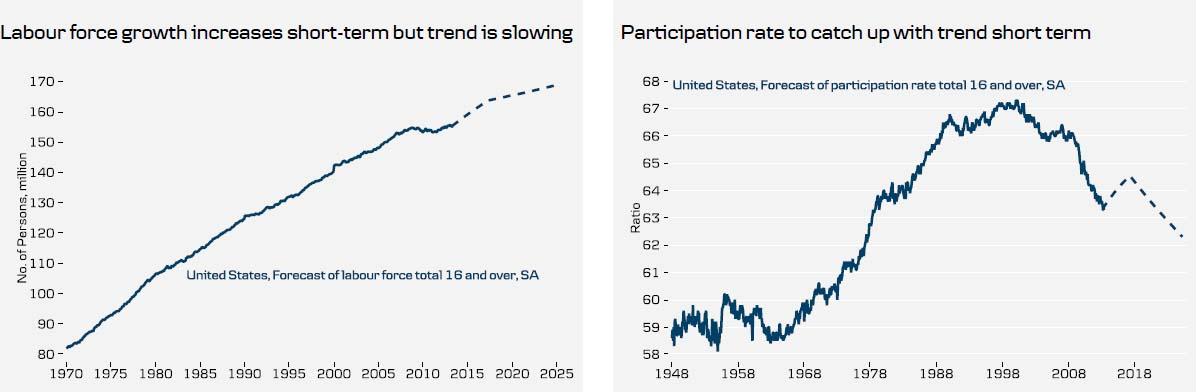

To derive the total labour force and aggregate participation rate, we use population forecasts for the eight different age groups and multiply those with the participation rate for the same age group. The results are shown in the charts above.

We forecast a cyclical boost to the aggregate labour force and participation rate over the next four years as participation rates adjust to their long-term averages for each age group. After this cyclical catch-up, the downward trend in the aggregate participation rate will resume and labour force growth will slow.

This means that the Fed’s 6.5% unemployment target is likely to be reached around mid- 2015 given our forecast for the labour force and a relatively positive view on GDP growth (2.1% in 2013, 2.8% in 2014) and job growth (on average 200,000-250,000 in monthly increases in nonfarm payrolls in 2013 and 2014) over the next three years. Hence, if the Fed follows through on its guidance, the first Fed funds rate hike is likely to come in mid- 2015 which is in line with current market pricing.

This is however far later than the standard Taylor rule would suggest. The reason is that the standard Taylor rule puts a relatively high weight on the inflation gap and less weight on the output/unemployment gap. Although inflation is low, it is not dramatically far away from the Fed’s 2% target rate. On the other hand, both the output gap and the gap between the unemployment rate and the NAIRU are at very high levels. Recent Fed actions and communications suggest that the Fed is currently focusing more on the output gap than the standard Taylor rule would suggest. Further, the Fed has openly said that the limits on Fed easing caused by the zero lower bound on the Fed funds target rate justifies keeping monetary policy extraordinarily accommodative for longer than usual.

We will look more into this issue in a later paper and the prospects for the pace of tightening once the Fed starts its hiking cycle.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.