RBA Preview: Markets looking for forecasts, not action

- Not much expected from the RBA this week, other themes in play.

- Geopolitical risk is heating up between the US and Australia.

The Reserve Bank Board meets on May 5 ahead of the Statement on Monetary Policy (SoMP) which will print later on in the week on May 8.

However, it is highly unlikely that the RBA acts to shift its policy at this meeting while content with current settings. Instead, markets will be looking for various forecasts made in the statement to then be elaborated upon in the SoMP.

The RBA has its dual objectives of full employment and its 2–3% inflation target and the central bank will be maintaining its tapering path amid an improvement in financial conditions. As revealed in a recent speech by Governor Lowe, when he addressed the RBA's central forecasts, the RBA is unlikely to be inclined to raise rates for a prolonged period.

We forecast that the RBA would hold the cash rate steady at 0.25% out to at least December 2023,

– analysts at Westpac argued. The analysts were noting that the Governor is indicating that marked progress towards full employment (4.5%) would need to be achieved before the cash rate would be increased – "our timeline of “not before December 2023” seems quite realistic."

Additionally, ...

we also noted that central banks no longer see the need to be as “pre-emptive” as they were in previous cycles with ample evidence that inflation is slow moving precluding the risk that the central bank will find itself well 'behind the curve',

– the analysts at Westpac explained.

COVID-19 is a highly fluid situation

Across the world, the virus and the countermeasures against it are creating a massive shock and the risk is that nations seeking to open their businesses too soon or fas stand the risk of a second wave of new cases and outbreaks. This is a highly fluid situation and the RBA will need to keep some in reserve before unloading all of its ammunition to battle against a potential economic meltdown.

SoMP on the cards

What could be more interesting is this week's SoMP as the attention will likely focus on how the recovery is expected to unfold. We should get various scenarios from the central bank which will expand on the economic outlook in Tuesday’s post Board meeting statement.

Key data coming up

Meanwhile, we will also get the first concrete pieces of the Q1 GDP puzzle for Australia with the release of both Retail Sales and the Trade Balance this week. Preliminary reads on key economic data were subsequently released by the ABS and looked robust.

ANZ job ads seems set to show another big drop. The jump in the number of people applying for the Jobseeker payment is consistent with a sharp rise in unemployment in Q2. We think job losses will likely be front-loaded given the nature of the economic shock. The ABS releases another of its Weekly Payroll Jobs and Wages updates,

– analysts at ANZ Bank predict.

How will AUD react to the RBA?

There are other forces now in play pertaining to the Chinese and US cold war. The trade wars had been the dominant theme in markets before a so-called phase 1 deal was agreed upon at the end of last year, but that was before the virus hit. In recent weeks, the US administration has been vocal of their district in the Chinse reporting of not only numbers of cases and the true extent of the virus in China, but also that it covered it up, to begin with. Taking the latest headlines into consideration, it is hardly the perfect setting for AUD to prosper:

-

US President Donald Trump: “Intelligence has just reported to me that I was correct” on China

-

What you need to know as markets open: Pompeo and Trump ratcheted up US and China tensions

-

US Intelligence reports reveal China hid coronavirus’ severity to hoard supplies – AP

-

AUD/USD: Bears attack 0.6400 as trade war fears spread faster

-

China is eclipsing US in Asia, Donald Trump adviser says – The Telegraph

-

Pompeo's anti-China bluff strategy reveals all-or-nothing mentality to fool US voters – GT

The RBA will need to be uber-confident that green pastures lay ahead for the economy. Pertaining to COVID-19, the RBA’s central scenario looks for restrictions to be “progressively lessened as we get closer to the middle of the year and mostly removed by late in the year”. However, on that basis, we have already known the key points from the Governor, namely:

- A 10% output contraction in 2020 H1;

- 6% contraction through 2020; 6–7% growth in 2021;

- Unemployment rate holding “above 6% for the next couple of years” after peaking at 10% mid-2020.

- Peak unemployment rate of 10% in June; and negative through the year headline inflation to the June quarter 2020.

- Wages growth is expected to fall below 2% year, and underlying inflation will remain “below 2% year for the next couple of years”.

Variance in those one way or another could lead to some price action but the precise details will likely be saved until the SoMP. Until broader themes will be at play and likely weigh on the commodity complex and the Aussie:

Specifically for AUD/USD, there are a couple of themes in the play, including weakness in CNH at the start the week. More on that here: AUD/USD Price Analysis: Heavy below 0.6400 on confirming short-term rising wedge amid Yuan’s drop

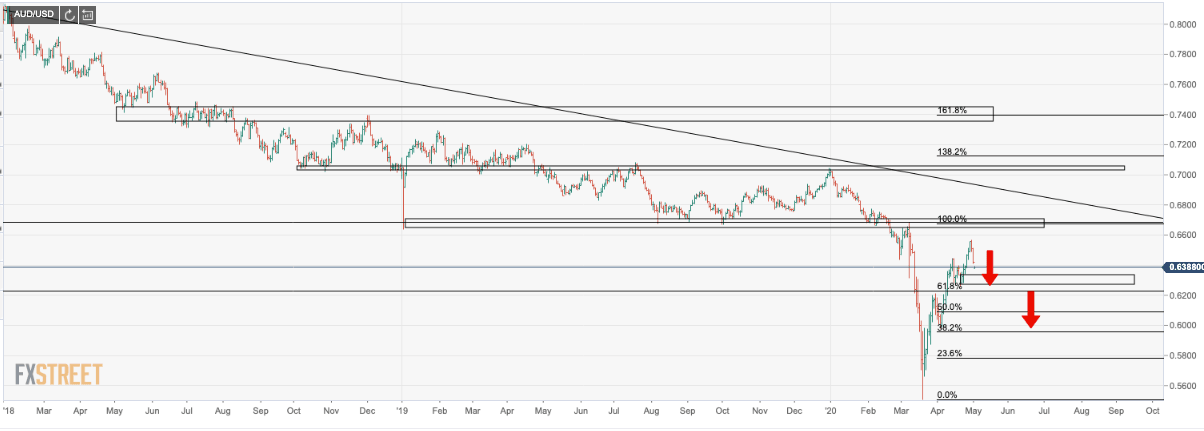

Given, however, Australia's scorecard as far as the virus goes, it makes for a bullish setting when comparing government balance sheets between the US and America. That may help to alleviate some pressures going forward unless there is another market shock for which would send the US dollar higher. However, if bearish fundamentals continue to play out, the following chart offers a potential scenario for the 0.6228/80 zone as the first port of call.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.