Chart of the week: AUD/JPY looking ripe for a short

- AUD is low bearing fruit for the bears, AUD/JPY ripe for a short.

- Geopolitical tensions are not the bullish environment AUD/JPY needs in order to prosper.

While there have been some positive themes lately, with a number of countries embarking on their partial reopenings this month in line with the COVID-19 curves flattening around the world, geopolitical tensions are heating up again. Regardless that markets have made up their minds that it is a forgone conclusion that the world will eventually recover from this pandemic.

Consequently, we have seen a recovery in commodity markets, with oil making a recovery on signs that the pace of inventory increase may be slowing and copper, an important barometer of the global economy, making a 6-week high. Then, coupled with such headlines as today's Gilead Sciences, there are arguments for further recoveries in the likes of AUD.

However, geopolitics could not be at their worst:

Considering AUD was the highest performer throughout April, how much of all the goods news (including its own COVID-19 curve) is priced in? Analysts at Westpac say that " it’s now the most expensive to the midpoint of our fair value model that it has been in 5 years meaning a lot of good news is 'already in the price'."

With geopolitical risks coming back to the fore, it's probably a good time to start thinking ahead and looking to AUD/JPY as a risk barometer again. On the charts, the cross has been rejected and is looking to be in a precarious position at this juncture with risk bias mounting to the downside, both fundamentally and technically.

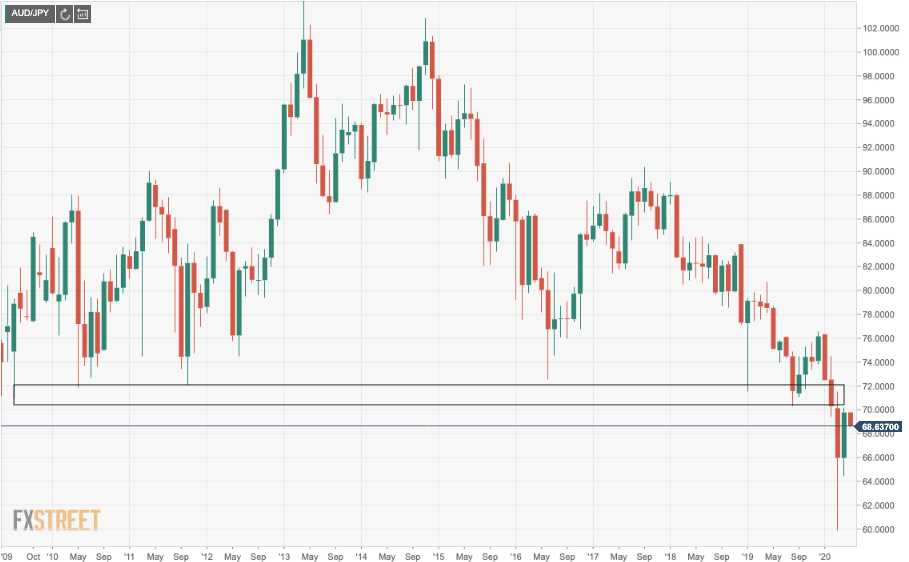

Let's take a look it at from the top-down starting with the monthly H&S topping pattern:

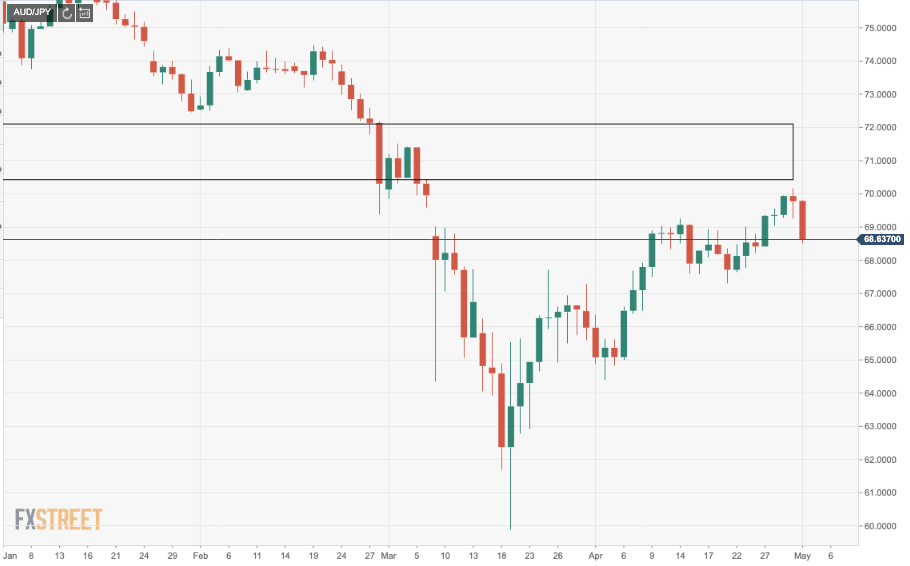

The weekly chart below shows bulls have reached and closed the gap:

The daily chart shows the rejection with sellers moving in, picking low hanging fruit, you might say:

Pulling up the Fibonacci retracements, we can a bearish scenario playing out:

As we can see, the price has been rejected at the golden ratio, 61.8% Fibo, of the monthly H&S decline. This has a confluence with the gap's closure and runs parallel to a worsening geopolitical backdrop which could be the trigger for the next significant stock market crash as outlined in the following article:

That is not to say that the crash is imminent. It may take weeks if not months to develop a solid enough foundation for the next economic downturn - but it is building.

Considering the Reserve Bank of Australia has called out for a weaker Aussie, noting that it had been helping in the weeks leading into the 3rd of March interest rate cut, the recent rally will not be favourable and will likely force the hand of the central bank, thus weakening the outlook for AUD again and thus weigh on the cross.

Bottom line we see the recent strength as unjustified and likely to be tested in the weeks ahead. We would, therefore, sell the A$ at current levels; add to that short on strength to the recent highs at 0.6550 and run a stop on the position at 0.66,

analysts at Westpac argue.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.