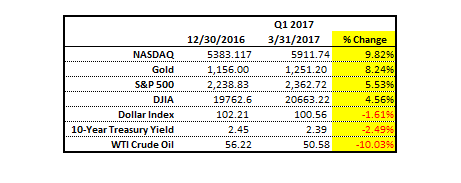

This past quarter in the markets was one of the more interesting three-month periods we’ve had in a while. Not because of what took place, but rather, the lack of what took place, considering the boiling global geopolitical climate. Almost all of Q1 unfolded against a backdrop of zero volatility and confounding complacency not seen in over twenty years, that included an incredible 109-day streak of less than 1% moves in the S&P 500 end just shy of the quarter’s close. Over the past couple of weeks, some negligible volatility has returned, with the U.S. markets posting their first weekly loss (March 20-24) since the Presidential election back in November. Since that fateful evening on November 8, 2016, however, the S&P 500 is up an impressive +10%, with over half of its gains coming during Q1 (S&P 500 +5.5%). Naturally, a meager -1% drop over the past two weeks would appear quite innocuous in a bull market that has posted six consecutive quarterly advances, but perhaps there is more than meets the eye as we head into Q2 and the rest of 2017.

While most Americans are asleep (again) at the wheel with the markets at or near all-time highs, those who are closely watching for red flags know there is a lot more to the mild uptick in volatility over the quarter’s end than simply a March Fed rate hike and a political failure by the Trump administration with its doomed healthcare bill.

While Janet Yellen can sell the everyday American on a rate hike signaling strength in the U.S. economy, the likely reality is that the Fed is actually hiking into growing economic weakness. Over the last two years, growth in the American economy has been stubbornly unable to maintain any momentum above a 2% growth rate. Now in 2017, the Fed’s own Atlanta Fed just lowered its Q1 GDP forecast to below 1%, with Europe and Japan barely holding onto 1% growth themselves, and the global anchor of growth in China now decelerating in tandem.

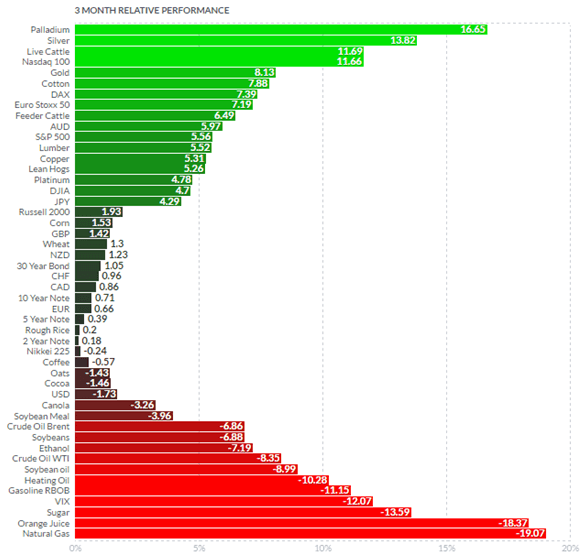

Look at the oil markets. Despite short-term production cut threats, crude prices are coming down, and very few want to admit the truth of the matter – demand is falling. With crude prices dropping roughly -10% this quarter and WTI Crude teetering around the psychologically important $50/barrel threshold, oil has quietly turned out to be one of the worst performing assets YTD. Add a rate hike to the mix, and the dollar should be continuing to rip higher, but that dollar trade everyone was promoting back in December appears to now be dead in the water. Over the quarter, the dollar gave up all of its gains to finish down nearly -2% with the dollar index near its lows of the year, and safe-haven gold advancing over +8% (one of the best performers YTD despite the fears over Fed rate hikes).

The Fed is holding onto whatever last little bit of credibility it has. Yellen was able to get a 25 bps hike in this past December based entirely on its promise to the markets that the economy was strong enough for multiple hikes in 2016. They got one in last year, and barely saved themselves from complete embarrassment. With the Trump-inspired rally of 2017 (based entirely on hope for reignited real growth through tax cuts, deregulation, repatriation, and fiscal spending), the Fed strategically snuck another hike in on March 15, moving the Fed funds rate up another 25 bps, now to a range of 0.75% – 1%, still at all-time historic lows.

Again, in promising multiple hikes to the markets this year, the Fed is claiming that the economy is healthy. The Fed, however, is not raising because of perceived strength. They’re aware that this perception in the economy is largely based on an illusion created by recent “soft” data releases (i.e. confidence/sentiment-based Trump inspired data), while the real data has shown little improvement at all. Just in the last week or so alone, we’ve continued to see the death of retail/department sales, the biggest weekly jump in unemployment claims in six months, and perhaps the demise of the auto bull, with Ford warning that its Q1 profits will drop by more than 50% because of higher costs and lower vehicle sales.

Yellen, rather, is doing whatever she can to “reload the gun,” so that the Fed can stand ready to cut rates (from a place other than 0%) when the economy falls back into recession at some point in the future, as we’re now in the eighth year of this modest, but lengthy economic expansion. The Fed knows that many of these encouraging “soft” data points are typically contrarian indicators found at market tops. This past Tuesday’s relief rally on consumer confidence spiking to a 16-year high, for example, should be sounding alarm bells for market participants instead of producing high-fives, but alas, it is human nature to quickly forget the past. The last time consumer confidence has been this high was back in the heyday of the tech boom in January of 2000, of course, only to be quickly followed a few months later with the complete collapse of the phony dot.com Nasdaq bubble.

With the market coming off its best quarter since 2015 (that included a DJIA winning streak not seen since 1987 – of all years) and stocks now up eight years in-a-row (tying records set from the 80’s and 90’s), the Fed is naturally up against increasingly lofty valuations, with record highs seen in the CAPE (Cyclically Adjusted P/E) Ratio, Price/Sales, Median P/E, and Total Market Cap/GDP, even as GDP growth decelerates below 1% behind the scenes. With these record valuations coming largely as a result of the entire economy having been subsidized by 100 straight months of ZIRP (Zero Interest Rate Policy), and inflation now picking up (up +2.5% YoY and past the Fed’s 2% inflation target), the Fed also has no choice but to raise.

The beauty of the Fed, though, is that they actually have no idea what they’re doing, and yet, they’re not stupid. As far as policy goes, they’ve flip-flopped on monetary policy direction nearly a dozen times over the last several years, and have lost almost all credibility, but they’re not completely knocked out of the game – the game, of course, looking more and more each day like one big game of hot potato. No one wants to be the one to blame when the music stops. Whether in the financial or geopolitical arena, if there is a way to deflect blame or accountability, those in the spotlight will take their chances passing that potato as quickly as possible. The Fed is no different, even going as far as acting as both the arsonist and fireman in the 2008 financial crisis, according to economist, Jim Grant.

Interestingly enough, though, the Fed has a unique opportunity in front of it to exonerate itself from the mess it’s largely responsible for. With Trump in the White House with an aggressive agenda, the Fed figuratively has a gun to Trump’s head. In contrast to the Obama presidency bolstered by eight years of Fed-friendly ZIRP, with enough rate hikes now, the economy implodes, and the Trump-led political opposition is left holding an economy and market in freefall. Candidate Trump would never allow that to happen. A huge bulk of the Trump campaign was devoted to rightly placing blame on the Fed for blowing our stock market, bond market, and real estate market bubbles even bigger. People think there’s no inflation – take a hard look at these three enormously bloated markets, and try explaining how they’re not entirely propped up on artificially low interest rates since 2008.

Yellen and the Fed, however, have played their cards well this year and have fooled Trump into falling on his own sword – otherwise known as his massive ego. Whatever one thinks of Trump, one of his biggest mistakes thus far has been taking credit for the record-breaking stock market he once lambasted during his campaign as being a complete phony bubble. Falling for the bait, of course, he has no choice now but to take ownership of these markets on the downside too.

Trump just went 0-1 on major policy initiatives with the failure of his healthcare bill and he’s facing a tough debt ceiling situation next amongst many other hurdles. He is being attacked internally and externally, and while wounded by the Clinton defeat, he is still up against a very powerful and entrenched globalist elite (i.e. individuals/groups heavily involved with organizations such as the UN, EU, CFR, Bilderberg, Trilateral Commission, etc.), many of whom are unelected and can strategically outlast U.S. and other governmental term limits. Just yesterday, in fact, EU Commission President, Jean-Claude Juncker, brazenly issued a jaw-dropping threat to Trump, saying he could campaign to break up the United States in retaliation for Brexit support.

In many ways, whether anticipated or not, a Donald Trump presidency may turn out to be an “ace in the hole” for many of these global elite. The world is awash in endless, unpayable debt, boundless and poorly defined wars all over the world (no clear way of defeating terrorism, ISIS, etc.), growing social unrest and the deterioration of the middle class, and is running on a global economy currently sitting on a massive debt-based, avalanche-prone mountain waiting for that last snow flake to drop, an analogy credited to complexity theorist and economist Jim Rickards.

While bringing up Trump and geopolitics is tangential to the markets, it is important to note that Trump, regardless of whether he turns out to be a “good” or “bad” President, has relatively little influence in preventing this fatal snowflake to drop. In a worst-case scenario, the global financial and economic system may, in fact, collapse and even spiral into chaos, but it will not be Trump’s doing. Like the Titanic, we could very well be a sinking ship anyways, with Trump, now conveniently in place to be the punching bag and embarrassing scapegoat to take the fall when the music stops playing. Of course, while all of the focus and blame is consequently put on Trump, the global elite can quietly reset off to the side and continue their multi-generational globalist agenda, with only a few bruises to report of.

Trump didn’t have to take ownership of this bubble economy we’re in, but his ego got the best of him, as it has done in the past in both his professional and personal dealings.

However, much like the Fed being down but not out, Trump has his own unique opportunities in front of him, and is perhaps strategizing like everyone’s other favorite villain, Vladimir Putin, who as a judo expert and master chess player, is known to be thinking two or three steps ahead of everyone else.

Coming back now to the markets, the biggest story most people are missing is the massive opportunity in front of Trump to completely overhaul the Fed. While most market participants are wasting time debating the meaningless timing and amount of rate hikes from the Fed later this year, few realize that Trump has a power-play in front of him no President has seen in over one hundred years. Far outweighing the power of having both the House and the Senate, President Trump has the ability to appoint more members to the Board of Governors of the Federal Reserve System at one time than any President since Woodrow Wilson, who as President in 1913 signed the Federal Reserve Act during the creation of the Fed. Made up of seven appointees, Trump has the authority to appoint three new members to the Board of Governors (with one lonely Republican, Jay Powell, already holding a position). With a majority at four members (and an ability then to make majority-vote decisions), along with two “cherries on top” in the option to remove liberal dove Janet Yellen as Fed Chair next January, and Vice Chair Stanley Fischer’s term ending in June 2018, Donald Trump theoretically “owns the Fed,” which is a situation never seen before outside of Wilson, who, of course, was instrumental in creating the institution in the first place.

With impending control over the most powerful central bank in the world, the leader of the free world has a once-in-a-lifetime opening to actually make some real systemic economic changes. The markets clearly DO NOT have this priced in. The markets are pricing in the conventional, and naturally, if we’re talking about any other President, this opportunity would be a moot point. As alluded to above, the mundane debate in the markets right now is the question of two or three more rate hikes in 2017, as if the Fed has ever been able to follow through on its ridiculous and poorly modeled dot-plots. With regards to Trump, the markets are pricing in the assumption that the Trump/Fed relationship is just like every other one that’s preceded it – in other words, a President trying to influence the Fed to be more dovish (i.e. a Fed run by Janet Yellen) or more hawkish (i.e. a Fed run by Paul Volcker) based on recessionary or over-heated economic conditions.

If we’ve learned anything about Donald Trump, it’s that he’s not conventional. If anything, after going 0-1 on policy initiatives thus far and getting a real dose of our Founder’s beautifully envisioned Executive vs. Legislative gridlock, Trump is likely to become even more unconventional. Enter one of Trump’s heroes – our nation’s 7th President, Andrew Jackson. Much has been covered about the similarities between Trump and Jackson as it pertains to their nationalistic and populist flair, but very little has been mentioned about the parallels between Trump’s criticisms about the Fed (during the campaign trail) and Andrew Jackson, who successfully took down the Second Bank of the United States (a central bank predecessor to our current Federal Reserve).

While Trump has control over Fed Governor appointees, he will need Senate confirmation to replace the Fed Chair. While there is certainly not enough political and financial willingness right now to allow Trump to step further into the shoes of Andrew Jackson with the removal of the Fed entirely, Trump may just be savvy enough to take a page out of his rival globalist playbook in never letting a crisis go to waste.

As the public continues to be fed one “red herring” after another, whether in the markets with consumer confidence numbers or in geopolitics about Russian conspiracies, there is an actual global monetary crisis and reset looming around the corner that the markets are also NOT pricing in appropriately. Over in the dark, murky waters of the currency markets where the everyday American never swims, the last snowflakes are falling faster and faster onto this avalanche-prone, debt-based global economic system. Very few are taking notice to the dangers that lie ahead, yet just in the last couple of years, instability in the system has begun to rear its ugly head. For example, in January 2015, the euro fell -20% vs. the Swiss franc in only two hours. In August 2015, the Chinese sent shockwaves through the Fx markets, devaluing the yuan by 3% to the U.S. dollar. Most recently, of course, on the heels of the U.K. Brexit vote last summer, the British pound fell a staggering -14% to the dollar. As these uncharacteristically large, volatile moves in the Fx markets increase in frequency, particularly for developed market currencies, the warning signs flash bigger and brighter that the monetary system is collapsing right in front of us.

As it stands now, our current dollar reserve-based monetary system is over 70 years old, and has already experienced one near death experience, when in 1973, President Nixon decided to close the gold window, preventing the dollar’s conversion into gold. Naturally, with no anchor or backing to restrain the Fed, the creation of dollars has exploded over the last 40+ years, yet global demand has kept up as the U.S. (along with the IMF and World Bank) essentially forced the rest of the world to hold dollars for international trade, oil transactions, and reserves. As history will show, however, man-made monetary systems generally last only about 30-40 years. Most recently we’ve seen the following global monetary systems:

- Pre WWI – Traditional Gold Standard

- Between World Wars – Gold Receipt Standard

- Post WWII – 1944 Bretton Woods System (partial gold backing)

- Post 1973 – Dollar Standard (no hard money – petrodollar)

Whether we’re at 73 years dating back to Bretton Woods, or 44 years with the current “petrodollar” based iteration, the monetary system will inevitably collapse, as it’s done every other time in history. Whether the last snowflake drops in the currency markets with an event like Friday’s surprise removal of the South African finance minister, in the bond markets as the ECB risks a catastrophic rise in Bund yields with its wary QE tapering process, or back in the political arena with Marine Le Pen potentially delivering a nationalist/populist knock-out blow to the “old” world globalist order in this month’s French presidential elections, the collapse is coming.

While no one individual, institution, and/or government wants to be responsible for actually triggering the collapse (see “hot potato” above), those who see the warning signs are preparing as the music continues to play. Many countries, particularly the BRICS (Brazil, Russia, India, China, South Africa) are now trading with their own currencies in bi-lateral trade agreements outside of the monetary system. Not wanting to spook the currency markets and/or trigger costlier prices, many countries are also quietly adding to their gold reserves. While Yellen and the Fed tip-toe around 25 bps throwaway rate hikes, Russia’s central bank just bought another 28 metric tonnes of gold, while China could now be holding as much as 30,000 tonnes of gold in various government accounts. Even individuals are taking matters into their own hands escaping the crumbling monetary system with the creation and advancement of decentralized digital and crypto currencies, like Bitcoin and Ethereum, which have skyrocketed in value and popularity in recent years.

Trump should be taking notice himself and preparing for what’s to come. His globalist opponents certainly are. With the last “clean” balance sheet left on the planet following an unprecedented series of global QE programs from central banks around the world, the IMF is ready to push the world further towards globalization with a global-currency called the SDR (Special Drawing Rights), which as a basket of currencies, will stand ready to officially replace the outdated dollar standard on its last day.

The markets are anticipating that Trump’s only line of defense in responding to this approaching crisis/collapse is, of course, the conventional and obedient use of the Fed/IMF and other multilateral, globalist institutions like the G7 and G20 to reverse currency trends that have “helped” export-heavy countries like Germany and China with artificially cheap exchange rates.

While pushing for a cheaper dollar may be the easier path and provide a short-term economic “advantage” to the U.S. economy, the positive effects of continuing to play these ongoing “currency wars” will last only as long as the music keeps playing on the ship.

The markets and the rest of the world, though, are forgetting what put Trump in office. As best-selling author and economist, Jim Rickards notes, “Nationalism is not a cause, it’s a symptom. The cause is low growth. And the cause of low growth is too much debt.” Right now, there is a record $230 Trillion in global debt in the global economic system, representing an astonishing 300% of global GDP. While Trump used debt as an effective instrument as an individual businessman in his real estate ventures, the continued use of debt now as President will not only fatally weaken the U.S. economy, but will also further fortify the globalist power structure he was elected to go up against. With rising nationalism and anti-globalist movements intensifying in the U.S. and around the world, a currency/debt crisis looming, and unprecedented ownership of the Fed, an unconventional Trump may, just in fact, turn to the one asset he’s built his entire brand and empire on – gold.

It’s one thing for a candidate to talk about gold and returning to the gold standard. Trump, did, of course, talk favorably about this move during the campaign, noting in a GQ interview, “Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money.” It’s a completely other thing, though, to think about Donald Trump, the man, and his relationship to gold. Everything that Trump has touched throughout his entire life, whether as businessman or politician, has been highlighted and amplified by gold. Why would his Presidency be any different?

Once a gold-basher from the Warren Buffett/Keynesian ilk of likening gold to a “barbarous relic,” Joe Weisenthal from Bloomberg, recently even changed his view on gold entirely because of Trump. As Weisenthal correctly points out, “Gold is a physical and visual manifestation of raw power. To have gold was to have power. It follows, then, that gold would make for a good basis for currency. If you knew that a kingdom had the ability to produce vast quantities of gold coins, then you could assume that it was a powerful and stable kingdom that had military might and wide influence. Could you name another commodity that instantly conveys so much information about its backer?”

Even geopolitically, a move towards gold could be strategic in bilateral relations outside of the globalist order, with a potentially newly elected Marine Le Pen tapping into the ghost of Charles de Gaulle in France, or even with Russia, which continues to maintain its sovereignty outside of the globalist system.

With glimmers of attention put on God from Trump/Putin, Judeo-Christian factions in the U.S. and Russia rising up against the “cultural Marxist,” globalist opposition born out of the Frankfurt School, and a monetary system collapse pending, perhaps Trump and Putin can unite together over God’s faultless monetary system centered around gold and silver, which is mentioned in the Bible nearly 800 times. As it has proven over the test of time, gold (in particular) is the perfect monetary instrument. Unlike the dollar and other forms of currency that have preceded it, gold has consistently demonstrated the seven key functions of money for thousands of years. Gold is: (1) a medium of exchange (able to be used as an intermediary in trade), (2) a unit of account (able to be numbered and counted), (3) durable (has a long usable life), (4) divisible (to make change by dividing into smaller units), (5) portable (easy to carry around), (6) fungible (each unit is capable of mutual substitution), and most importantly, (7) a store of value (retains its purchasing power over long periods of time). It’s no wonder this precious metal has become synonymous with wealth and power over the course of time.

Based on above, one would think Trump would bring back a gold standard tomorrow, perhaps even create a gold-backed dollar-franc-ruble system. Now that would make the media’s heads spin. Much like Obamacare, though, Trump’s best bet may be to allow the system to implode under its own weight and stand ready with an anti-globalist, gold-friendly, Trump-controlled-Fed solution. While the likelihood of a return to a gold standard is admittedly still very low, the likelihood of Trump once becoming President was even lower. Of course, no one knows what this would look like in the markets if it were to come to fruition, but the set-up is undeniably there – a monetary-based financial crisis is in the queue, a ripe anti-globalist political climate is only intensifying, an archaic Federal Reserve System is uniquely vulnerable to being turned completely upside down, and an anti-globalist President is in power, who has an affinity for gold like no one else in the world.

Don’t think Trump will do it? Let’s talk after he goes 0-2 with tax reform. Perhaps that will be the final snowflake to drop.

“He who has the gold makes the rules.”

The Information on this blog is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this blog and provided from or through this blog is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial investments, trading or otherwise, based on any of the information presented on this blog without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all information available on or through this blog at your own risk.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.