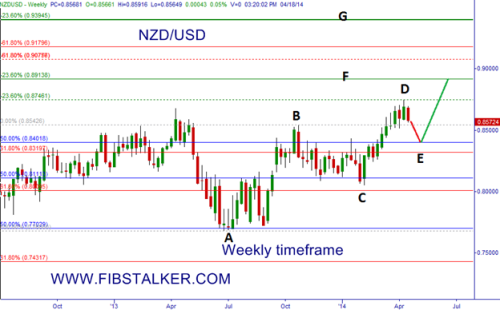

NZD/USD market has been a very good, “technical†market. What I mean with that is: it has followed the rules I use to model Program Trading (a class of Algorithmic Trading) activity on price beautifully. In fact, when we look at the weekly chart below:

“NZD/USD hit a target at 0.8740 known two months in advance†– April 18th 2014

We can clearly see that traditional trace ABC identified an area of support in C, starting at the level 0.8110 (blue line) and with a stop below 0.8009. The stop level was never touched, while price picked up as algos and professional traders participated at that area and eventually was brought into level 0.0846 (D area), to the pip!

This is the beauty of studying Program Trading on larger timeframes. Very neat setups, with entry, stop and targets are known and available with weeks if not months in advance. In this case the support found at the beginning of February 2014 was known at the end of October 2013, while the 1st target that was fulfilled last week was known 4 mounts in advance!

What can we now expect next from NZD/USD? At the moment we are seeing a correction, clearly visible on the daily timeframe. If the market continues in its sequence of moves higher, and at this stage there are no reasons to believe it will not (I am not going to skew what I clearly and objectively see in price with considerations on fundamentals or what the market “should do†based on the opinions of other people, or based on “news†and other facts believed to be true which, on the other hand are very subjective), we should witness a price correction into the E area.

This is the next area of support that, in my opinion, Program Trading and professional traders are going to closely scrutinize. This area starts at the 0.8400 level and ends at 0.8318. Below this level we should anticipate a larger retracement for the NZD/USD (at this moment a lower probability scenario). So, should we prepare for a further slide here in the NZD/USD?

Let us study the daily timeframe and point out what are the key levels to watch:

“Will the support starting at 0.8545 hold on NZD/USD daily?†– April 18th 2014

This market has still a support level on the daily timeframe starting at 0.8545. NZD/USD is also in a sequence of measured move shorts with the next target right aligned with that 0.8545. Second tests of support/resistances are dangerous tests and we will need to see what happens.

I will evaluate what happens at that level using the FibStalking timing technique (by the way if you want to learn more about this technique, register and tune in at the FXStreet webinar next Tuesday April 22 at 12GMT).

If price slides below 0.8508 then a test of 0.84 (area E in the weekly timeframe) is almost certain. Even if/after that happens (i.e. after price goes below 0.8508), the market could still offer a retrace as an opportunity to enter short (remember that Program Trading and professionals want their safe entry too!).

I will be closely watching the 0.8508 level and any bounces as opportunities to “safely†short this market (mind your risk: nothing is safe or sure in the markets).

Once and if the market will get in area E (see weekly chart above), I will be using again the FibStalking technique to test this area. If this area tests successfully the entry will have a stop below the E area at 0.8318, as mentioned already.

In that case I will also start looking at my next (Program Trading) target at 0.8908 (area F). Here is where I anticipate Program Trading and professional traders are going to push price to take profits. The reason why I believe , after this correction, a continuation higher is more probable than a continuation lower is that if we look at the weekly timeframe we can see that there is another larger area of support at the 0.77 area (this is area A).

This support has already seen participation from even a larger and higher capitalized group of traders (algos and human). This group of participants had a much larger and higher target in mind: the 0.9390 (area G).

So, if we put everything in perspective and study the activity of Program Trading on the various timeframes, we have to consider that we are just halfway to that objective and there is no reason why we should not believe that we cannot get there, especially when we consider the size of the big mammoths, which traded down at 0.77

Happy Trading

Have a great long weekend.

Regards,,,

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.