Good Morning Traders,

As of this writing 5:15 AM EST, here’s what we see:

US Dollar: Up at 98.970 the US Dollar is up 186 ticks and trading at 98.970.

Energies: February Crude is down at 31.06.

Financials: The Mar 30 year bond is down 19 ticks and trading at 155.06.

Indices: The Mar S&P 500 emini ES contract is up 25 ticks and trading at 1922.50.

Gold: The Feb gold contract is trading down at 1094.20. Gold is 20 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and crude is down- which is normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading lower which is correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded lower with the exception of the Shanghai exchange which traded fractionally higher. As this writing all of Europe is trading higher.

Possible Challenges To Traders Today

- FOMC Member Fischer Speaks at 5:30 AM EST. This is major.

- NFIB Small Business Index is out at 6 AM EST. This is not major.

- JOLTS Job Openings is out at 10 AM EST. This is major.

Currencies

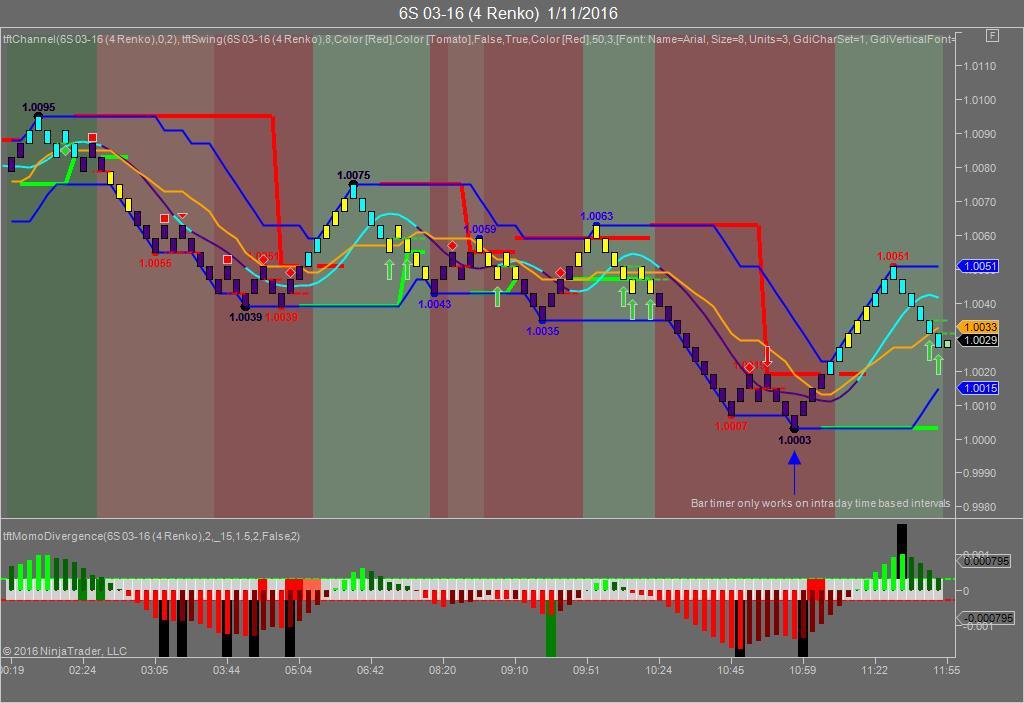

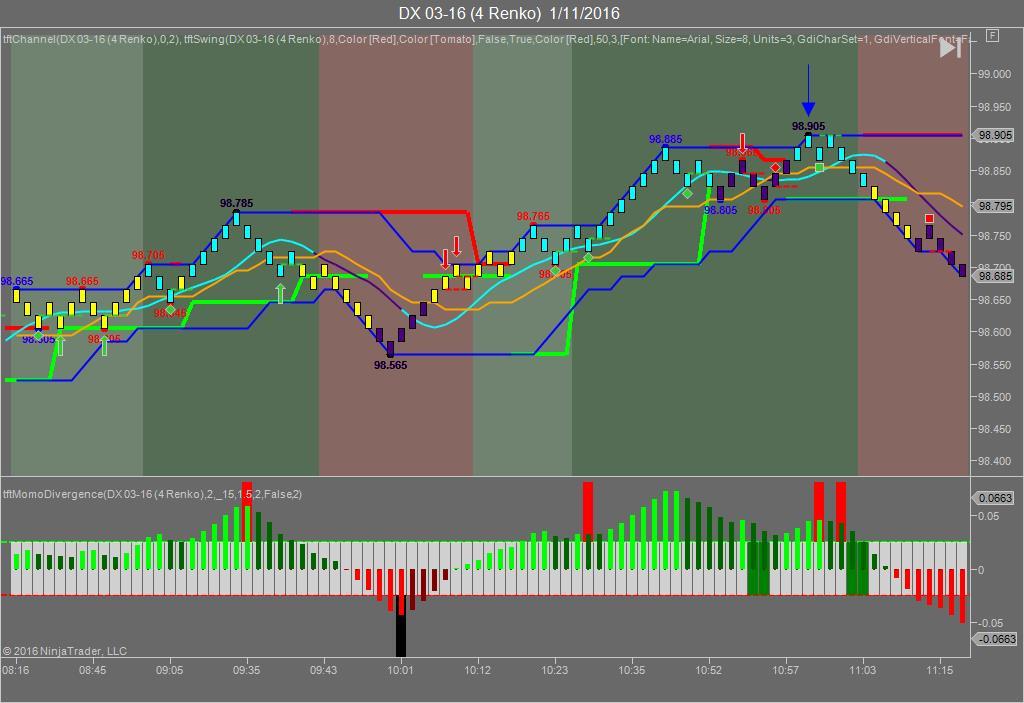

Yesterday the Swiss Franc made it’s move at around 11 AM EST with no economic news in sight. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 11 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 11 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted about 20 plus ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we gave the markets a neutral bias as the futures gave no indication regarding direction. The Dow gained 53 points but the Nasdaq dropped 6 and the S&P gained 2. All in all a neutral day. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Well earnings season started yesterday with the release of Alcoa’s quarterly numbers. No one expects this to be a stellar earnings season as the market of late hasn’t been behaving with any sense of normalcy. This would have been different we think if the Fed had held off on hiking rates, but they didn’t. It appears that everyone in DC is drinking the “recovery” Kool Aid as they think all is well in the economy. In the meantime you have people working two part time jobs just to make ends meet as no one wants to pay a living wage and part time because no one wants to be accountable for benefits. Today we have the Jolts Job Opening numbers and that is always major. Don’t be surprised if it turns out to be a great number but just take it with a grain of salt…..

Alcoa reported an 18% drop in revenue for the quarter and thus far the Asian markets didn’t like it as all of Asia traded lower except Shanghai which traded fractionally higher.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.