Polish Zloty (EUR/PLN) – Higher and higher…

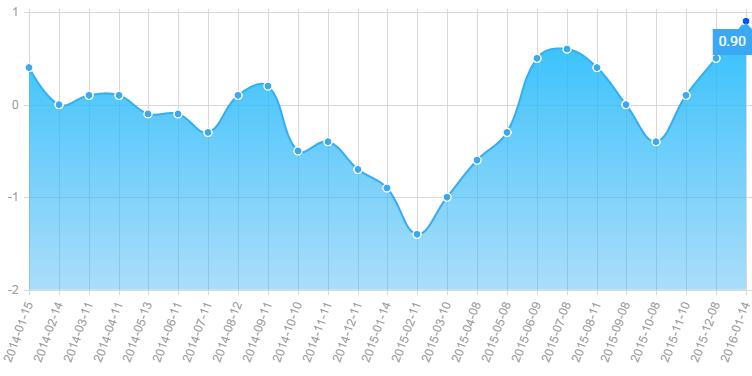

It was a tough week for the Zloty. Not only the global situation on financial markets is volatile and risk aversion has increased. Also, local factors are more and more important for foreign traders. This past week, the European Commission stated it will be monitoring Poland’s rule of law. This is an unprecedented move and it’s the effect of the turmoil around the Constitutional Court (the ruling party, Law and Justice, appointing only their members). What is not helping are the plans of the government to increase spending and the taxes that will be imposed on banks (bank tax based on assets) and supermarkets (based on turnover). There are also discussion about lowering the retirement age (how?? There is no money in the government’s cash register for such a move…). All this causes foreign analysts to be very cautious about investing in Poland. It is hard to believe that will all those actions deflation will be gone. The government expects GDP will grow by over 3.5% in 2016, but without inflation I believe that will not happen. In the meantime, the MPC kept interest rates unchanged at 1.5%. According to MPC’s Governor, Marek Belka, further easing at this moment is difficult due to global turmoil and a weak Zloty. It was the last meeting of the current MPC members. Three new replacing members were already appointed by the Senate. It seems the ruling party is appointing people who have dovish views and the possibility of another interest rate cut increases. All this is not helping the Zloty and the stock market which is having a really hard time in January (down 4.7% from the beginning of the year). At this moment, the PLN is the worst performing currency in the region. Now, the analysts’ eyes will turn to rating agencies…The EUR/PLN continued its way up reaching levels above 4.40, the highest since June of 2012. As we see on the graph, the scenario we expected last week realized and the question now is: what’s next? If the 4.40 resistance level is broken, the Zloty could keep depreciating and the EUR/PLN could heading towards the magical barrier of 4.50 (levels unseen since 2001 and 2012). The stochastic oscillator shows the market is overbought and that we could expect a corrective movement. If so, the EUR/PLN could go back to 4.37 and if this support is broken, the next target would be 4.34.

_20160115155005.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Forint stayed calm

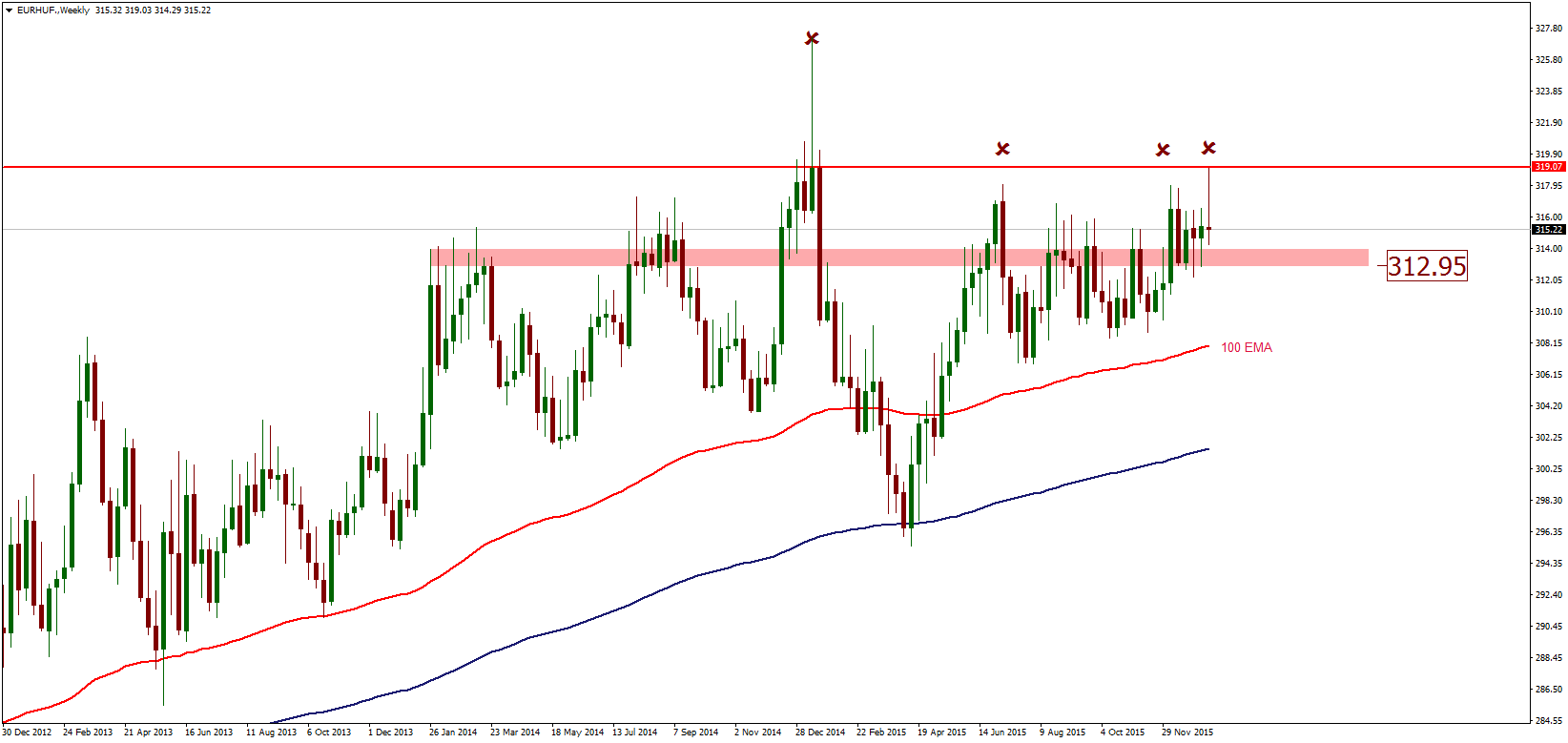

Hungary's CPI was down 0.3% on a monthly basis and annual average inflation came in at -0.1%. On the other hand, Hungary’s headline inflation rose to 0.9% (yearly basis) in December 2015 from 0.5% in November. Interesting, if there is no price increase to this extent how come the 12-month index rose to 0.9% from 0.5%? Actually, consumer prices fell on a monthly basis but for example, the food and motor fuel prices drop was smaller than a year earlier. Therefore, this pushed the headline figure higher. The quarterly annualized core inflation was 1.4% in December, which is far from the 3% target. The central bank (MNB) is resolute that it will not lower its key policy rate further, but if inflation cannot increase, the MNB might find no other means to monetary easing than cutting the base rate again.

Pic.2 Hungary's Core CPI from 2013 to 2016, Source: Tradebeat.com

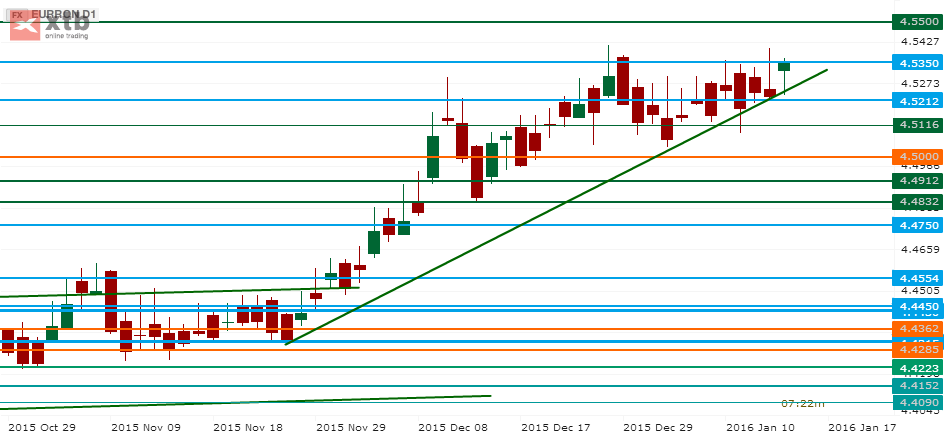

There are no crucial local macro events for the next week. The Forint almost reached January’s 2015 lows this week but in the end the currency pair remained below the 317 resistance zone. Immediate support is seen around 312.95. A clear break below that area could lead price to neutral zone in nearest term testing 312/310. Overall, the EUR/HUF should remain bearish for next week.

Pic.3 EUR/HUF W1 source: Metatrader

Romanian Leu (EUR/RON) – How does a trend on the RON look like?

EUR?RON is unlike other pairs, be they from CEE or elsewhere. EURRON likes to take its time. The trend took us higher, but only very gradually. The market sees through the recent GDP data, which was more than decent with a growth of 3.6% annualized in Q4 and hopes of pushing to 3.9% next year, and this seems the right thing to do. One thing: industrial activity looks like moving into plateau, and this may mean the NBR would allow a weaker RON to compensate for weakness especially given the China weakness imported via Germany. The other thing: the fiscal buffer is close to nil, since the budget is built on massive public spending and tax cuts. And yet another thing: interbank lending rates continued to move to record lows, slashing the ”yield” from the ”search for yield” phrase, right at the time when markets lean on the side of capital preservation. So the signature, gently upwards trend may take us towards 4.55 next week.The technical picture provides a bit more detail on what is otherwise a rather clear story: an uptrend that has recently hit 4.5350, yet appears strong enough to overcome this resistance. Further upwards we may find 4.55 and 4.56, followed by record highs around 4.65. Support offered by trendline, then 4.5212 and more round and important, 4.5000.

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.