Polish Zloty (EUR/PLN) – Presidential elections on their way

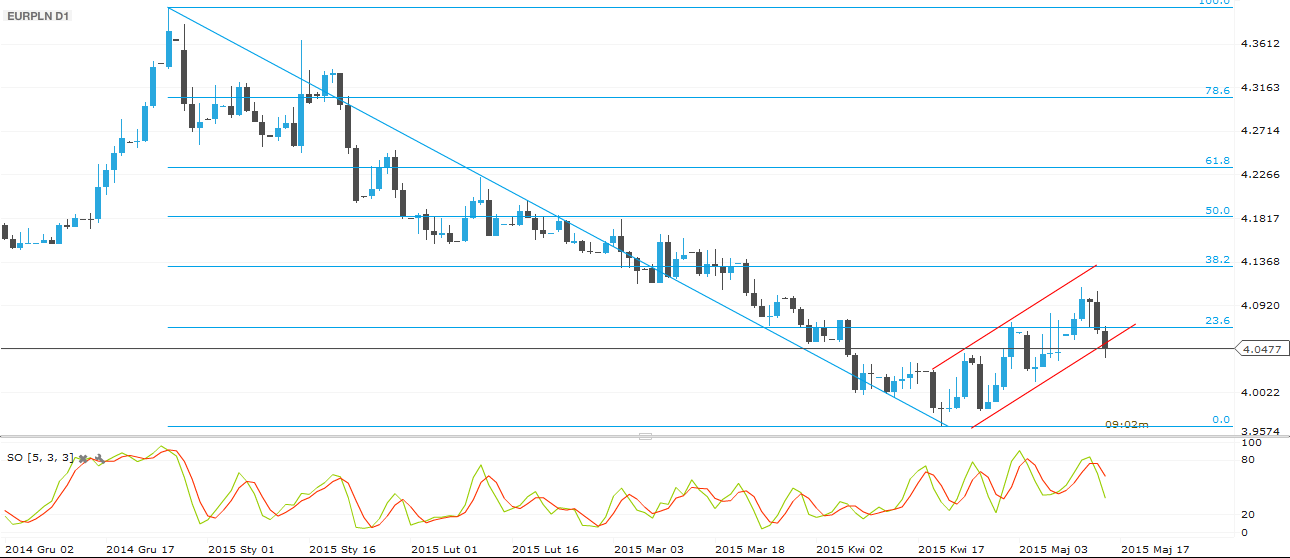

The main topic on the Polish market is still the presidential elections, which took part last Sunday. The first round was won by Andrzej Duda (from the right-wing Law and Justice party) by a small margin over the actual President, Bronislaw Komorowski (34% to 33% in votes). To many, this was a shock. Even more shocking was the result of Pawel Kukiz (non-attached to any part but conservative, former lead singer of the rock band, Piersi), for whom 20% voted (mostly younger people). The second round will take place on May 24th between Duda and Komorowski and it can actually affect the market. It is believed that the conservative Duda will be a disaster to the Polish economy. The more liberal Komorowski is believed to be a better choice for capital markets. To be honest, it should not matter too much. It is not the President who runs the country but the Prime Minister and the ruling party. Nevertheless, on Monday, May 25th, we can have some volatility on the PLN market. From the economic news – the CPI index showed a higher reading on a monthly basis (0.4%) and a lower deflation on a yearly basis (-1.1%) than expected. It seems the market starts to believe the MPC is actually telling the truth that there will no more interest rate cuts. Marek Belka, MPC Governor, has been stating that for some time already but the published macro news from economy were proving differently so far. Now, we got the first one that shows inflation might be picking up. Of course, we need a couple of more months of observations to confirm the situation will stabilize. So far, the PLN reacted to the published inflation data and the Zloty regained some ground it has lost at the beginning of the week.As we see on the daily chart, the EUR/PLN continued its corrective, upward movement rallying through the 4.08 resistance reaching a weekly high of 4.11. It seemed it will continue going up to the next target at 4.13. That is when the inflation news came up and the market turned around. Currently, the EUR/PLN is being traded at 4.05. If the market continues its downward move, it will target 4.02. If it does not break the short-term upward trendline, the rebound should take it back to 4.08.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Hungary's GDP is on fire

Record low interest rates and monetary expansion had its effect. Hungary’s GDP grew by 3.4% on a yearly basis in the first quarter of 2015. Actually, industrial production, construction and retail trade showed faster (4-4.5%) growth in Q1. Of course, the European Central Bank's asset purchase program also helped in this surpassing performance. On the other hand, we have got some news from the local bond market. Franklin Templeton has cut its holdings of Hungarian government bonds by a fifth after the fund’s investments in Ukraine slumped. It seems foreign-investor holdings of Hungary’s forint-denominated bonds have dropped 4.5% since hitting a two-year high on April 10th. Probably, hard days are coming again, especially if the National Bank of Hungary cuts its base rate again (1.80%) on the 26th of May. We are expecting further easing from the Monetary Council's side and waiting for two more cuts (by 30bps) in 2015.Looking at the daily chart, we see that the 200 DEMA resistance was attacked successfully by the market at 305.80. Furthermore, Euro bulls kept that line as a support for the next week. We are afraid from that the EUR/HUF downtrend was broken and we will not be able to see the market below 303 for a while. The next target is the 50% Fibonacci retracement level at 311.30.

_20150515143158.png)

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – An unconvincing rally of the Euro

Definitely some traders noticed that in the CEE region there is something called ”Leu”, or maybe they know it by the symbol ”RON”, as the market has been closer to a real, with deeper liquidity than a children’s pool. We have seen push above 4.45 on worries of a political confrontation between the President and the Prime Minister, Greece possible default and the need to buy EUR for a repayment of a large bond issue. The very good GDP data, showing an increase of 4.3% in Q1 2015 vs. 2014 shows that a new paradigm of growth may take us closer to the potential, given no large regional or European shocks. The improvement in RON valuation was however largely seen with a delay, only after some blocks in the road were removed. We view the economy to be a driver for Leu in the year ahead, yet before swimming in champagne traders will take into account the dovish stance of the NBR and Hellenic banks’ share of local assets, which may limit the rush. EURRON is possibly finding a new breathing area around 4.45, with a wider 200 pips band.

Technical assumption of a trend channel has been broken, but reversal is far from an already settled route. The market may decide to move rather laterally, if 4.4315 or even 4.4152 do their support job. Seeing a retest of a former, wider trend channel around 4.43 is probably the natural thing. Resistance at 4.4525 is followed by 4.4750, with an island of the young top at 4.4680.

_20150515143224.png)

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.