So much for being nicknamed after a flightless bird! Here are four reasons why the New Zealand dollar or the Kiwi could fly soon.

1. Finance Minister English’s exchange rate comments

In a recent interview with Bloomberg TV, New Zealand Finance Minister Bill English remarked that NZD/USD is trading at sustainable levels, which is around the “mid-to-high 70s.” He added that the recent Kiwi depreciation has been positive for exporters, boosting their productivity and competitiveness.

“We’re pretty comfortable with the kind of adjustment we’ve seen,” English mentioned, which was enough to convince most forex traders that another ecret RBNZ currency intervention is no longer likely.

2. Positive inflation expectations

Finance Minister English also pointed out that inflationary pressures might pick up, as wage growth could be seen later on. However, he cautioned that it would take some time before overall consumer prices increase, as annual CPI is currently at 1%.

“It could be it’s just going to take a while to show up or it could be that the global deflationary pressures are keeping our inflation rate down,” he noted, citing the potential drag from months of falling producer prices in China.

3. Recent pickup in economic data

The latest set of reports from New Zealand has been pretty impressive, as quarterly retail sales and employment figures have exceeded expectations. Headline retail sales jumped by 1.5% versus the estimated 0.8% uptick in Q3 while core retail sales showed a 1.4% gain, higher than the projected 1.0% increase.

The country’s jobless rate has improved from 5.6% to 5.4% in the same period, better than the estimated 5.5% reading. This was spurred by a 0.8% rise in hiring for Q3 and an upward revision from 0.4% to 0.5% in the Q2 employment change figure.

4. Reversal pattern on NZD/USD’s daily chart

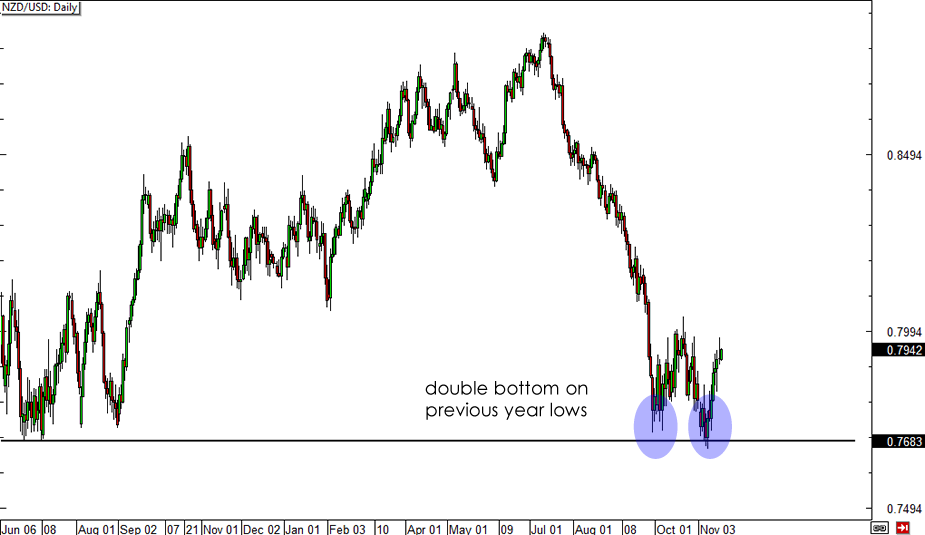

Last but most definitely not least… Check out this neat double bottom formation on NZD/USD’s daily forex time frame!

NZD/USD Daily Forex Chart

NZD/USD Daily Forex ChartThe pair seems to have bottomed out right around the previous year lows and may be showing more bullish momentum, as price gears up to break past the neckline around .8000. Gains past this resistance level could spur a 300-pip climb, which is the same height as the reversal chart pattern.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.