Fed Chairperson Yellen was her usual cautious self in the latest FOMC statement, but it looks like dollar bulls ain’t done partying in the forex scene! Here’s a quick rundown of what went on:

1. The Fed is working on its exit strategy.

As expected, the FOMC decided to reduce asset purchases by $10 billion this month and reaffirmed its intention to take the remaining $15 billion off the table in October, effectively ending their easing program then. What’s next for the Fed?

Well, policymakers confirmed that they are already working on an exit strategy, which would involve new monetary policy instruments geared at normalizing the federal funds rate. These might include adjustments on interest paid on excess reserves, the use of overnight reverse repurchase agreements, and reductions on the Fed’s securities holdings.

2. Rates will still stay low for a “considerable time” after easing ends.

It looks like the Fed ain’t ready to rock the boat yet, as it refrained from removing the “considerable time” phrase when it comes to setting expectations on how long interest rates will remain low after easing ends. This dashed hopes that the Fed might be ready to hike rates in March next year and suggested that the first rate increase might take place sometime during the summer. Bear in mind though that a couple of policymakers, namely Fisher and Plosser, wanted to remove the “considerable time” phrase.

On a brighter note, the Fed revealed that 14 out of 17 policymakers expect short-term interest rates to be raised in 2015. Most policymakers also projected short-term rates to move above 3% around three years from now, with some estimating that the benchmark rate will hover between 1.25%-1.50% late next year.

3. The Fed downgraded growth forecasts.

Although the U.S. economy printed a few strong reports recently, Fed officials are far from impressed. In fact, they decided to downgrade GDP forecasts for next year from their previous estimate of 3.0%-3.2% to just 2.6%-3.0%.

Aside from that, Yellen reiterated that “the labor market has yet to fully recover” and that “inflation has been running below the Committee’s 2% objective” in an effort to keep market expectations in check.

4. Still long-term bullish for the Greenback?

Despite the mixed signals and Yellen’s attempt to maintain her cautious tone, the Greenback still reacted positively to the event, as forex market participants appeared to zoom in on the Fed’s exit strategy.

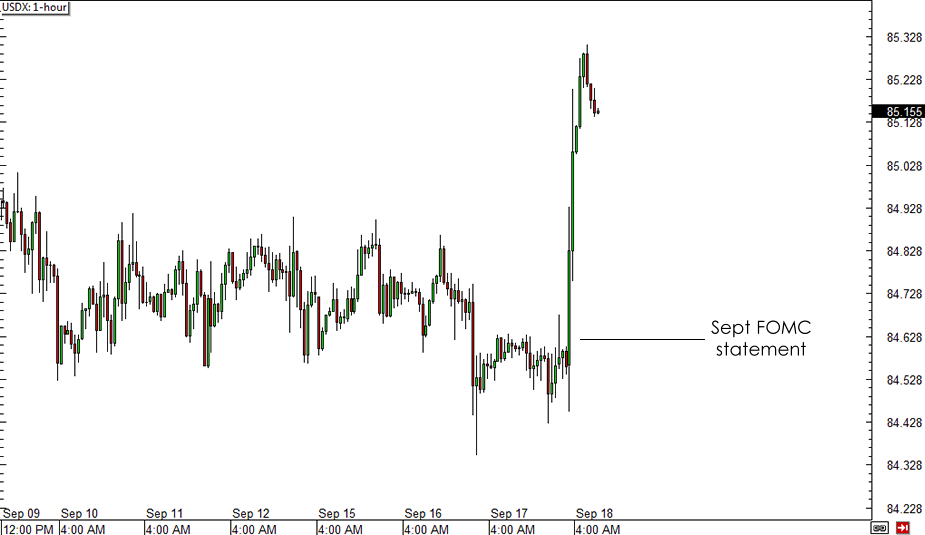

USDX 1-hour Chart

After a few days of consolidation, the U.S. dollar index broke to the upside after the FOMC announcement. USD/JPY surged to new highs as it moved past 108.50 while EUR/USD resumed its drop and dipped to a low of 1.2834 during the U.S. trading session.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.