What is this report all about?

The Australian jobs report has two main components: the employment change figure and the unemployment rate. Since the former indicates the change in the number of employed people in the previous month, it is considered a gauge of job creation. Meanwhile, the latter measures the percentage of the work force that is employed or actively seeking employment during the reporting period.As discussed in the School of Pipsology lesson on fundamental analysis, employment is an important economic aspect because it serves as a leading indicator of consumer spending. A stable jobs market inspires financial confidence, which then encourages consumers to spend more instead of holding tight to their hard-earned cash. In turn, stronger consumer spending then spurs increased business production and eventually overall economic growth.

What happened last time?

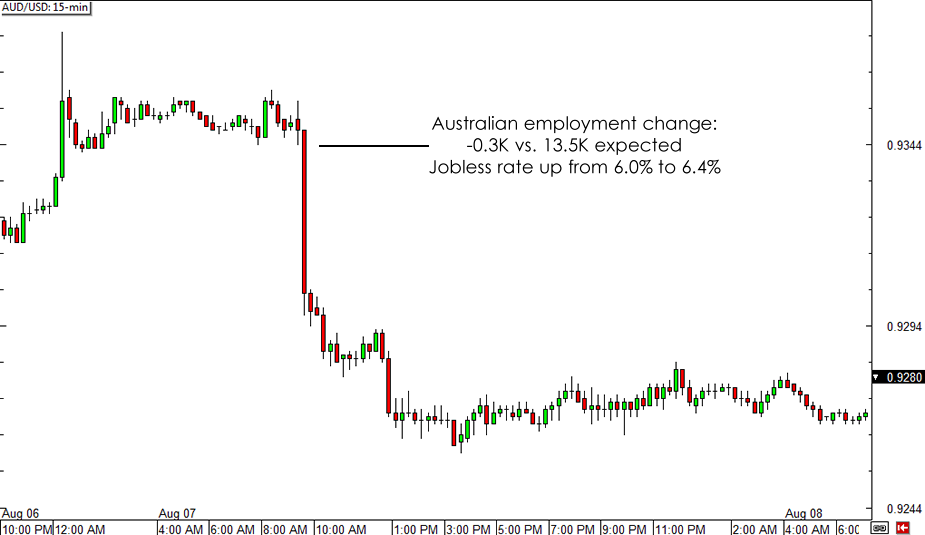

Unfortunately for the Australian economy, the previous jobs release was much weaker than expected, as it showed a 0.3K drop in hiring for July. This brought the unemployment rate up from 6.0% to 6.4%, leading to speculations of a labor market meltdown for the Land Down Under.A closer look at the underlying figures, however, revealed that a significant improvement in the participation rate was mostly accountable for the jobless rate jump. Apart from that, some market analysts have remarked that changes in the labor survey method may have also been one of the reasons for the skewed results.

AUD/USD 15-min Forex Chart

Reviewing AUD/USD’s reaction to the event suggests that traders may have focused purely on the headline figures. After a bit of consolidation prior to the actual release, AUD/USD tumbled by close to 50 pips when the employment figures came in the red then followed through with more losses at the start of the next trading session.

What is expected?

For the month of August, hiring is expected to have rebounded by 15.2K, which might be enough to bring the jobless rate a notch lower to 6.3%. Based on the reaction to the July report, another round of weaker than expected jobs figures might lead to roughly 100 pips in losses for AUD/USD hours after the release.On the other hand, a strong recovery in Australia’s jobs market might lead to an AUD/USD bounce during the Asian trading session. Price tends to continue in the same direction as the reaction candle until the start of the London trading session, before consolidating for the rest of the day.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.