While the central bank interest rate decisions are bound to steal the spotlight in the forex arena this week, the U.S. labor market could take center stage later on, as the August non-farm payrolls report is up for release.

As always, let’s go through our usual routine of understanding why this report matters, how the previous report turned out, what is expected this time, and how the U.S. dollar might react.

What is this report all about?

The U.S. non-farm payrolls report or the NFP measures the change in the number of employed people from the previous month. In other words, this tracks whether jobs were added or lost during the period.

Aside from the employment change figure, the labor report also indicates the jobless rate, which gauges the percentage of the total workforce that is unemployed or actively seeking employment during the month.

What happened last time?

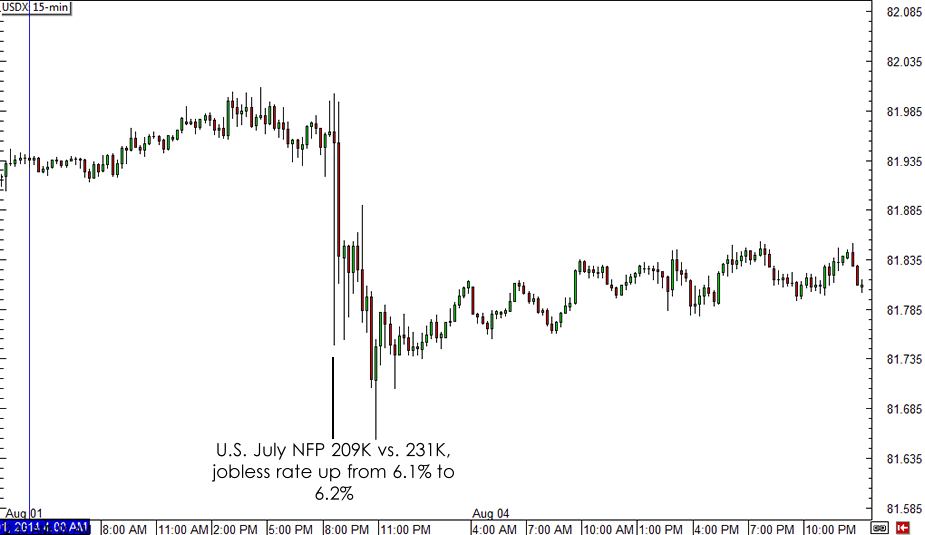

The July non-farm payrolls figure came in below expectations, marking 209K in hiring gains versus the estimated 231K increase. At the same time, the jobless rate ticked higher from 6.1% to 6.2%.

The U.S. dollar initially had a negative reaction when the headline figures came in the red, but it soon recovered when market participants zoomed in on the improvements in underlying labor components, such as the participation rate. Apart from that, significant upward revisions were made in the May and July reports, indicating that the U.S. labor market is actually doing pretty well.

What is expected this time?

For the month of August, the U.S. economy is expected to have added 222K jobs, which might be enough to bring the jobless rate back down to 6.1%. Average hourly earnings could pick up by 0.2% after staying flat in July while the labor force participation rate might also show another increase, as consumer confidence has been improving recently.

Market watchers might pay closer attention to other labor market indicators included in the report, especially those highlighted in Fed Chairperson Janet Yellen’s Jackson Hole testimony. These include trends in job vacancies, hiring rates, and quit rates among many others.

How might the U.S. dollar react?

With that, dollar pairs might have a more cautious reaction to this week’s NFP release, as traders try to dig past the headline data to make a more thorough assessment of the U.S. labor situation.

Analysts predict that an upside surprise might trigger a much larger price reaction compared to disappointing figures, as the sentiment has turned a tad more positive for the U.S. dollar relative to other major currencies. After all, the U.S. economy appears to be making a slow but consistent progress in recovering and Yellen has confirmed that they would be ready to tighten if the pickup is more rapid than anticipated.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.