On Tuesday, crude oil gained 0.22% as stronger-than-expected U.S. economic data weighted on the price. Thanks to these solid numbers, the commodity closed the day above the medium-term resistance line, but how reliable this breakout is?

Yesterday, the Labor Department showed that the consumer price index rose 0.2% in March (above expectations for a 0.1% increase), while the on-year rate rose 1.5% in the previous month, beating estimates for a 1.4% gain. Additionally, the core consumer price index (without volatile food and energy items) rose 0.2% last month (also above forecast of a 0.1% gain), while the on-year core consumer prices index rose 1,7%, beating expectations for the index to remain unchanged at 1.6%. Thanks to these better-than-expected numbers, the commodity moved higher, but reports that crude shipments will resume from key Libyan ports capped the gains.

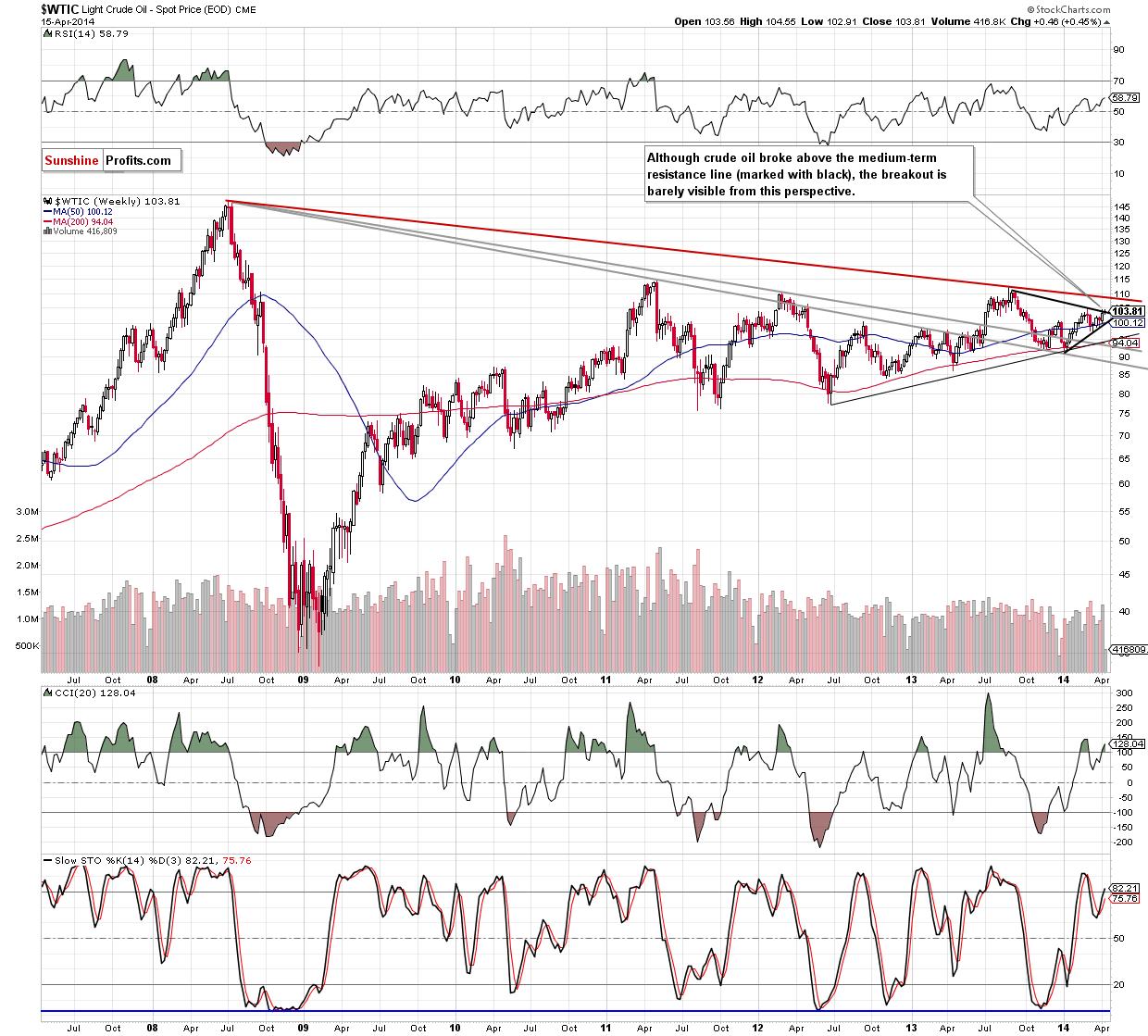

Having discussed the above, let’s move on to the technical changes in crude oil (charts courtesy of http://stockcharts.com).

Looking at the weekly chart, we don’t see any changes at the first glance. However, crude oil broke above the medium-term resistance line based on the September and March highs (which is also the upper line of a triangle) yesterday. According to theory, such price action should trigger further improvement and an increase to around $108, where the long-term resistance line (marked with red) is (you could read this bullish scenario in our previous Oil Trading Alert). However, taking into account the size of the upswing it’s too early to say that this breakout is reliable.

To see the current situation in crude oil more clearly, let’s zoom in on our picture and move on to the daily chart.

In our last Oil Trading Alert, we wrote the following:

(…) crude oil dropped not only below the black resistance line, but also under the upper line of the rising trend channel (marked with black dashed lines), which is a bearish signal. However, taking into account the fact that we saw similar price action on Friday, another attempt to break above the medium-term resistance line can’t be ruled out.

Looking at the above chart, we see that although crude oil slipped below the medium-term resistance line after the market open, oil bulls didn’t give up and pushed the commodity higher. With this upswing light crude came back above the major resistance and reached the upper line of the rising trend channel. As you see on the above chart, for the firt time in three days, crude oil closed the day above the medium-term resistance line, which is a strong bullish signal. Despite this positive event, we should keep in mind that the breakout is not confirmed at the moment. Additionally, as mentioined earlier, the size of the upswing is too small to say that this breakout is reliable. If we see two consecutive closing above this line (or a significant upward move on high volume), the breakout will be confirmed and we likely see further improvement and an increase to (at least) the 2014 high. Nevertheless, the volume that accompanied yesterday’s upswing was smaller than the day before, which questions the strength of the buyers. Additionally, the positon of the indicators, doesn't look bullish at the moment. Therefore, if buyers do not manage to push the price higher, we may see a pullback and an invalidation of the breakout in the near future.

Summing up, at the first glance, the situation has improved as crude oil broke above the medium-term resistance. However, yesterday’s upswing materialized on relative small volume, which questions the reliability of the breakout. If oil bulls do not give up and light crude extends gains, we will likely see an upward move to the 2014 high. However, if they fail, may see a pullback and an invalidation of the breakout in the near future.

- Very short-term outlook: mixed

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Trading position (short-term): Although crude oil moved above the medium-term resistance line, the size of the upswing and the volume that accompanied this move question the reliability of the breakout. Therefore, in our opinion, it seems justified to wait for a confirmation of the breakout before opening long positions.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.