Northern star, a sign of USD/JPY getting tired?

The US Dollar rose to a peak of 114.69 against the Yen for the first time since November 2017, with the benchmark 10-year Treasury yield touching a fresh 5-month high of 1.68%. Higher long-term US yields increase the allure of the asset to Japanese investors. However, the two-year Treasury yield was up around 0.41% after retreating sharply overnight from Monday’s 19-month high of 0.45%.

The USD index, which measures the greenback against major currencies, including the Yen, was little changed at 93.73 after forming a double bottom at a low of 93.45 this month, gaining 0.17% below the minor resistance of 93.85. The outlook for the US economy is mixed after data showed that US housing construction unexpectedly fell in September and permits fell to a one-year low amid acute shortages of raw materials and labor, supporting expectations that economic growth slowed sharply in the third quarter. However, existing-home sales in September rose +7.0% m/m to an 8-month high of 6.29 million, stronger than expectations of 6.10 million. On the upside, US weekly initial jobless claims unexpectedly fell -6,000 to a 19-month low of 290,000, suggesting a stronger-than-expected labor market for an increase to 297,000.

The Yen strengthened on Thursday amid increasing safe-haven demand, after the JPN225 fell -1.67%. The Yen also found support on Thursday amid a report from Kyodo News that said Tokyo would lift its pandemic restrictions starting this Monday.

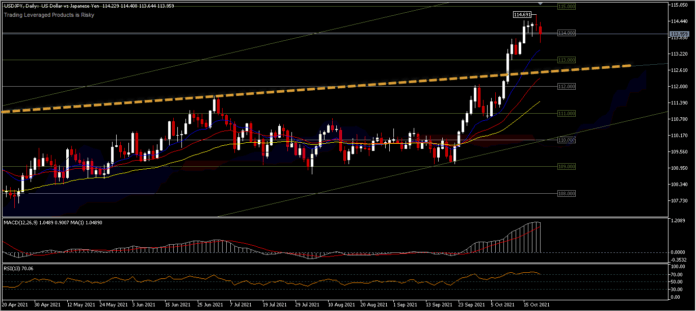

USD/JPY, daily

USDJPY is starting to look exhausted at the annual resistance area, below the 115.00 price level with the appearance of a daily doji candle pattern above 114.00. The RSI validates the rally momentum that is starting to fade at overbought levels, while the MACD takes more than one day of trading to validate a bearish signal. Overall, the uptrend has not shown any change, but the signs are already starting to be felt with the presence of 3 northern star candles. The pair is trading down 0.25% slightly below 114.00 at press time. A move to the downside will target 113.18 and a break of this level, the correction will target 112.05. On the upside, the price still has the potential to test the minor resistance at 114.20; 114.40 and recent peaks. Overall prices still look neutral towards the weekend.