North Asian production struggling

Disappointing year-on-year growth doesn't tell the whole story, but Japan and Korean production figures for October hint at a slow grind going into 2022 rather than strong growth.

Difficult to be precise, but big picture is one of moribund growth

With the legacy of the 2020 pandemic impact still echoing through seasonal adjustments to economic data, we have to be a little more cagey than usual before drawing any firm conclusions from any data releases. But the overall impression from today's October production releases from both S Korea and Japan is to confirm that production is grinding forward at best, or possibly even stagnating.

The Korean numbers show October production up 4.5%YoY, which doesn't sound too bad. But it is hard to say that this is not just noise kicked up by messy historical data in 2020. Certainly, the monthly seasonally adjusted data, to the extent that we can rely on them, are not very positive. Seasonally adjusted production in Korea has declined in each of the last three months, and in seven out of the ten months this year. In any case, low single-digit growth appears to be giving a more accurate picture of the situation than the base-distorted double-digit gains seen earlier in the year.

For Japan, it looks if anything a little worse. Year-on-year growth registered a 4.7% decline in October. Though the overall pattern of growth of both economies is strikingly similar - not surprising as their economic composition is also quite similar, with strong contributions from autos, electronics, metals and chemicals.

Industrial production – Korea and Japan (YoY%)

Source: CEIC, ING

It's not all terrible though

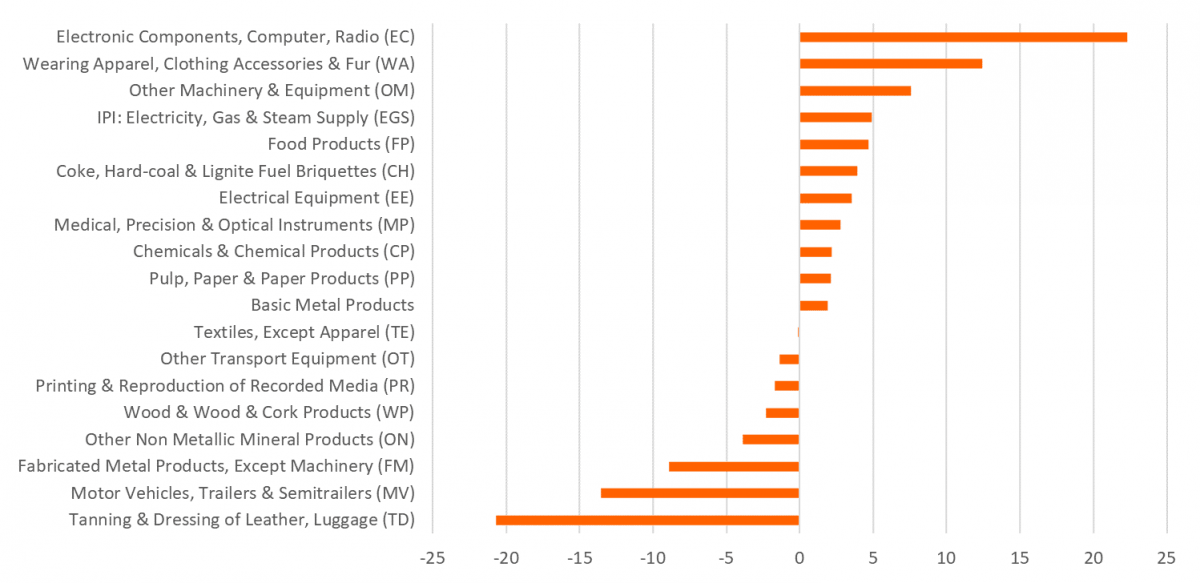

The detail of the reports shows that there is a widely differing performance by different components of production. We show the Korean breakdown here, though there are overlaps with the Japanese situation.

As has been the case for some time, and indeed, as is usually the case in Korea, the electronics sector is growing strongly, with some growth also evident in other machinery and equipment as well as apparel. At the other end of the spectrum is motor vehicles as well as items relating to international travel, such as leather and luggage.

The picture for Japan is much the same, with production growth of electronic parts towards the top of the growth league, and transport equipment right at the bottom.

The fact that the motor industry globally has been criticising a lack of semiconductors for its production growth is somewhat at odds with these figures, as the production of electronics seems to be proceeding at a decent pace. Either there is so much demand from other sectors for semiconductors that auto manufacturers are not getting what they need, or the output is being swallowed up in exports to other countries - China perhaps? Wherever the bottleneck is, it does not appear to be in semiconductor production.

Korean production by component

Read the original analysis: North Asian production struggling

Author

Robert Carnell

ING Economic and Financial Analysis

Robert Carnell is Chief Economist and Head of Research, Asia-Pacific, based in Singapore.